- In the past year, the highest easy access rates have fallen by 0.37% and fixed terms by 1%.

- Fixed terms across the board are now offering 4.5% and should remain steady in 2025.

- Cash ISAs are the fastest growing sector in the UK savings market (source: Bank of England).

- Assets in the HL Cash ISA have risen 230% since 1 January 2024.

- HL expects clients to increasingly shift from variable rate products towards fixed terms in 2025.

Mark Hicks (pictured above), head of Active Savings, Hargreaves Lansdown:

“2024 has been a challenging year for savers, with base rate cuts and the prospect of lower rates in the future forcing banks to reduce their rates from the highs of 6% in 2023 to below 5%. However, there are signs that the biggest falls may be behind us. Inflation expectations have steadied, and with government policy adding inflationary pressures, the outlook for 2025 is looking better for savers than it was at the start of 2024. Whilst mortgage rates have risen in recent weeks, rather disappointingly savings rates have remained relatively subdued.

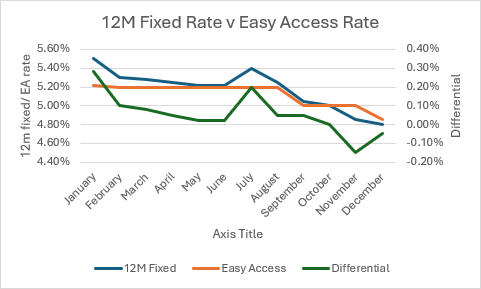

In the past year, we have seen some big falls across the savings market, with the highest easy access rates falling by 0.37% and fixed terms falling the most by 1%. This has meant the highest rates on offer in the latter part of 2024 can all be found in variable rate accounts. This is due to the fact that fixed term savings product are priced based on future expectations of interest rates. In the last quarter of 2024 we have started to see this trend normalise, with fixed terms across the board now offering 4.5% or more, a trend we may see continue into 2025 if further interest rate cuts are taken off the table.

With the backdrop of a higher tax burden for the UK population, cash ISAs have become increasingly popular, being the fastest growing sector in the UK savings market. Assets in the HL Cash ISA have risen 230% since 1 January 2024 as clients take advantage of tax wrappers. Higher interest rates have meant more UK savers earn more than the personal savings allowance, which has increased the attractiveness of Cash ISAs.

Decline in savings rates by product

| Easy access | 1-year fixed | 2-year fixed | 3-year fixed | 5-year fixed | |

| Highest rate (1 Dec 2024) | 5.22% | 5.80% | 5.50% | 5.25% | 5.00% |

| Highest rate (1 Dec 2025) | 4.85% | 4.80% | 4.60% | 4.6% | 4.60% |

| Change | -0.37% | -1.00% | -0.90% | -0.65% | -0.40% |

Differential between easy access and 12-month fixed rate accounts

Outlook and predictions for 2025

As we look into 2025, the outlook for the savings market is mixed, with a high degree of uncertainty. While financial markets are still pricing in approximately two rate cuts in 2025, the outlook in 2026 is one of relative stability in the base rate, with expectations for it to settle at 4%. Given that fixed rates are dependent on future expectations, I expect fixed rates to remain relatively stable in 2025, with variable rates and particularly easy access products continuing to come under pressure in the early half of 2025. If we see a further two cuts in 2025, it is likely that the easy access market settles around 4%. This would mean that the savings market returns to a sense of normality with fixed rates offering higher returns than easy access. Savers should look to lock in fixed rates, so they aren’t exposed to further falls in the easy access market, a strategy that has worked well so far in 2024.

The Cash ISA market will continue to grow in 2025. With the tax burden only increasing, more savers will look to take advantage of tax-free rates. Throughout 2024 the best Cash ISA rates have been found on savings platforms in easy access space, but looking into 2025, fixed terms may become increasingly attractive and we could see a shift into fixed term Cash ISAs from variable rate products. Across the HL Cash ISA platform, over 70% of instructions have been placed into variable rate products, a trend we expect to shift more towards fixed terms as we move into 2025.

There is likely to be an increase in competition in the savings market in 2025, as more new entrants come into the market and the regulator continues to pressure the large retail banks to ensure their clients are being paid fair value under the consumer duty. To add to the regulatory pressure, banks and building societies still have billions of outstanding TFSME loans, which were offered during the pandemic and need to be re-financed next year, a technical factor which will mean a lot of the banks will have to refinance these loans by raising deposits.

For savers looking to maximise their interest and protect their case I would follow four simple rules:

- Emergency cash – hold three–six months’ worth of essential expenditure in an easy access account.

- Used fixed-term products for your savings to take advantage of competitive rates if you aren’t going to need quick access to the money.

- Look to savings and investment platforms to make switching between rates quick and easy and enable simple money management.

- Use your Cash ISA allowance to take advantage of tax-free interest.”