Strong container spot rates up at USD 1,124 due to seasonality – not IMO2020

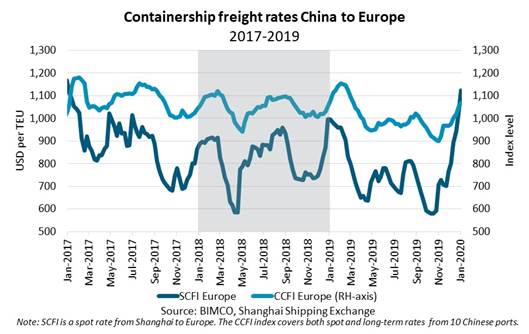

The Shanghai Containerized Freight Index (SCFI) spot rate for transporting one TEU from Shanghai to Europe was up 41% to USD 1,124 per container on 3 January 2020 – its highest level since December 2016 – from USD 800 on 6 December 2019.

The China Containerized Freight Index (CCFI), which covers both spot and long-term contractual rates in 10 Chinese ports, has similarly risen by 10% to 1,096 index points in the same period.

These rate increases are because of strong seasonality, rather than carriers successfully implementing new bunker adjustment factors (BAFs) to pass on additional fuel costs linked to IMO 2020. In the past five years, the SCFI Europe spot rate has averaged USD 1,063 per TEU in the first week of the year. The spot rate on 3 January 2020 is thus only USD 60 above this five-year average.

A 60 USD increase will not be enough to fully offset the cost of IMO 2020 compliance, especially as the price of compliant fuels have risen as the sulphur cap has entered into force. The new BAFs have proven hard to implement due to a lack of transparency in the calculations as well as poor market fundamentals

A 60 USD increase will not be enough to fully offset the cost of IMO 2020 compliance, especially as the price of compliant fuels have risen as the sulphur cap has entered into force. The new BAFs have proven hard to implement due to a lack of transparency in the calculations as well as poor market fundamentals