ATLANTA, Georgia, April 10, 2025 — Descartes Systems Group, the global leader in uniting logistics-intensive businesses in commerce, released its April Global Shipping Report for logistics and supply chain professionals. In March 2025, U.S. container imports increased 6.3% over February and 11% compared to the same month last year. While the growth reflects the additional business days in March, it also reinforces the strong performance in January at the start of the year when container import volumes surpassed 2.4 million TEUs. March 2025 also saw a shift in port dynamics, with East and Gulf Coast ports overtaking West Coast ports in market share for the first time in nine months. At the same time, port transit time delays improved across all major ports, suggesting that port operations are keeping pace with rising volumes.

Imports from China were down 12.6% in March over February, potentially influenced in part by a new 10% tariff imposed by the U.S. on February 4 and an additional 10% tariff imposed on March 4. Year-over-year, however, Chinese imports were up 9.4% over March 2024. The April update of the logistics metrics Descartes is tracking shows strong growth in import performance in the face of increasingly volatile global trade conditions. Quickly evolving U.S. trade policies, shifting port dynamics, and ongoing instability in the Middle East and Eastern Europe, however, are complicating global supply chains and heightening the risks of disruption.

March U.S. container imports perform well amid escalating tariffs.

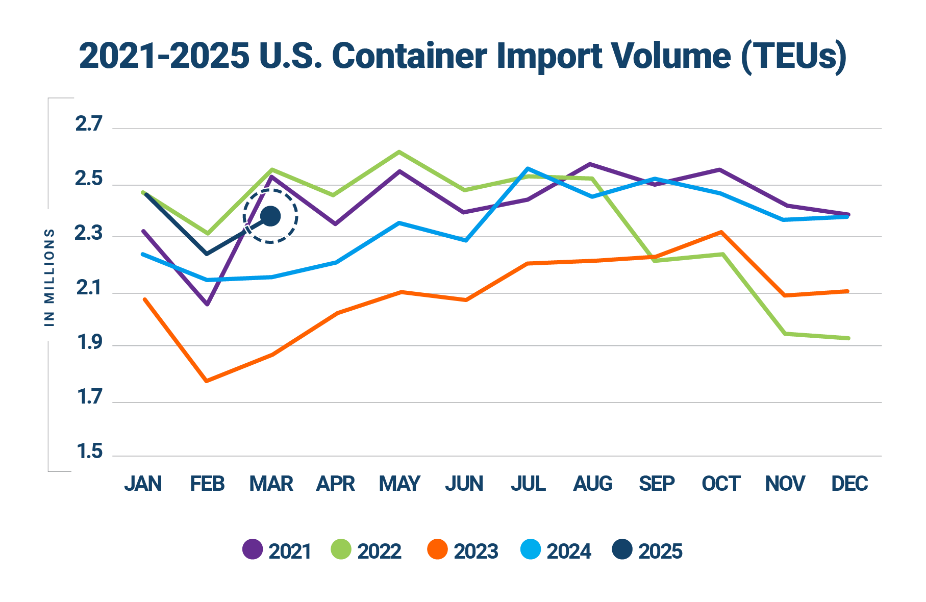

At 2,380,674 twenty-foot equivalent units (TEUs), March 2025 posted the third-highest volume recorded for the month, trailing only March 2022 and March 2021 (see Figure 1). Overall, for the first three months of the year, total U.S. container imports increased 8.4% over the same period in 2024.

Figure 1. U.S. Container Import Volume Year-over-Year Comparison

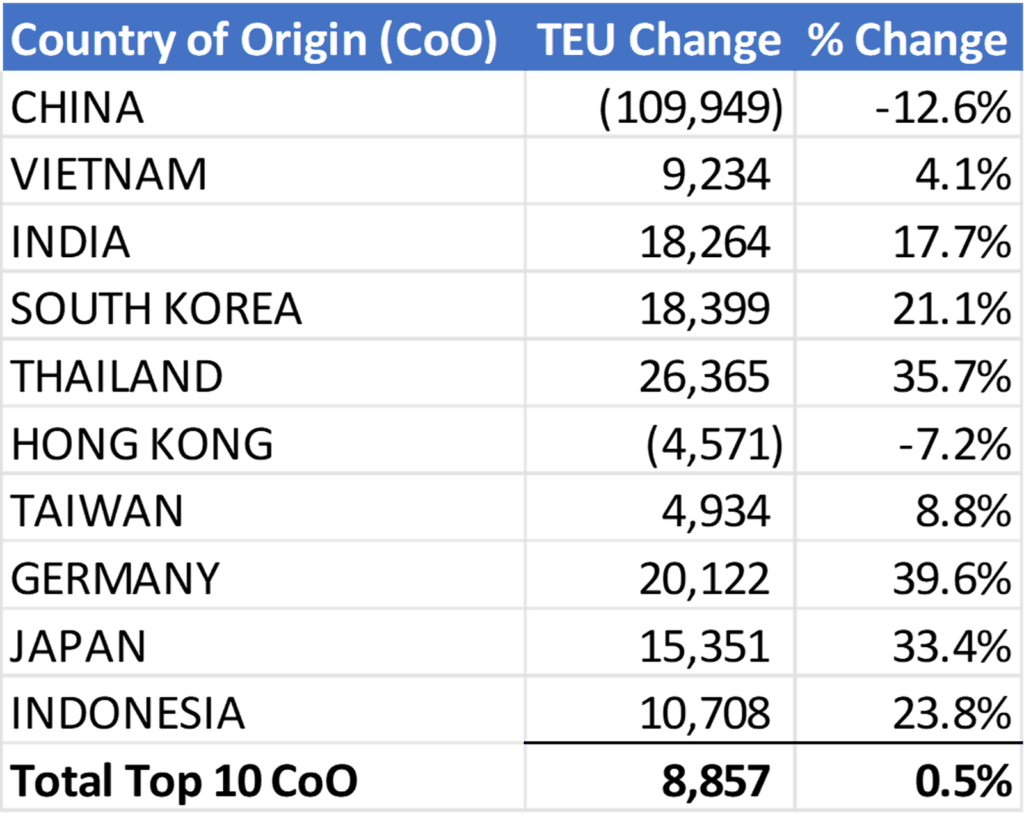

In March 2025, U.S. container import volume from the top 10 countries of origin (CoO) increased marginally by 8,857 TEUs, or 0.5% compared to February (see Figure 2). Among these countries, China saw the largest drop, down 109,949 TEUs, followed by Hong Kong (down 4,571 TEUs). All other countries in the top 10 experienced increases, with Germany (up 39.6%), Thailand (up 35.7%) and Japan (33.4%) leading the pack. New U.S. tariffs announced on April 2 and targeting a wide range of countries could, however, disrupt trade flows from these top U.S. maritime trading partners in the months to come.

Figure 2: February 2025 to March 2025 Comparison of U.S. Import Volumes from Top 10 Countries of Origin

“While March volumes rebounded following a typical seasonal dip in February, global supply chains are facing significant challenges, in particular from the volatility associated with widening U.S. tariffs and retaliatory measures from key trading partners,” said Jackson Wood, Director, Industry Strategy at Descartes. “With high U.S. tariffs on goods from China and new tariffs on imports from most other countries, we can expect further upheaval for global logistics, as many businesses evaluate how to potentially reorient their supply chains to help manage costs and mitigate risk.”

The April report is Descartes’ forty-fourth installment since beginning its analysis in August 2021. To read past reports, learn more about the key economic and logistics factors driving global shipping, and review strategies to help address challenges in the near-, short- and long-term, visit Descartes’ Global Shipping Resource Center.