- HL’s Investor Confidence Index has dropped 7% to 71. Responses were gathered as Hamas attacked Gaza

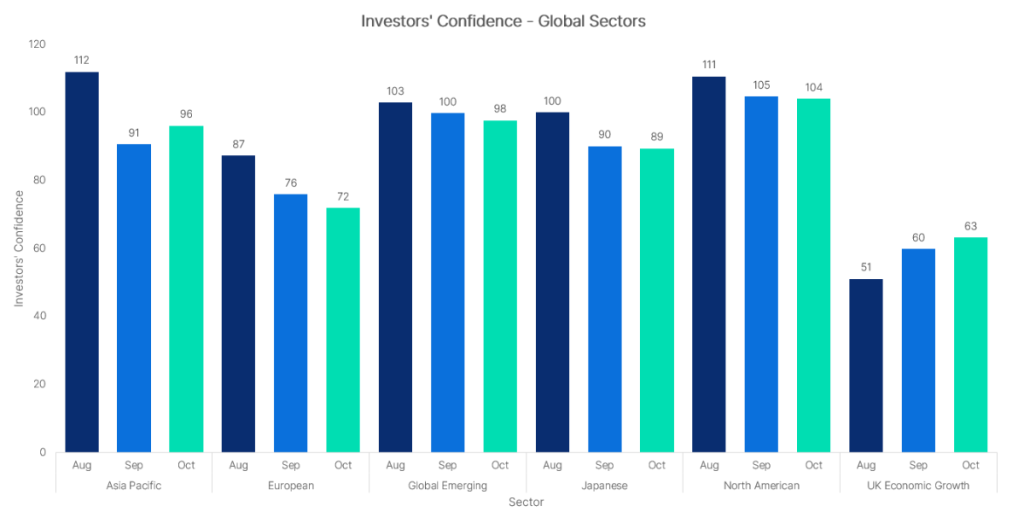

- Confidence has risen in the Asia Pacific but fallen in Europe, Emerging Markets, Japan and North America

- Investors continue to favour cash assets as markets are turbulent

Emma Wall, head of investment analysis and research, Hargreaves Lansdown:

“It is not surprising to see Investor Confidence has dropped following the devastating war in the Middle East. The conflict has impacted both oil and gold prices. But retail investors were already loading up on perceived lower-risk assets, thanks to market volatility, an uncertain global economic outlook, and compelling yields.

Trades on platform reveal investors have been choosing plenty of money market funds and ETFs, alongside NASDAQ and tech trackers and a few US equity and developed market options – also chock full of big tech.

Cash has an important part to play in your financial resilience. Three months’ salary is the rough guide for your rainy-day fund, to ensure you can weather personal uncertainty. It can also be a great tactical play in a portfolio – in a rising rate environment, with market volatility you are rewarded for keeping your powder dry. But it has limited long term strategic asset allocation benefits. Investors should be looking longer term – markets will be choppy over the next six months, but rates have peaked so holding cash in your investment portfolio no longer pays.

Investors should therefore look to diversify. Put cash to work with strategic bond managers which have the flexibility to take advantage of opportunities when the rate cycle starts to turn, and the news cycle causes pricing volatility. On a valuation basis, UK equities – with good dividend cover and the opportunity for income growth – and emerging markets look attractive. And if all of this is too time consuming or complicated, outsource to a multi-asset fund, preferably one with a track record of managing through a downturn.”

| Top Funds, October 2023 (net buys, alphabetical) |

| Fidelity Cash |

| Fidelity Index World |

| HSBC FTSE All World Index |

| Jupiter India |

| Legal & General Cash |

| Legal & General Global Technology Index Trust |

| Legal & General US Index |

| Premier Milton UK Money Market |

| Royal London Short Term Money Market |

| UBS S&P 500 Index |

| Top Investment Trusts, October 2023 (net buys, alphabetical) |

| City Of London Investment Trust |

| CVC Income and Growth Limited |

| European Opportunities Trust |

| Greencoat UK Wind plc |

| HICL Infrastructure plc |

| JPMorgan Global Growth & Income plc |

| Murray International Trust plc |

| Pershing Square Holdings Ltd |

| Sequoia Economic Infrastructure Income Fund Ltd |

| Supermarket Income REIT plc |

Investor confidence index

The investor confidence index is compiled by surveying HL clients on a monthly basis. Each month we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average around 10% of clients respond.