Mark Heine, CEO: “I am pleased with the significant margin expansion that we have achieved during the first half of the year, in particular in our Marine business. The improved performance was underpinned by better terms and conditions, operating leverage and solid project execution, despite still increasing cost levels.

“While geopolitical developments and elections worldwide create uncertainties which may impact policies, our Geo-data solutions remain key to the energy transition, infrastructure development and climate change adaptation. We continue to capture the ample opportunities in our markets, supported by our healthy and growing backlog.

“We are progressing well with the implementation of our Towards Full Potential strategy, supported by ongoing investments in people, technology and execution excellence. Since early July, Fugro Resolve and Fugro Resilience are at work, supporting further growth in the buoyant market for geotechnical site characterisation solutions. We are successfully attracting the people we need to support our clients. In the first half year, despite tight labour markets, we hired over 1000 people, and voluntary staff turnover dropped to 9%.

“Looking ahead, I am convinced that with our people, technology and solutions we are well positioned to achieve our strategic objectives and mid-term targets.“

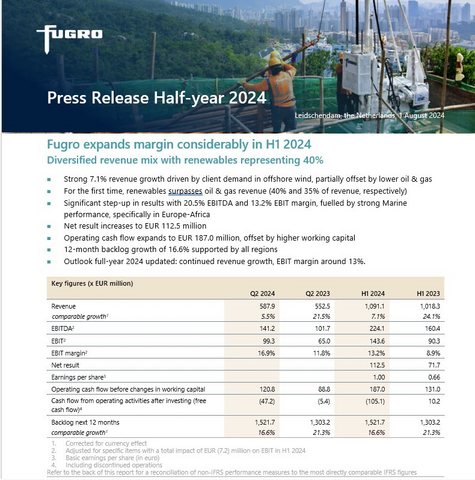

Overall, as a result of the carbon reduction roadmaps in an increasing number of countries worldwide, our renewables revenue grew by 33%, to 40% of group revenue. Revenue in oil & gas was 8% lower, in particular in the US. In the infrastructure market, we are experiencing limited growth in some of our key geographies. While Fugro’s current revenue in the nascent water market is still limited, further expansion in the medium term is part of Fugro’s Towards Full Potential strategy.

Fugro’s EBIT margin improved to 13.2%. The strong Marine performance, in particular in Europe-Africa, was the result of improved terms & conditions, operating leverage and solid project execution. Land margin was in line with last year.

Operating cash flow before changes in working capital increased by EUR 56.0 million to EUR 187.0 million, driven by a substantially higher EBITDA. As expected, working capital increased from an exceptionally low level at year-end 2023 (at 8.9% of 12-months revenue), by EUR 176.7 million in total (to 15.9% of 12-months revenue).

For the second half of this year, an unwind of working capital is expected. Capital expenditure amounted to EUR 119.3 million, including the delivery of the Fugro Zephyr vessel, compared to EUR 71.8 million last year. On balance, free cash flow decreased by EUR 115.3 million. Net debt amounted to EUR 345.3 million compared to EUR 110.5 million at year-end 2023 as the result of the cash flow development, dividend payment in respect of the year 2023 (EUR 45 million) and share buyback programme (EUR 46 million). Net leverage amounted to 0.7x.

Diversified revenue mix with renewables representing 40%