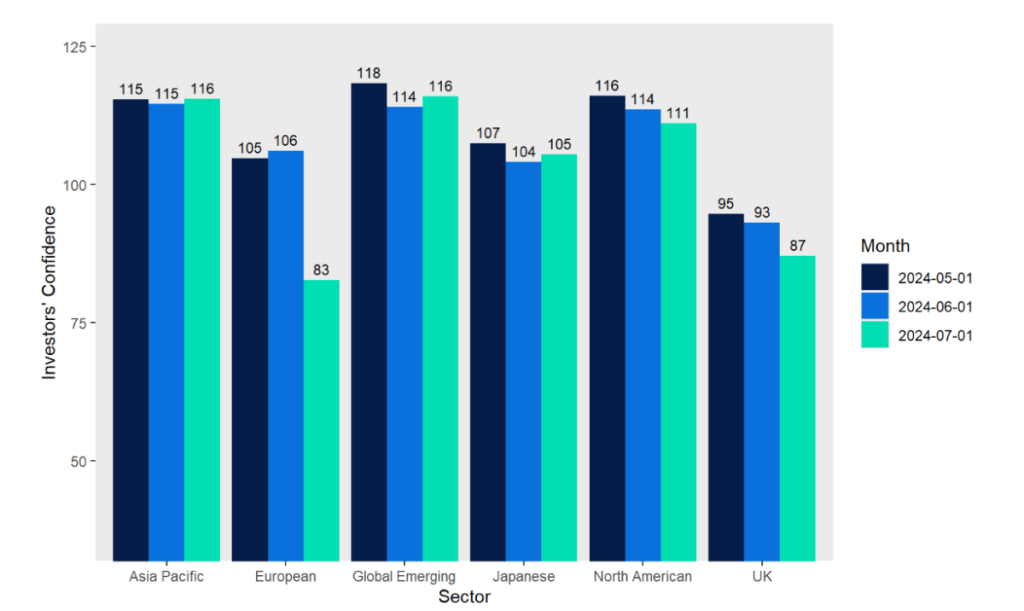

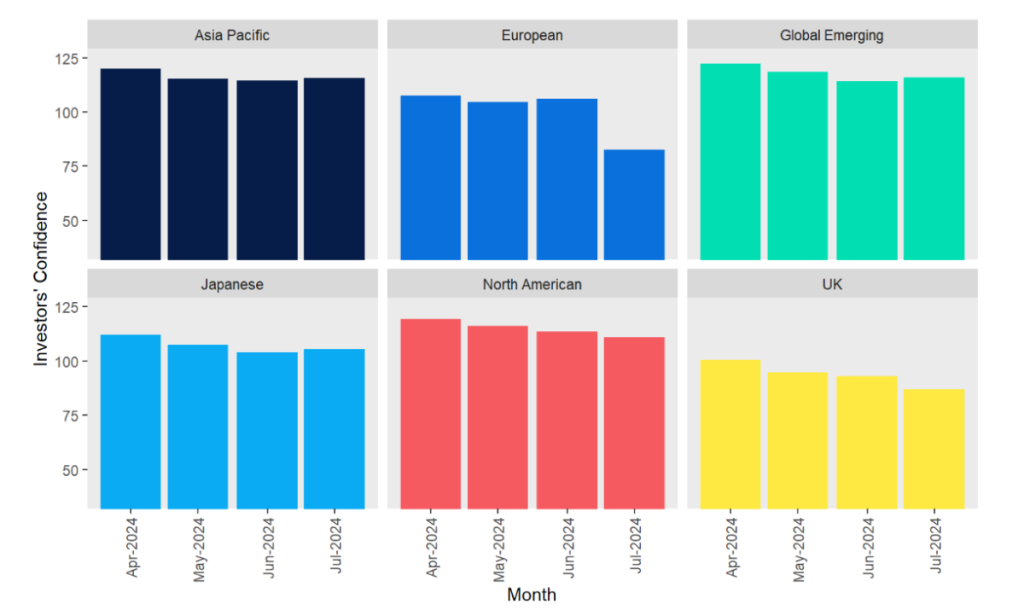

- HL’s Investor Confidence Index has fallen by 6.5% in July

- Political instability in Europe, and an intense General Election campaign in the UK both damaged investor confidence.

- Confidence decreased significantly in the European sector and marginally in North American sector. It increased in the Asia Pacific, Global Emerging and Japanese sectors.

- Confidence in UK Economic Growth decreased by 3.7%.

- But has subsequently been revealed that the UK economy is on the bounce.

Emma Wall, head of investment analysis and research, Hargreaves Lansdown:

“Investor confidence fell at the beginning of July, as political uncertainty swirled the developed world. Snap elections and subsequent campaigns in France and the UK led to a drop in optimism on both sides of the Channel. European equities saw the worst fall in outlook with a staggering 22% in investor confidence, while confidence in the UK market fell 6.4% in the run up to our General Election. The US is not immune from instability either. Investor confidence in US equities has fallen as cracks have appeared in Joe Biden’s Presidential campaign, and the likelihood of Donald Trump returning to the White House has risen – along with increasingly fractious politics, as seen at the weekend, after an assassination attempt on Donald Trump during a campaign rally.

Instead, investors are more optimistic about Asia Pacific, Japanese and Emerging Markets equities. Japan’s major indices, the Nikkei 225 has hit an all-time-high twice in the last month thanks to firmer expectations of a US interest rate cut, reducing the differential between US and Japanese central bank policy which has so damaged the Japanese Yen in over the past year.

When it comes to fund flows, HL clients haven’t quite flipped US for Asia just yet. While an Indian fund makes the top 10, thanks to strong performance over the last year – Modi election blip aside – most of the top 10 are made up of US funds or US-biased global funds, typical of the top 10 most-bought funds every month year-to-date. Clients should be mindful that they risk concentrating portfolios with this approach, before doubling down on exposures, consider which regions your portfolio is underweight and where offers value right now. We like the UK and emerging markets on a valuation basis, though expect some volatility in the latter.”

Investor confidence in global sectors – HL data

HL data

| Top funds, July 2024 (net buys, HL clients) |

| Legal & General Global Technology Index Trust |

| Jupiter India |

| Fidelity Index World |

| Legal & General US Index |

| Legal & General International Index Trust |

| UBS S&P 500 Index |

| Legal & General Global 100 Index |

| Stewart Inv Indian Subcontinent Sustainability |

| HSBC FTSE All World Index |

| Artemis Global Income |