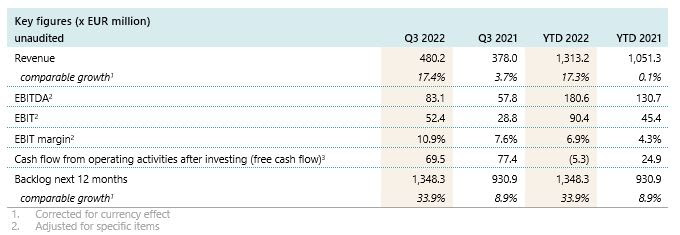

Further margin increase and solid cash flow Continued strong revenue growth

- Revenue increased by 17.4% supported by high client demand in energy and infrastructure markets, in particular for offshore wind solutions

- EBIT margin continues upward trajectory, supported by all four regions and all business lines

- Impact of inflationary and supply chain challenges largely mitigated

- Operating cash flow increase offset by higher capital expenditure

- 12-month backlog is up substantially by 33.9%, supported by all four regions

- Outlook full-year 2022: ongoing revenue growth, margin expansion and positive free cash flow

Mark Heine, CEO: “I am pleased to report a solid set of results. In uncertain macro-economic and geopolitical times, we continue to experience strong demand for our solutions for the energy transition and climate change adaptation. We are involved in numerous site characterisations for offshore wind parks, including Thor in Denmark, Atlantic Shores in the US, and Australia’s first development Star of the South. Within days of Hurricane Ian making landfall in Florida we completed damage assessments, which will allow the hardest hit communities to recover from this catastrophic event as quickly as possible. At the same time, the urgency for balancing affordability, sustainability and reliable energy is leading to increased interest in the traditional energy markets, in particular in LNG. Recently, we have been engaged to perform site investigation and consulting services for FLNG projects in Altamira, Mexico and the US Gulf of Mexico.

“Our EBIT margin increased in all regions. We realised further improvement in the operational performance of our land business and, through improved pricing of our solutions, we are mitigating the impact of unprecedented inflation and supply chain pressures. In line with these developments and to support the ongoing growth, full-year capex is now estimated at around EUR 125 million.

“With our solutions for the energy transition, climate change adaptation and sustainable infrastructure, we are well placed to capitalise on the strength of our end-markets, with clients seeking to secure capacity, also beyond the coming 12 months. We are making good progress on our Path to Profitable Growth and we are on track to deliver on our mid-term targets.”

Review Q3 2022

Revenue was up by 17.4% on a currency comparable basis, fuelled by ongoing high client demand across markets, most notably renewables, and to a lesser extent infrastructure. In addition, oil and in particular gas related revenue is increasing. In Marine, revenue was up by 13.4%, while the utilisation of Fugro’s owned and long-term chartered vessel fleet was in line with the comparable period last year (75% versus 76% in the third quarter of 2021). Growth was driven by marine site characterisation, especially in Europe-Africa and Middle East & India. In Land, revenue was up by 28.2%; the increase in site characterisation in all regions was supported by nearshore wind farm related activities.

The group’s profitability continued its upward trajectory. The EBIT margin amounted to 10.9% compared to 7.6% in the third quarter of last year and 8.7% in the second quarter. The improvement was broad-based and supported by all regions and business lines. We have managed to largely mitigate the impact of higher cost levels for fuel, charters and third-party personnel. In the land-based activities, the margin improved as a result of higher revenue and restructurings in multiple countries during the past couple of years.

The 12-month backlog increased significantly in all regions, by 33.9% to EUR 1,348.3 million.

The improvement in EBITDA resulted in a higher operating cash flow before changes in working capital. At the end of September, working capital as a percentage of revenue amounted to 14.6 versus 15.7 in June of this year and 13.0 per September last year. Capital expenditure was higher (EUR 29.1 million compared to EUR 17.2 million last year). As a result, free cash flow amounted to EUR 69.5 million, slightly below EUR 77.4 million in the third quarter of last year. In September, Fugro entered into a sale and lease back agreement for its TechCenter in the Netherlands with cash proceeds of EUR 25.2 million, of which EUR 8.6 million is included in the free cash flow, and the remainder is classified as financing cash flow.

In July, Fugro arranged a new comprehensive sustainability-linked financing with extended maturities, including an equity raise, which supported the strong decrease in net debt to EUR 217.8 million versus EUR 389.2 million during the quarter. Net leverage amounts to 1.0x versus 2.0x per the end of June.

Recent project awards

- Europe-Africa region: site investigation for Norway’s first large-scale offshore wind farm Sørlinge Nordsjø II, the Offshore Aramis CO2 Transport and Sequestration project in the Netherlands, an electrical cable between Malta and Italy, infrastructure development projects for Dublin Port Company; a multi-year partnership with the Land Registry in the Netherlands.

- Americas region: follow-on work for Ørsted’s Sunrise and Ocean Wind projects on the US East Coast; nearshore site investigations and consulting services for New Fortress Energy’s FLNG projects in Altamira (Mexico) and West Delta 38 (Louisiana, US); a geophysical and light geotechnical site investigation for Total Energies Block 58 in Suriname and a shoreline mapping project on the Gulf Coast for the National Oceanic and Atmospheric Administration (NOAA).

- Asia Pacific region: multiple offshore wind farm site investigations including KF Wind in Korea, Yunlin in Taiwan, Niigata Offshore Wind in Japan and Star of the South in Australia; a site inspection for the Hung Shui Kiu/Ha Tsuen development area in Hong Kong.

- Middle East & India region: a pipeline survey on the North Field South development for Qatar Gas; various site investigations in support of ‘The Rig Project’ and a pre-FEED nearshore geotechnical study for Larson & Toubro in Saudi Arabia.

Outlook 2022

Given the year-to-date realisation and the strong backlog, Fugro expects ongoing revenue growth, margin expansion and a positive free cash flow.

Management will continue to actively manage any impacts of geopolitical uncertainties, inflationary and supply chain pressures, and remains focused on further margin expansion towards the 2023-2024 mid-term targets of an EBIT margin of 8-12% and a free cash flow of 4-7% of revenue, on the back of higher pricing, increasing asset utilisation, disciplined cost management, operational excellence and digital transformation. To support the ongoing growth and due to higher prices and supply chain challenges, full-year capex is now estimated at around EUR 125 million.