BIMCO June Outlook: Tanker shipping: sky high freight rates replaced by reality of falling global oil demand

BIMCO June Outlook: Tanker shipping: sky high freight rates replaced by reality of falling global oil demand . Macroeconomic outlook included.

Tanker shipping: sky high freight rates replaced by reality of falling global oil demand

Geopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.

Macroeconomic outlook – click here.

For the Live on YouTube – BIMCO Market Analysis Webinar 2020 Q2 – click here https://www.youtube.com/watch?v=I4ELOOeSoKw&feature=youtu.be

Demand drivers and freight rates

The tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates. Geopolitics continues to dominate the headlines when it comes to the tanker market, and developments in the supply of oil overshadow the steep drop in demand caused by the Covid-19 crisis. Floating storage has also increased primarily due to the mismatch between oil production and oil demand, tightening tonnage availability in the market and further supporting freight rates.

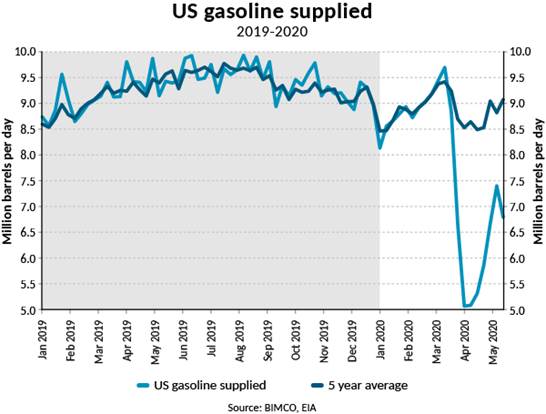

This drop in demand is illustrated by the collapse in oil products being supplied in the US: gasoline fell by 37.7% from 3 January to 3 April, a loss of 3.1 million barrels per day (bpd), but has since recovered some of that lost supply and, as of 15 May, stands at 6.8m bpd (down 16.5% from 3 January). The supply of jet fuel has fallen by 62.5% since the start of the year, standing at 0.6m bpd on 15 May (down from 1.6m bpd on 3 January).

April was certainly a month to remember, with the biggest oil-producing nations setting off a price war and flooding the market with millions of extra barrels each day – at the same time as demand was collapsing. The OPEC+ (an expanded alliance of countries collaborating to control the world production of crude oil) production cut that was eventually agreed, and has now come into force is, however, still not enough to balance the oil market after lockdown measures around the world cut demand for all oil products. The chartering spree from Saudi Arabia, as it prepared to flood the market with its cheap oil in April, led average Very Large Crude Carrier (VLCC) earnings to soar to USD 279,259 per day on 13 March, with rates staying high until the end of April. However, since then, as oil production has been cut and the reality of an oversaturated market hit home, rates have dropped to USD 42,547 per day on 22 May.

Rates will continue to fall, as the global economy is unable to provide the demand needed to keep them elevated. As is often the case, rates for the smaller crude oil tankers followed the paths of the VLCCs with Suezmax earnings peaking at USD 120,870 per day before falling to USD 30,992 on 22 May. Aframax earnings peaked later, reaching USD 83,921 per day on 24 April before falling to USD 26,959 per day on 22 May.

The realisation of the commitments made under the “Phase One” agreement become even more unacheivable when you consider the recent drop in the oil price. The extra volumes agreed upon for this year (+244%) and the next were based on 2017 export values, when the oil price was considerably higher. To match 2017 values, let alone exceed them by several billion dollars, exports by volume would have to rise by significantly more than the 244% growth needed in value. After the first quarter, exports of energy goods are down by 94% from Q1 2017. Read more about the trade war here.

Fleet news

Unsurprisingly, given the developments in the market, no tankers were demolished in April, with reductions in the total tanker fleet so far this year coming to only 0.6m DWT, down 63% from the same period last year. Of total tanker demolitions, 0.4m DWT were product tankers and the remaining 0.2m DWT crude oil tankers.

BIMCO expects the product tanker fleet to expand by 2.4% this year, with growth so far of 1.1%. The crude oil tanker fleet is expected to rise 2.1% this year. BIMCO’s expectations for demolition levels in the two markets remain unchanged from the previous update at 1m DWT and 7.5m DWT, respectively. Product tankers were particularly popular among investors in April, with new orders for these totalling 1.8m DWT, including 12 for 120,000 DWT LR2s by Chinese leasing companies.

Outlook

The outlook for the tanker shipping market is highly dependent on how long lockdown measures and travel restrictions continue. However, even once restrictions are officially lifted, demand for transportation, which accounts for 55% of oil demand, will not rebound suddenly, as uncertainty will keep downward pressure on the market. Travel – and air travel in particular – will be slow to return. The direct impact of lower demand for transport will add to the decrease in demand for fuel caused by diminished economic activity. Similarly, the demand for plastics and petrochemicals (19% of oil demand) is heading for a slow recovery.

As a result of the dramatic drop in demand, refineries around the world have announced cuts to production in response to faltering demand. In the US, for example, refinery throughput has fallen by 24.5% since the start of the year, taking in 12.7m bpd of crude oil in the last week of April – the lowest levels since 2008, and 4.1m bpd lower than the start of this year.

Floating storage has been one of the hot topics in the tanker shipping market recently, but remains clouded in uncertainty, particularly in respect of how much tanker capacity is currently being used for storage. What is clear however, is that floating storage has reached its peak and will start to wind down. As it does so, tonnage currently tied up in storage will re-enter the market and put further downward pressure on freight rates.

The main talking point going into the year – the IMO 2020 sulphur cap – has also been affected by the Covid-19 pandemic and subsequent drop in oil prices. On 1 January, a metric tonne of high-sulphur fuel oil (HSFO) in Singapore cost USD 360 and a tonne of very low-sulphur fuel (VLSFO) USD 710, giving a spread of USD 350 per tonne, and offering a large advantage to scrubber-fitted ships. Since then, fuel prices have fallen, lowering costs for all, but also significantly increasing the payback period for a scrubber investment, as the HSFO-VLSFO spread has fallen to just USD 73 per tonne on 19 May.

Macroeconomics: global trade to suffer massive losses from Covid-19-related shutdowns

No V-shaped recovery in sight after the large-scale shutdown of economic activity and the virus posing a risk to globalisation.

The global economy and world trade are being battered by the widespread and comprehensive measures to limit the spread of Covid-19. Even though some countries have started easing their lockdown measures – such as in China – there has been no swift uptick in economic activity, leaving no hope of a swift global economic recovery.

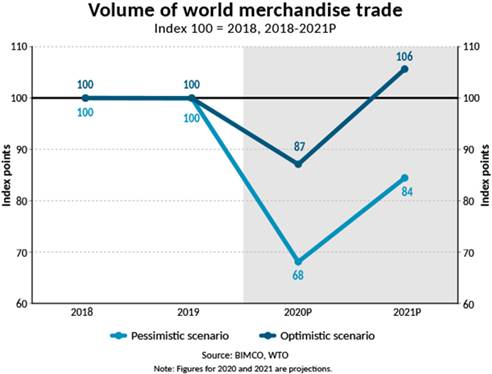

On 8 April, the World Trade Organization set out two scenarios and both predict trade dropping in every region and across all sectors. In its most optimistic view, global trade will fall by 13% in 2020, whereas its pessimistic outlook sees trade falling by 32% from 2019 levels, with a recovery in 2021 that will not return volumes to pre-pandemic levels. BIMCO believes the actual drop will be somewhere between these two figures, depending on how long it takes for the pandemic to be brought under control, and how governments around the world are able to coordinate and implement effective stimulus measures to get their economies back up and running.

The International Monetary Fund (IMF) has turned its 2020 growth forecast on its head, from + 3.3% growth before the outbreak, to a 3% contraction, although this prediction remains shrouded in uncertainty as the duration of the crisis and the speed at which nations can reverse lockdown measures remains unclear. This sudden and drastic contraction far exceeds that of the 2008 financial crisis; the Great Depression of the 1930s, unfortunately, looks like a closer comparison. In its April World Economic Outlook, the IMF forecasts the economy will normalise in 2021 with growth of 5.8%, bringing the global economy to an index level of 102.6 from 2019 levels. This forecast assumes that most containment efforts will be removed over the course of the second half of 2020.

Europe

The crisis, which took hold in Europe in March, has seen countries responding in different ways, although most have been on a scale ranging from a full lockdown and curfews to more restrained social distancing measures. Common to all countries, however, is that their economies have taken a massive hit. The largest economies in Europe are among those worst affected. Germany, the UK, France and Italy have all posted negative Q1 GDP growth: -2.2%, -2.0%, -5.8% and -4.7%, respectively. The European Union as a whole saw its economy shrink by 3.5% in the first quarter of 2020 compared with Q4 2019, although when looking year-on-year, the economy was 0.2% larger than in Q1 2019. The impact on shipping will be lower demand across all sectors.

The service sector, which outperformed manufacturing last year, has been even harder hit by the global health crisis. The eurozone’s service Purchasing Managers Index (PMI) fell to its lowest reading on record in April at just 12 points (the threshold of 50 indicates no change from the previous month, with anything under 50 representing a contraction).

Manufacturing on the continent has also been dealt a heavy blow, with countries lining up to post record low readings of their manufacturing PMIs. The eurozone saw a massive contraction. Its index fell from 44.5 to 33.4 in March, as factories closed and demand plummeted, with the new export orders sub-index falling to record lows. In the five biggest nations in Europe, the indexes fell to between 30.8 and 34.5 points. Despite government measures to avoid unemployment, manufacturers reported cutting staffing levels at the fastest rate since April 2009.

US

The virus has devastated the economy in the United States, with the first estimate showing GDP shrinking by 4.8% in the first quarter (quarter on quarter). Personal consumption expenditure fell by 7.6%, exports are down by 8.7% and imports by 15.3% (Source: Bureau of Economic Analysis). The outlook for the second quarter looks even worse.

Retail sales figures in March and April give a detailed indication of what the lockdown has meant for sales of consumer goods. Advance figures from the US Census Bureau show that sales in grocery stores rose 29.3% in March 2020 from March 2019, with April sales up 12% from the previous year. However, sales in other stores have plummeted: clothing sales were down 89.3% in April and sales in furniture and electronics stores were down by 66.5% and 64.8% respectively. These are important goods for the container shipping sector, and if they are not being bought in the US, they will not need transportation across the Pacific.

The outlook for sales picking up remains poor; lockdown measures continued into May and the increases in unemployment and the looming recession offer little hope that consumers will boost their spending once back at the shopping malls.

Asia

In China, where the virus outbreak led to a much earlier shutdown than in the rest of the world, the easing of the measures has provided some insight into how the rest of the world could emerge from this crisis. China’s economy shrank by 6.8% in the first quarter, with it being harder hit than other countries because the containment efforts started earlier. The outlook for a strong recovery remains muted, as the after- effects of the lockdown in China and lower demand from the rest of the world take hold.

A testament to this is the new export orders index out of China that in April stood at only 33.5 points. This is above the 28.7 it posted in February, but with March also posting a reading below 50 (46.4), the absolute volumes of exports remain much lower than before the crisis, with no hope of a rapid V-shaped recovery. It will take many consecutive months of PMI readings above 50 for manufacturing activity to return to pre-Covid-19 levels.

Even a country such as South Korea, which has for the most part avoided strict lockdowns and confinement, has seen its economy take a battering, shrinking 1.4% in the first quarter, with a drop in consumer demand and exports being the primary causes. Japan has also been hit by these two factors which, along with -3.4% growth in Q1, caused it to enter a technical recession, following a 1.8% quarter-on-quarter contraction in Q4 2019.

Outlook

BIMCO does not expect a V-shaped recovery of shipping demand and economic activity in general. Instead – after an alarmingly steep drop – the economy faces a long and uncertain climb back to growth. This is due to the following reasons:

The speed and scale of the slowdown in economic activity in nations around the world are unprecedented, and, while the threat from the virus remains, the duration of this crisis and the speed at which the nations will emerge from the slowdown are highly uncertain. The massive stimulus packages materialising around the world – including wage compensation for workers otherwise at risk of unemployment, cheques from the government and deferred tax payments – all aim to ensure that as much of the economy as possible is still standing once the health crisis eases. Even so, an economic crisis will follow.

The post-pandemic world will be faced with, among other things, lower consumer spending power, lower consumer confidence and lower overall demand, both domestically and internationally. As we have seen in China, a recovery in its domestic market is not enough to shore-up demand – it also needs a strong global economy. The slow re-opening of economies around the world also increases the risk of a new wave of infections and a return to more stringent lockdown measures, all of which will weigh heavily on government, business and consumer decisions until the crisis has passed.

Global oil demand is massively impacted and lower demand will be felt by shipping, despite a short-term boost caused by the oil price war in April. A coordinated response is needed to ensure as smooth a recovery of globalisation and the global economy as possible. Countries must avoid turning towards protectionism. On this front, worrying signs are emerging. In particular, the trade war between the US and China – which had been experiencing a truce since the signing of the “Phase One” agreement in January – risks flaring back up, as the US threatens more tariffs on imports from China in a response to its handling of the Covid-19 outbreak. It goes without saying, this will only hamper both economies’ recoveries, at a time when they both need plenty of help rather than further stifling.

However, increased tariffs are not the only threat to global trade. The virus has opened many people’s eyes to the vulnerability of international supply chains and their reliance on manufacturing plants on the other side of the world. This is the case for governments – many of which experienced shortages of critical equipment usually imported from abroad – as well as businesses. The exposure of these vulnerabilities will no doubt lead to changes in supply chains, with some benefiting the shipping industry, while others will harm it.

More analysis: https://www.bimco.org/news-and-trends/market-analysis

More events: https://www.bimco.org/events

TOMORROW: BIMCO’s June 2020 outlook for dry bulk and container shipping

___

BIMCO2020-June Outlook -Tanker_Shipping

BIMCO2020-June Outlook – Macroeconomics