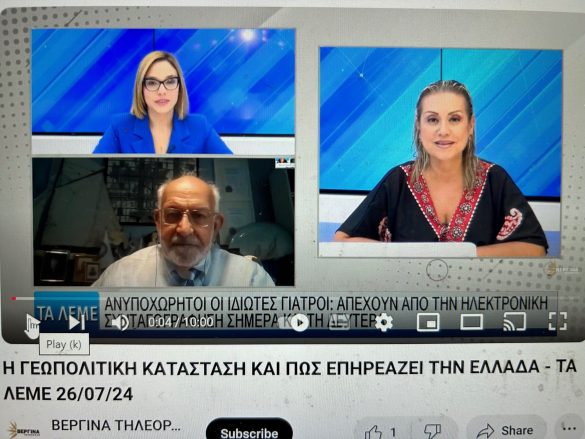

Vergina TV’s Christina Tsorba assisted by Theodora Apota questions John Faraclas on the Geopolitical issues affecting Greece just before the summer break: – The Wars in Ukraine and the Middle…

Finance

HIGHLIGHTS July 26 2024 Global Markets US GDP growth accelerated more than anticipated in Q2 rising by an annualised rate of 2.8%, 0.8ppts above market consensus. Short-dated USTs came…

Derren Nathan, head of equity research, Hargreaves Lansdown: “In contrast to the big tech-weighted US indices, the FTSE 100 has held its ground this week, and has opened up this…

Matt Britzman, senior equity analyst, Hargreaves Lansdown: “Lloyd’s shares are under pressure in early trading. Investors should look past the headline year-on-year numbers; they don’t make for great reading. It’s…

Re-emerging markets: investors will be back By Kaan Nazli and Jahangir Aka There were record-breaking investor outflows from emerging markets debt in 2022 and 2023. So far, 2024 hasn’t seen…

Financial services can find innovation in tokenisation By Dom Ghazan The rights to various assets can be converted into digital tokens using distributed ledger technology. This enhances accessibility and liquidity and…

Towards a European Capital Markets Union: An update on revived moves for a single market in savings and investments The upturning of the geopolitical world order in the aftermath of…

Steve Clayton, head of equity funds, Hargreaves Lansdown: “The UK market has opened strongly, led higher by futures markets that were pricing in an opening gain of around 0.8%. Frasers…

Why the Bank of England should stop selling bonds By John Redwood By early 2022, the Bank of England had bought £875bn of UK government bonds and £20bn of commercial…

UK turns to private finance to boost infrastructure investment By Peter Sedgwick Given the constraints on public sector borrowing in the UK, the new Labour government wants a substantial increase…

Susannah Streeter, head of money and markets, Hargreaves Lansdown: “The FTSE 100 has struggled to gain ground, opening lower in early trade as investors assess the struggles in the retail…

Matt Britzman, senior equity analyst, Hargreaves Lansdown: “Credit giant Experian has made a good start to the year. Experian’s a leader in its field, with US operations taking centre stage…

Figures are from the latest edition of the HL Savings & Resilience Barometer. It also found: *Enough emergency savings is classed as having enough savings to cover at least 3…

Trump’s platform won’t support dollar’s global reserve currency role By Mark Sobel The Republican convention platform to ‘Make America Great Again’ with ‘a return to common sense’ is out, with…

Susannah Streeter, head of money and markets, Hargreaves Lansdown: ‘’The UK has jogged into growth after stagnating on the sidelines in April, providing another boost to the feel-good factor currently…

Inflation figures are out on 17 June. What we’re likely to see Susannah Streeter, head of money and markets, Hargreaves Lansdown: “Inflation is not expected to veer significantly away from…

Susannah Streeter, head of money and markets, Hargreaves Lansdown: ‘’The FTSE 100 has opened on the front foot, taking cues from unruffled markets in the US despite a continued lack…

Susannah Streeter, head of money and markets, Hargreaves Lansdown: ‘’Thames Water is keeping afloat, but its emergency life buoy is deflating as efforts to raise funds from shareholders proves elusive.…

Tara Irwin, ESG analyst, Hargreaves Lansdown: “Almost one-third of the electricity generated in Britain last year came from wind farms, a capacity capped by the ban on onshore wind. With…

Susannah Streeter, head of money and markets, Hargreaves Lansdown: ‘’It’s a subdued start for the London market, as traders digest the latest round of political upset in France, and its…

Keir Starmer: Put country first, then reform electoral system By Clive Horwood While Labour basks in the glow of a thumping 170-seat majority, smarter heads in the party – and…

Halifax HPI: Labour’s long-term plan for property isn’t going to shift the market right now

Halifax has published its house price index for June: june-2024-halifax-house-price-index.pdf Sarah Coles, head of personal finance, Hargreaves Lansdown: “The property market is likely to be near the top of the government’s…

Pension funds ‘overwhelmed’ by inconsistent transition regulations By Emma McGarthy and Sarah Moloney Access to capital, a long-term view of risk and return and the nature of their investments in…

HFW Briefing: Celestial – when is an “autonomous” payment obligation not quite “autonomous”?

Last month the Court of Appeal handed down judgment in a case which will be of significance to all those involved in the movement, financing, and insurance of goods around…

Susannah Streeter, head of money and markets, Hargreaves Lansdown: ‘’The FTSE 100 has opened higher, riding on the coattails of the fresh enthusiasm which swept over Wall Street, with any…