Brief Update No 25/01 Date: 15 – Jan – 2025

STATEMENT

This document has been approved for distribution by Sea Guardian S.G. Ltd / Operations Department. The provided Intel and information derive from open sources, the Institute for the Study of War (ISW), the Joint Maritime Information Center (JMIC) and United Kingdom Maritime Trade Operations (UKMTO) respective WebPages and products. All rights reserved. No part of this Risk Assessment may be reproduced in any form: electronic, mechanical, or other means without written permission by Sea Guardian S.G. Ltd. Under no Circumstances can Sea Guardian S.G. Ltd be held responsible for any loss or damage caused by a reader’s reliance on information obtained by this Assessment.

Objectives

The purpose of this brief is to provide the Maritime Industry and the Security Stakeholders with:

- Major maritime security incident summary and analysis for the time period 01 – 13 Jan 2025

- Threat assessment updates concerning military operations – terrorism – piracy and also cargo theft, smuggling, stowaways

- Overview of risk assessment and relevant information,in order to support operational planning and decision making.

RECENT KEY DEVELOPMENTS

- On Jan 02, Houthi Supreme Leader Abdulmalik al Houthi stated that the Houthis are in an “open war” with Israel and will continue to intensify attacks against it. He also said that the U.S. and Israel have not deterred the Houthis and that the group has used the war to develop its capabilities.

- On Jan 02, Deputy Pentagon Press Secretary Sabrina Singh said that the US has no plans to establish a base in Kobani, Syria and dismissed local Syrian reports as “inaccurate.”

- On Jan 02, Interim Syrian Foreign Minister Assad al Shaibani, Defense Minister Marhaf Abu Qasra, and Head of General Intelligence Anas Khattab traveled to Saudi Arabia and met with senior Saudi officials.

- On Jan 03, the French Foreign Minister Jean-Noel Barrot and the German Foreign Minister Annalena Baerbock met with HTS leader Ahmed al Shara in Damascus. Shara has previously called for Western nations to lift sanctions on Syria. Baerbock stated that the delegation traveled to Syria to express its support for a peaceful transition of power and convey clear expectations that a new Syria includes Syrians of all ethnicities and religions in its political process.

During early morning on Jan 03, a ballistic missile launched from Yemen was intercepted by the IDF air defense systems, with fragments falling near Modi’in-Maccabim-Re’ut and in Har Gilo at Central Israel, causing minor damage. A UAV launched from Yemen was later intercepted outside Israeli territory by the IAF. The Houthis took responsibility for both the attacks, claiming to have successfully struck a power plant near Tel Aviv with a Palestine 2 missile and a military target in the Tel Aviv area with the UAV.

- On Jan 04, during an interview with Chinese CCTV, Iranian Foreign Affairs Minister Abbas Araghchi emphasized Iran’s readiness to return to the Joint Comprehensive Plan of Action (JCPOA) negotiations signaling its readiness to resume nuclear talks. He stressed trust-building and sanctions relief as key pillars of the negotiations. The statement likely reflects Iran’s concerns over potential snapback sanctions, which could go into effect in Oct 2025 and, would reimpose all pre-2015 UN sanctions on Iran.

- On Jan 04, UK sources in Yemen indicated that Iran has significantly increased its support for the Houthis during the last weeks, providing weapons and expertise to sustain missile strikes on Israel and attacks on global shipping. This is also related to Yemeni military spokesman Abdul Basit al Baher recent statements that Iran’s assistance includes parts of advanced missiles and drones which are assembled in Yemen.

- On Jan 05, another ballistic missile launched by the Houthis was intercepted before crossing into Israeli territory. The Houthis claimed to have successfully targeted the Orot Rabin power station near Hadera.

- Senior Israeli officials indicated on Jan 05, that the IDF will likely extend its deployment in southern Lebanon if the Israel-Lebanon ceasefire agreement conditions are not met by Jan 26. Israeli Defense Minister Israel Katz stated that if the first condition of the Israel-Lebanon ceasefire agreement–the complete withdrawal of Hezbollah and dismantling of Hezbollah weapons and infrastructure by the Lebanese Armed Forces (LAF)–is not met, Israel will be “forced to act on its own.” Katz specified that if Hezbollah does not withdraw there is “no agreement”.

- On Jan 05, Syrian interim government officials traveled to Doha, Qatar. Syrian Interim Foreign Affairs Minister Asad al Shaibani, Interim Defense Minister Marhaf Abu Qasra, and Interim Intelligence head Anas Khattab met with Qatari Prime Minister and Foreign Minister Mohammad al Thani and Qatari Minister of State Mohammed bin Abdulaziz al Khulaifi. During these meetings “all basic and strategic issues” between the two countries were discussed, according to later statements. Qatar, which never normalized relations with the Assad regime, was among the first states to open contact with HTS after the fall of Assad.

- On Jan 06, 3 Russian vessels arrived off the coast of Tartus to evacuate Russian military assets from Syria, but the vessels have not docked yet. This was verified by commercially available satellite imagery. This imagery is consistent with Ukraine’s Main Military Intelligence Directorate’s (GUR) Jan 03 report, that an Ivan Gren-class large landing ship, an Alexander Otrakovsky Ropucha-class landing ship, and the Sparta cargo ship were scheduled to arrive on Jan 05 at the port of Tartus to transfer Russian military assets to an unspecified location in Libya.

- On Jan 06, SDF Commander Mazloum Abdi stated to Agence France-Presse that the SDF came to an unspecified agreement on Syrian unity with the Hayat Tahrir al Sham (HTS)-led interim government on Dec 30, 2024.

- On Jan 06 a Syrian government delegation, headed by the Syrian Foreign Minister Asaad al-Shaybani went to the UAE on an official visit and met with Sheikh Abdullah Bin Zayed Al Nahyan, UAE Deputy Prime Minister and Minister of Foreign Affairs.

- On Jan 07, the Turkish Foreign Minister, Hakan Fidan, stated that Turkey would carry out a “military operation” against the Kurdish militias in Syria if they do not disband and join the new integrated Syrian Ministry of Defense.

- On Jan 07, the Syrian Foreign Minister Asaad al Shaibani announced that the HTS-led interim government delayed the Syrian National Dialogue Conference. Shaibani said that the government is first working to expand the preparatory committee for the conference to include representatives from all segments of society and geographic areas.

- On Jan 07, the Lebanese Prime Minister Najib Mikati told the ceasefire monitoring committee that Israel must end its violation of the ceasefire and withdraw from Lebanon. Mikati is presumably responding to Israeli and Lebanese media reports on January 4, suggesting that the IDF may extend its deployment in southern Lebanon by an additional 30 days.

- On Jan 08, the US Central Command (CENTCOM) announced that US military carried out air strikes against two underground facilities used by Houthis for storing advanced conventional weapons in “Amran and Sanaa Governorates”. In addition, 3 UAVs launched from Yemen were intercepted by the IAF, with one being shot down over Israeli territory by IAF helicopters and its fragments crashing into an open field, while two others have being intercepted by the IAF over the Mediterranean Sea.

On Jan 08, General Joseph Aoun, Commander-in-chief of the Lebanese armed forces, was elected president of Lebanon by the country’s parliament.”A new era in Lebanon’s history begins today,” the president-elect said, announcing that the Lebanese state would have a monopoly on arms. Gen. Joseph Aoun, enjoys US approval and the result reflects shifts in the balance of power in Lebanon and the wider Middle East, with Hezbollah having lost much of its influence since the devastating war with Israel and the fall of its ally, the Syrian President Bashar al-Assad.

- On Jan 09, Houthi Foreign Affairs Minister Jamal Amer told the UN Special Envoy to Yemen Hans Grundberg that the Houthis will de-escalate tensions in the Red Sea only after Houthi Supreme Leader Abdulmalik al Houthi commands it. On the same day Abdulmalik stated that the Houthis would continue to fight and that they would continue their attacks in the Gulf of Aden and Red Sea.

- On Jan 09, Turkey conducted several airstrikes targeting SDF positions on the eastern bank of the Euphrates River near the SDF-SNA frontline. Turkish artillery and aircraft also struck SDF positions in the area.

- On Jan 09, the HTS-led Defense Ministry appointed HTS commander Ali Nour al Din al Nassan asCchief of Staff of the Syrian Armed Forces. Nassan and other Defense Ministry officials met with Syrian militia leaders on January 9 to continue discussions on HTS leader and interim head of state Ahmed al Shara’s plan to disarm and dissolve armed groups into the new Syrian Armed Forces.

- On Jan 09, Lebanon’s new President Joseph Aoun discussed the situation in southern Lebanon and the Israeli withdrawal under the ceasefire agreement with the head of the U.S. military commandant of CENTCOM, General Eric Kurilla. During the meeting they discussed on the situation in the south and the stages of execution of the Israeli withdrawal from the south, in accordance with the withdrawal plan drawn up for this purpose.

- On Jan 10, the US-led coalition and IAF carried out coordinated airstrikes on targets in Yemen. Al-Masirah (Houthis news agency) reported that warplanes of US and UK carried out 12 airstrikes on the Harf Sufyan district, the Hudaydah port, and on Sanaa. More than 20 IAF jets later bombed the Hudaydah port, Ras Issa port, and the Hezyaz power plant in Sanaa. The Houthis meanwhile claimed to have prevented an attack by the USS Harry S. Truman after targeting it as well as several escort US naval vessels, using cruise missiles and UAVs

- On Jan 11 Syria‘s de facto leader Ahmed al-Sharaa met Lebanon’s caretaker Prime Minister Najib Mikati in Damascus in a bid to improve long-fraught ties, with the pair focusing on strengthening their shared border.

- On Jan 12, Foreign ministers from Arab and Western countries held a meeting in the Saudi capital Riyadh to discuss the situation in Syria following last month’s fall of the Bashar al-Assad regime. The meeting was attended by Turkey, Syria, Saudi Arabia, the United Arab Emirates (UAE), Bahrain, Oman, Qatar, Kuwait, Iraq, Lebanon, Jordan, Egypt, Britain, and Germany. The United States and Italy were present at the level of deputy foreign minister. No statements were made after the meeting.

- On Jan 13, Kremlin and Iran announced that they will sign a “Comprehensive Strategic Partnership Agreement” on Jan 17 during an official of the Iranian President Massoud Pezeskian to Russia.

- On Jan 13, the White House national security adviser Jake Sullivan stated, referring to negotiations on a ceasefire in Gaza that “We’re very close to a deal and we can get it done this week,” “I’m not making promises or making predictions, but it’s within reach,” he added. As he said, the gaps between the two sides are gradually being bridged.

MARITIME SECURITY INCIDENTS: 01 – 13 Jan 251

1 In accordance to JMIC and/or UKMTO sources

| INCIDENT No | INCIDENT Type | INCIDENT TIME | INCIDENT DETAILS |

| – | – | – | – |

THREAT ASSESSMENT UPDATE:

Military operations – terrorism – piracy and also cargo theft, smuggling, stowaways

Military Operations

- The volatile state in Syria since Nov 2024, is added to the general military conflict and unrest that takes place in the middle east region, affecting also the East Mediterranean Sea. Though the Bashar al-Assad regime has fallen and the HTS has become the predominant group, it is almost certain that conflicts between rival rebels’ factions will resume over the status in future Syria.

- Conflicts in the northern part of Syria between rival groups backed by Turkey, Turkish lead rebels and Kurdish militias as well as in the eastern part between HTS and other armed groups, are still ongoing.

- The airstrikes of IDF against former Syrian Arab Army (SAA) targets continue at almost a daily base and in an effort to mitigate the risk of hi-tech armament and arsenal left behind by the SAA to fall into HTS or any other group hands. In addition, the IDF is resuming its attacks against HAMAS targets throughout the Gaza Strip.

- The Houthis resume their campaign against Israel by conducting several attacks with Palestine 2 hypersonic ballistic missiles and long-range UAVs.

- The US and UK forces, the assets of Operation “Prosperity Guardian” and the US CENTCOM assets along with IAF aircraft are increasingly conducting attacks over the last period against Houthi military and infrastructure, as a response to Houthis attacks against Israel and US escorted merchant convoys passing through the Red Sea.

- The Israeli ARROW and US THAAD air defense systems have provided so far satisfactory protection against Houthi ballistic missiles with the exception of the Palestine 2 hypersonic ballistic missile which has proved more difficult to intercept.

- Overall, the ceasefire in Lebanon is still maintained though IDF forces from time to time conduct minor strikes against selected targets within the country.

Terrorism – piracy and also cargo theft, smuggling, stowaways

- The reemergence of terrorists group associated with ISIS and Al Qaeda in Syria since Nov 2024, has enhanced the terrorist threat level across East Mediterranean Sea. Nevertheless, the US, UK and French efforts in destroying potential terrorist targets and infrastructure in Syria have equally increased.

- The recent U.N. Security Council’s green light to a new African Union force expected to be deployed in Somalia in a few days to help counter the radical Islamist militant group Al Shabaab and the US AFRICOM airstrikes, are expected to counter/mitigate the “Shabaab Youth” terrorist organization threat in Somalia, over the next period.

- Weapons smuggling has almost certainly persisted throughout the US naval action in the Red Sea, especially due to at least one breakdown in UN inspection mechanism at Hudaydah, that enabled several cargo vessels to enter uninspected. The Houthis more often rely upon overland transport and small dhows that are difficult to intercept, however.

RISK ASSESSMENT

East Mediterranean Sea

- The risk of attacks or incidents in the East Mediterranean Sea for the time being is assessed LOW with the exception of all Israeli ports and potentially the Syrian Coastline. Any port call should be arranged after a direct contact with the Israeli authorities, while it is not clear whether there are still any Syrian authorities or if they represent the newly establish government.

- The rise of terrorist groups and other uncharted armed groups in northern and western Syria could potentially be dangerous for merchant shipping security along the Syrian coastline and ports, destabilizing the security environment in the region even further.

- Turkey is attempting on one hand to definitively dismantle the Kurds on its southern border and on the other hand to occupy more Syrian territory under the pretext of a safe zone. It is assessed that SNA with Turkish Armed Forces support will continue to assail SDF forces in the Kobani region and that these efforts could also be a precursor to a wider Turkish or Turkish-backed operation in Northern Syria. Ankara has repeatedly insisted that the U.S.-backed Kurdish militia has to be disbanded, arguing that it has no place in

- Syria’s future. Turkey identifies the Kurdish PYD faction and the Syrian Democratic Forces (SDF), an extension of the Kurdish PKK group linking them to terrorism. Turkey and HTS have coordinated their efforts to coerce the SDF into disarming and integrating into the HTS-led defense apparatus since the fall of the Assad regime but with no effect till now.

- It is assessed that the efforts of Turkey to project itself as a “regional power” in the MENA region and East Africa, either through political intervention or military presence will be intensified over the next period.

- Conflicts in the northern part of Syria between rival groups backed by Turkey, Turkish lead rebels and Kurdish militias, no matter the HTS-led interim government’s efforts to dissolve all former opposition forces and integrate them into the new Syrian Defense Ministry, indicate that it will highly likely be impossible to finally reach to an agreement on how to govern the country over the following month. There is risk for Syria to become another “failed state” in the Middle East & North Africa region (MENA), following the footsteps of Libya and Iraq.

- The new Syrian leadership of HTS is under the microscope of the international community and Syrians themselves who want to see whether it will show respect for human rights, the treatment of minorities in a multi-ethnic and multi-religious country, and the future of the semi-autonomous Kurdish regions of northern Syria. During the last period, the interim Syrian Government has begun to establish lines of communication and made attempts to reinvigorate diplomatic relations with Turkey, the Arab states, the US and EU. It is assessed that relations with Turkey, Qatar and Saudi Arabia are already at a high level, with the rest of the Arab states following at a lower level, while Egypt considers the HTS as a potential threat due to its ties with Turkey and the Muslim Brotherhood. It has to be considered that the international community has not yet established a plan for how to engage with the transitional government in Syria, and most countries will wait for this mosaic of militias and armed groups to show their true intentions on how to build and run the future Syrian State.

- While the appointment of HTS loyalists within the interim government allows HTS to further consolidate its rule,the HTS-led interim Syrian government appears to be taking initial steps to secure cooperation with minority religious communities ahead of the Syrian National Dialogue Conference.

- For the US establishing channels of communication with the new Syrian de facto government under HTS leader Ahmed al Shara, trying to determine whether they will keep their promises of unity and moderation, is assessed to be a priority. However, ISIS or other terrorist group reemerging through this turmoil is a daunting possibility that requires constant vigilance and even though Trump has openly declared that he does not want the US to be involved with the forming of future Syria, he will eventually be forced at the least to support the SDF against SNA and Turkish aggression and to take action against any terrorist groups that might arise.

- It is assessed that the SDF’s fight against Turkey and its proxies will render it unable to support US policy objectives in Syria. The SDF cannot conduct offensive operations against ISIS and other terrorist groups while contending with the threat from Turkey and its allies in Syria.

- US and IDF air strikes in former SAA arms depots and critical military assets is assessed to have severely mitigated the risk of sophisticated and high tech ballistic and antiship missile equipment falling into HTS or other military group’s hands.

- For the time being communication between Russia and the interim Syrian government has proved problematic and Russia has been essentially cut off from its military assets in Syria. However, it is assessed that Russia will resume attempts to move its forces from Syria into an East Libya area (probably the Cyrenaica peninsula) controlled by General Haftar, in order to establish a new naval and air base to assure its presence in the Mediterranean Sea.

- It is assessed that further Israeli efforts to neutralize Syria as a potential threat and to establish a safe zone during the next weeks will almost certainly lead to a new escalation in tensions between Israel and Turkey over the future of Syria, since their interests are colliding.

- The newly elected Lebanon President and Prime Minister, which for the first time are not related to Hezbollah and enjoy US approval, underscore a major shift in the balance of power in Lebanon after Hezbollah was pounded by Israel and the overthrow of its ally, Bashar al-Assad, in Syria. In addition the announcements that the Lebanese state army would have a monopoly on arms within Lebanon clearly indicates that over the next period the Hezbolah military with be highly likely evicted from Lebanon.

- Israel’s efforts to mitigate the threat of Hezbollah in Lebanon have certainly paid off and it is assessed that the ceasefire agreement will be renewed and that eventually Israel will come to terms with the new Lebanon leadership.

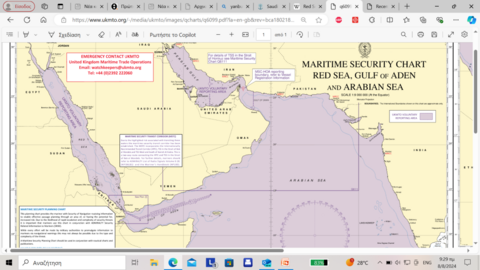

Suez Canal – Northern Red Sea

- The risk of attacks or incidents at the Suez Canal and the Northern Red Sea for the time being is assessed LOW.

- Increased kinetic retaliations between Yemen and Israel is a major concern for collateral damage on merchant vessels in the vicinity of Eilat port and while transiting the Gulf of Aqaba.

- The risk of attacks or incidents in Eilat port is assessed HIGH, while the risk for merchant shipping transiting the Gulf of Aqaba if they are heading for Jordanian, Egyptian or Saudi Arabian ports and with no Israeli, US or UK ties has been is assessed to be LOW, since the Houthis are avoiding to attack any Arab state port in the region.

Bab-el-Mandeb Straits – Southern Rea Sea

- The southernmost part of the Rea Sea and the Bab-el-Mandeb Strait are still assessed to be the most hazardous areas for international shipping, with no significant incident occurring during last period. Still the risk of attacks or incidents is assessed HIGH.

- As targets of opportunity for the Houthis diminish due to the decrease of Marine Traffic through the Bab-el-Mandeb Strait, it is assessed that vessels with multiple layers of indirect associations to Israel, US or UK will be targeted ever more frequently. Maritime industry stakeholders should take into account such associations when conducting threat and risk assessments.

- It is assessed that the US and UK airstrike campaign along with the naval USN and RN buildup in the area and the deployment of warships of international/EU maritime Operations “PROSPERITY GUARDIAN” and “ASPIDES”, have not mitigated enough the Houthi threat against merchant shipping, bringing the Bab-el-Mandeb Straits essentially under Houthi control, neutralizing the Suez Canal and imposing embargo to the port of Eilat (from south directions).

Gulf of Aden

- The eastern part of the Gulf of Aden is still assessed to be the one of the most hazardous areas for international shipping, with no significant incident occurring during last period. Still the risk of attacks or incidents is assessed HIGH.

- For the rest part of the Gulf of Aden the risk of attacks or incidents is assessed LOW.

- It is assessed that the naval USN and RN buildup in the area and the deployment of warships of international maritime Operations “PROSPERITY GUARDIAN” have proved to be more effective comparing to the area of Bab-el-Mandeb Straits and the Southern Rea Sea.

Arabian Sea – Gulf of Oman

- The risk of attacks or incidents at the Arabian Sea and the Gulf of Oman for the time being is assessed LOW.

Hormuz Strait – Persian Gulf

- The risk of attacks or incidents at the Hormuz Straits and the Persian Gulf for the time being is assessed LOW.

Overall Assessment

- Recent IDF, UK and US airstrikes against the Houthi military and infrastructure in Yemen is assessed to mark the beginning of a more powerful and decisive campaign of the International Community against the Houthi threat for the weeks to come. In addition, IDF assets and intelligence – targeting capabilities recently established in Somaliland (territory of Somalia) are expected over the next period to play a crucial role in countering and containing the Houthi threat. It also assessed that Egypt will be forced also to act against the Houthis due the severe loses of Suez Canal revenues as a consequence of the Houthis disruption campaign against merchant shipping in the Red Sea.

- The current situation around the seas of the Arabic Peninsula will continue the weeks to come to create risk for the shipping industry and will deter vessels to cross the Red Sea and the Suez Canal. However taking into consideration that the recent blows to Iran’s foothold in the Middle, first in Gaza, then in Lebanon, and now in Syria, Russia’s predicted loss of access to Syrian ports, airports and naval bases in the Mediterranean Sea, the new political situation in Syria and the advantageous military situation that has emerged for Israel, it is assessed that at the beginning of Feb 2025 the newly appointed Trump administration will spearhead an

- effort by the international community to finally counter the Houthis’ threat against merchant shipping. This will bring the last of Iran’s proxies to heel and will undoubtedly change the overall balances in the whole Middle East region, opening the way for the U.S. and Israel to deal with Iran itself.

- It is assessed that the Houthi, as Iran’s last remaining proxy in the region, have now focused their attention and their military efforts and assets on attacks against Israeli territory placing the campaign of disrupting merchant shipping as secondary objective.

- Within the next days it is highly likely that Israel will reach to a ceasefire agreement with HAMAS at Gaza which will include the exchange of hostages. Nevertheless, it is assessed that the Houthis will resume with their campaign against Israel and merchant shipping in the Red Sea through invoking their pretext of supporting the Palestinian struggle.

Sea Guardian S.G. Ltd / Intel Department (www.sguardian.com / +30 6944373465) can support your operational planning, assist in determining the risk assessment and provide assistance in decision making by producing tailored made assessments upon request on ports in the region, on routes, on cargos and specific merchant vessels.

You can refer to our Threat & Risk assessment analysis brief No 24/001//10 Sep 24 for more information and background analysis on the events and situation in the region.