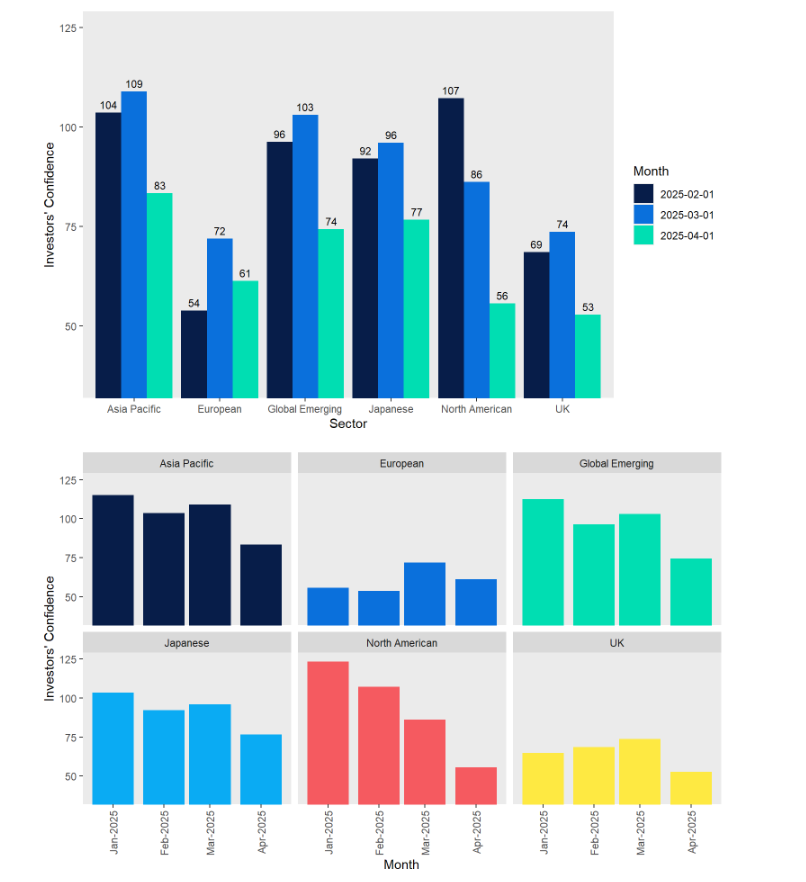

- HL investors’ confidence plummeted across the board in April, with a 35% drop in confidence in North American markets and a 28% drop in the UK.

- Confidence in UK economic growth also dropped significantly (43%) among HL clients.

- US and Global tracker funds remain popular, while investors have preferred to stick to the familiar stalwarts of the investment trust world.

- The Investor Confidence Index is compiled by surveying HL clients on a monthly basis. This month’s survey was open 1-8 April.

Victoria Hasler, head of fund research, Hargreaves Lansdown:

“In what has been an incredibly volatile time for both markets and politics, investor confidence has tumbled. The first week of April saw President Trump introduce tariffs across virtually all its trading partners and pretty much all goods. The extent and level of tariffs imposed sent shockwaves through markets and our survey shows that investors lost confidence in droves. Whiet Trump later announced a 90-day rollback on the tariffs, this came too late to be reflected in our data and, regardless, has done little to calm investors.

The largest fall, perhaps unsurprisingly, was in North America where investor confidence fell by 35% over the month. Fears of increased inflation and decreased growth started to bite and investors chose to avoid the volatility of both the US’s president and its market.

Global Emerging Markets and Asia saw falls in confidence of 28% and 23% respectively. With China introducing retaliatory tariffs, it now seems locked in a battle of wills with the US which is likely to damage the prospects of both economies. Japan also saw a fall of 20%.

Investor confidence in the UK also fell by 28%, and to the lowest level of any region in our survey. Confidence in UK growth fell more dramatically still, down 43% since the previous month.

Europe saw a fall of “just” 15% – the best of a terrible bunch.

The proportion of investors rating the political situation as “important” or “very important” when considering which investments to buy is now higher than any other factor (although the economic outlook is a close second). This makes sense given the events of the past few weeks.

In such difficult times our data shows that passive investment funds are still the most popular choice, with only one actively managed fund, Artemis Income, making it into the top ten most bought funds. The list is still dominated by US and global funds, but a European tracker has crept in at number nine and a UK tracker at number eight.

In terms of investment trusts, it seems that investors are still keen to take advantage of discounts to hunt out some bargains. The mix is fairly eclectic but features a couple of infrastructure funds as well as some of the real stalwarts of the investment trust world such as Scottish Mortgage and City of London Investment Trust. In volatile times, it would seem that investors prefer to stick to what they know.”

Global investor confidence

HL data

| Top funds, HL clients, April so far (net buys) |

| UBS S&P 500 Index |

| Fidelity Index World |

| Legal & General US Index |

| Legal & General International Index Trust |

| Legal & General Global Technology Index Trust |

| Vanguard FTSE Global All Cap Index |

| Artemis Global Income |

| Legal & General European Index |

| HSBC FTSE All World Index |

| Legal & General UK 100 Index Trust |

| Top investment trusts, HL clients, April so far (net buys) |

| Scottish Mortgage Investment Trust plc Ordinary Shares 5p |

| City Of London Investment Trust Ordinary 25p Shares |

| Greencoat UK Wind plc Ordinary 1p |

| JPMorgan Global Growth & Income plc Ordinary 5p |

| F&C Investment Trust plc Ordinary 25p |

| Polar Capital Technology Trust plc ORD GBP0.025 |

| International Public Partnerships Limited Ord GBP0.01 |

| Merchants Trust plc Ordinary 25p |

| Alliance Witan plc Ordinary 2.5p Shares |

| Henderson Far East Income Ltd Ordinary NPV |

Investor Confidence Index

Each month, we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average around 10% of clients respond.