• New business target of €1 bn for infrastructure projects in 2022

• Supply constraints and raw materials shortages challenging for companies – Chief economist: Investments urgently required

• Germany’s government plans to invest € ~50 bn annually

HAMBURG – Financing infrastructure projects is part of Hamburg Commercial Bank’s (HCOB)

core business, with around one billion euros in new business concluded in the past twelve months.

In the current year, the bank is targeting new business on approximately the same scale, despite

the challenging geopolitical and economic situation. While disrupted supply chains and related

secondary effects are challenging for the economy, the bank sees an increasing need for financing

for forward-thinking as well as sustainable infrastructure projects.

“We have committed around one billion euros to infrastructure projects in Europe over the past

twelve months and we aim to match this volume again this year,” said Christopher Brody, Chief

Investment Officer at Hamburg Commercial Bank. “In view of the devastating war in Ukraine and

the associated uncertainties, we have set our sights high on this. And of course, we will monitor

developments very closely and manage our activities carefully and flexibly. However, we are

convinced that important infrastructure projects are urgently necessary now.”

Jens Thiele, Head of Project Finance and Corporates at HCOB added: “We focus on digital and

social infrastructure projects as well as on innovative projects in the field of traditional

infrastructure, such as transport networks. In addition, investments in the production, transmission

and storage of alternative energy sources are necessary now to be less dependent on energy

imports in the future. This also includes the expansion of bridging technologies, such as the

construction of port and storage terminals for liquefied natural gas (LNG) tankers.”

Sustainable information technology high on the agenda

In the past twelve months, around 60 percent of HCOB’s infrastructure new business came from

the construction and expansion of data centers and fiber-optic networks, which consume

significantly less electricity than conventional copper networks and therefore reduce CO2

emissions. The expansion of this digital infrastructure is one of the investment projects being

promoted throughout Europe and is the basis for the use of 5G technology. And the demand for

fast and reliable Internet access is high: For private households, home office work and e-learning

are creating high demand. On the corporate side, stable digital network connections and modern,

high-performance data centers are indispensable. Only with digitized business processes and up to-date, energy-efficient technology they can be competitive and at the same time make an important contribution to greater environmental protection.

Chief Economist: “Unsettled global economy – investments required to bridge the gap”

Looking at the current situation, Dr. Cyrus de la Rubia, Chief Economist at HCOB, sees challenges

for manufacturing companies in particular: “A whole range of raw materials is becoming scarcer,

as the export share of Russia and Ukraine for commodities such as nickel, aluminum or palladium

ranges between 20 and 26 percent. In addition, the global interconnectedness of companies today

makes them more vulnerable to disruptions in the value chains. Supply chains are disrupted, high

prices for energy and intermediate products affect competitiveness, and noticeable increases in

fuel and food costs can trigger political turmoil, especially in low-income countries.” Nonetheless,

he said, the task now is to bridge the situation: “It is precisely these factors that make private as

well as state-supported investment in infrastructure particularly urgent.”

Companies in many sectors will have to adapt to the new circumstances, and governments are

being asked to step up their support for infrastructure investment. For example, expanding

transportation infrastructure will ensure that regionally oriented value chains function more

efficiently. Electricity and data networks should be made fit for the future and energy sources

diversified. “Here, public funding and well-structured financing models will play an important role in

ensuring that companies are willing to invest despite the uncertainties that currently exist,” says

Dr. de la Rubia.

Investment support for transportation services and infrastructure is an important issue in view of

decarbonization, digitalization and public infrastructure. “In the German government’s budget plan,

investments of around 50 billion euros a year are planned up to 2026, a significant part is for

infrastructure. Strong and professional financing partners will continue to be needed to realize

these investment projects and integrate the subsidies.

More than two decades of experience

Hamburg Commercial Bank has been financing infrastructure projects in Germany and Europe for

more than 20 years, making it one of the pioneers in this sector. HCOB has a high level of

expertise in the integration of development loans from KfW or the European Investment Bank and

in public-private partnerships, as well as in the integration of export credit cover. “Especially in the

financing of digitalization and IT – a sector that is important for the transformation of the economy

towards more sustainability – we have built up a very good track record that we are building on

today,” says Jens Thiele. “We continue to see high demand for financing in the market, despite the

difficult economic environment. Our customers appreciate our experience, especially now, as we

structure complex projects for them individually, promptly and reliably.”

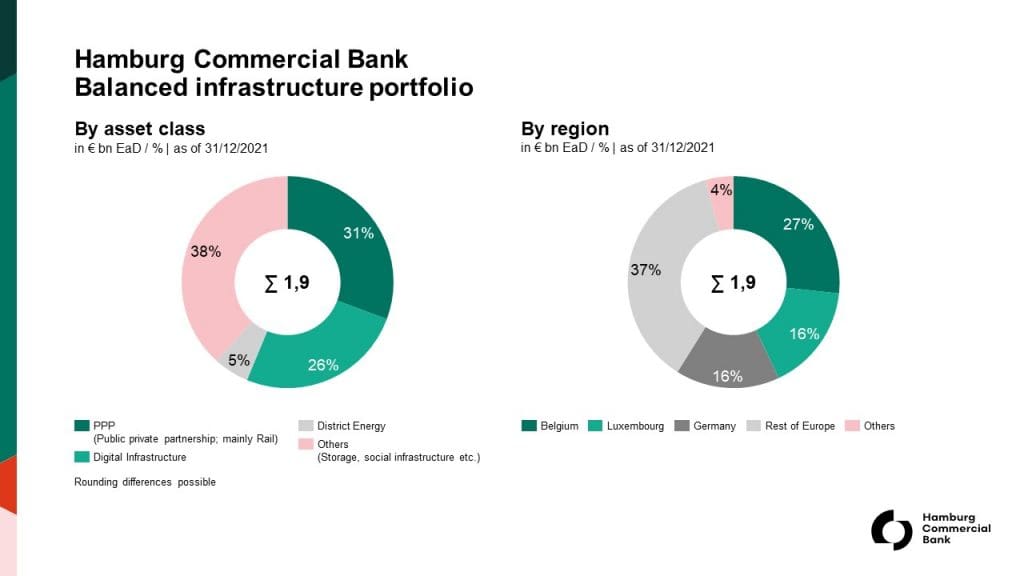

HCOB’s infrastructure portfolio is broadly diversified and included EUR 1.9 bn in assets as of 31

December 2021 (see chart).