ATLANTA, Georgia, June 9, 2025 — Descartes Systems Group, the global leader in uniting logistics-intensive businesses in commerce, released its June Global Shipping Report for logistics and supply chain professionals. In May 2025, U.S. container import volumes dropped after several months of growth, falling 9.7% from April and 7.2% year-over-year. Imports from China declined by 20.8% over April—the steepest monthly decline since March 2020—and by 28.5% compared to May 2024. Port dynamics also shifted in May, with East and Gulf Coast ports gaining market share over West Coast ports that experienced the brunt of much lower China-origin volumes. Port delays remained steady across most major gateways, though Los Angeles and Long Beach experienced increases despite lower volumes.

U.S. container import volumes retreat as tariff impacts emerge.

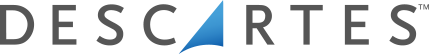

May 2025 U.S. container import volumes declined to 2,177,453 TEUs—a 9.7% drop from April (see Figure 1). Historically a month of rising import volumes over April, May 2025 is the only year in the past seven to post a month-over-month decrease, apart from pandemic 2020 (8.2%). Compared to May 2024, volumes were down 7.2% but were 4.3% above May 2019, signaling that overall demand remains elevated versus pre-pandemic norms. Despite strong early-year performance, the May decline marks the first significant contraction reflecting the impact of tariff volatility and growing trade pressures. For the first five months of the year, total imports are up 5.3% compared to the same period in 2024, though the gap has narrowed.

Figure 1. U.S. Container Import Volume Year-over-Year Comparison

Source: Descartes Datamyne™

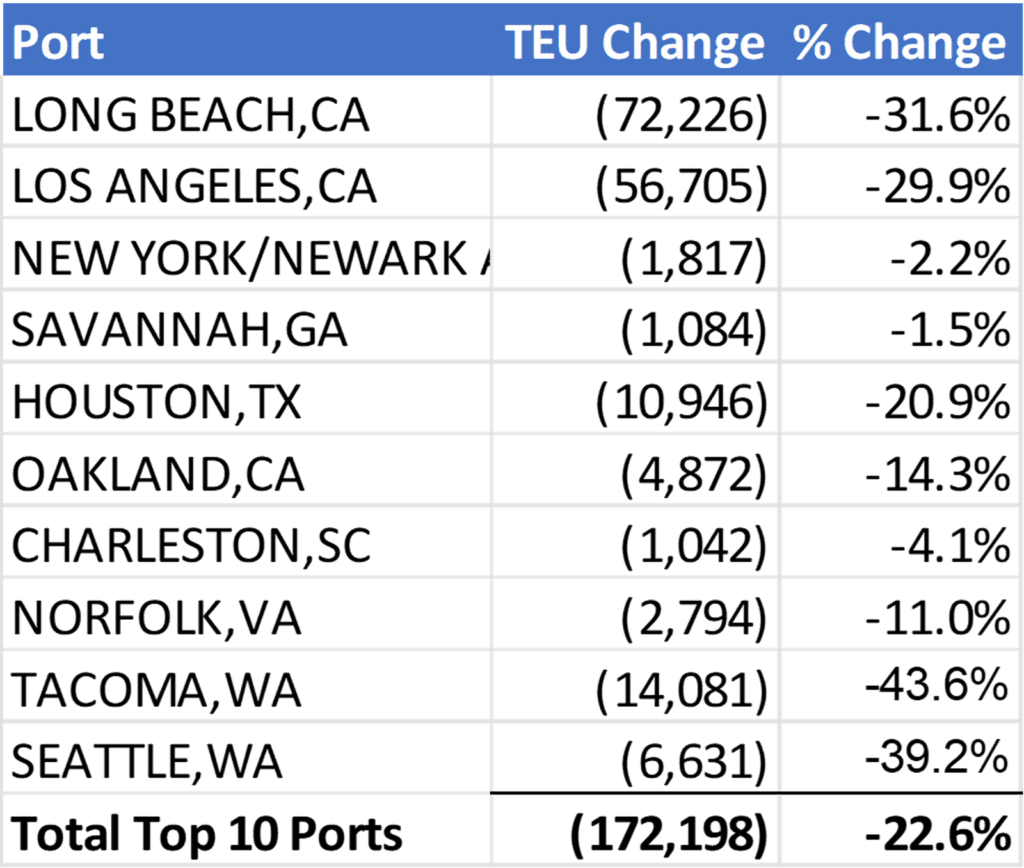

U.S. imports from China fell to 637,001 TEUs in May 2025, a drop of 20.8% from April (804,122 TEUs) and 28.5% year-over-year. In addition, China’s share of total U.S. containerized imports fell to 29.3% in May, its lowest level in over two years. At the port level, China-origin imports declined sharply in May across nearly all major U.S. gateways (see Figure 2). Long Beach and Los Angeles experienced the steepest drops in volume, down 31.6% and 29.9%, respectively, over April.

Figure 2. April 2025 to May 2025 Comparison of Imports from China at Top U.S. Ports

Source: Descartes Datamyne™

“After several months of import growth and following a wave of frontloading of shipments in April, the impact of new tariffs began to materialize in May,” said Jackson Wood, at Descartes. “The effects of U.S. policy shifts with China are also now clearly visible in monthly trade flows. While the 90-day agreement between the two countries to lower tariffs may bring U.S. importers some short-term relief, China-origin imports may continue to soften in the months ahead as organizations continue to reassess sourcing strategies amid rising landed costs, and as changes to the U.S. de minimis regulation for low-value Chinese imports continues to add cost pressures to trade.”

The June report is Descartes’ forty-sixth installment since beginning its analysis in August 2021. To read past reports, learn more about the key economic and logistics factors driving global shipping, and review strategies to help address challenges in the near-, short- and long-term, visit Descartes’ Global Shipping Resource Center.