BIMCO Shipping Market Outlook Feb 2020: Oil Tankers and Macroeconomics

Macroeconomics: clear risks to global growth in 2020

Across the world, there are signs that global trade tensions are easing: the US and China have signed “Phase One” of a trade agreement, which – importantly – avoids further escalation of the almost two-year trade war between the two countries (although on the downside, it also leaves most tariffs in place); the new United States – Mexico – Canada deal has passed into law in the US, with only Canada left to approve it; and a hard Brexit was avoided.

These developments have helped push global growth projections for 2020 up to 3.3%, from just 2.9% in 2019 – the lowest figure since the global financial crisis. Growth in 2019 was heavily affected by the trade war and is part of the explanation for the percentage point drop in the International Monetary Fund’s (IMF’s) projection for 2018, from 3.9% in its January 2019 World Economic Outlook to the 2.9% in its latest report.

These projections were published before the coronavirus (COVID-19) outbreak, and BIMCO therefore expects a adjustment downwards in the next update. The longer the outbreak remains uncontained, the larger the expected drop in growth, the knock on effects of which will be felt by industries across the world.

Outlook

Strengthening global growth could be derailed by a range of factors this year. The coronavirus threatens not only the Chinese economy, but potentially that of the entire world. With factories and offices closed for prolonged periods, it could also affect the “Phase One” agreement between the US and China, especially if China finds itself unable to increase its imports from the US by the amounts detailed in the deal.

Compared with 2003, when China was faced with the threat of the SARS virus, its economy has expanded enormously and is much more connected with the rest of the world. Back then, China accounted for just 7% of global imports by volume; by 2019 its share was 22%. Significant disruption to the world’s second-largest economy now has a knock-on effect on the rest of the world, given China’s substantial presence in global trading. Dry bulk and tanker trades are directly affected by a lowering of Chinese demand and, given the importance of Chinese imports, disruptions to these segments will affect the entire market. While demand for containerised exports out of China depend on other countries, the prolonged shutdown in the country’s manufacturing sector limits its ability to meet this demand, thereby harming the containerised shipping sector. […]

Tanker shipping: freight rates drop as strong seasonality fades and high fleet growth and coronavirus uncertainty hits

High fleet growth in 2019 and the coronavirus in China are clouding the outlook for 2020, despite the expected lower fleet growth.

Demand drivers and freight rates

Strong winter demand is fading away and has been reflected in falling freight rates. However, because charters are often fixed months in advance, ships with contracts from Q4 2019 are still earning high rates.

Moving into the new year, oil product tanker freight rates have fallen, with smaller vessel sizes earning more than larger ones. On 7 February, average earnings for an MR tanker stood at USD 12,531 per day and those for Handysize at USD 19,114 per day. At the other end of the scale, day rates for both LR1 and LR2 tankers have fallen to USD 7,154 and USD 9,573, respectively. Rates for both Long Range tankers peaked in the last week of 2019.

Outlook

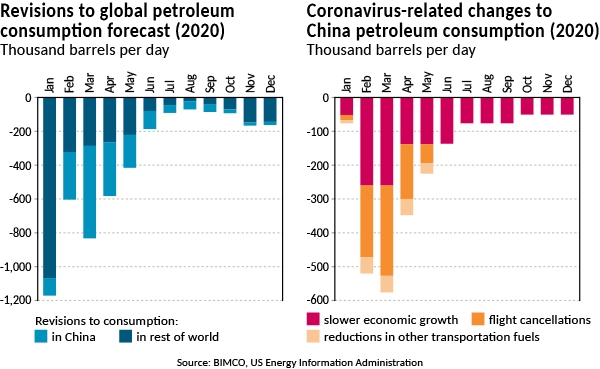

The optimism for a seasonally strong Q1 has been eroded by the effects of the coronavirus (COVID-19) and a warm winter in the northern hemisphere. Following the outbreak the International Energy Agency (IEA) has adjusted its forecast, and now expects global oil demand to fall by 435,000 barrels per day (bpd) in Q1, the first contraction in over ten years. Furthermore it has lowered its 2020 growth forecast to 825,000 barrels per day, down from 1.2m bpd before the outbreak.

US-imposed sanctions on certain Chinese-owned oil tankers, essentially removing them from the market and creating uncertainty, led to the high freight rates. But the sanctions were lifted on 31 January and around 40 tankers, more than half of which are VLCCs, have now returned to the market, adding to the pressure created by the 68 new VLCCs delivered in 2019. But this is not the only reason for unpredictability in the sector.

At the time of writing (mid-February), the full effect of the coronavirus outbreak is still impossible to predict. But because of China’s size and importance to the tanker market, any disruptions to its oil trading caused by coronavirus will have a major impact on the tanker market.

Demand for oil products will be directly impacted by restrictions on travel – with air, road and rail transportation all affected in some way – as China shuts off cities in an attempt to stop the virus from spreading. Furthermore, the extended Chinese Lunar New Year holiday – which delayed the return to full work of many workplaces – has already lowered utilisation rates of Chinese refineries, thereby reducing its demand for crude throughput.

BIMCO2020-Feb-Tanker-ShippingMarketOutlook

BIMCO2020-Feb-Economics-ShippingMarketOutlook