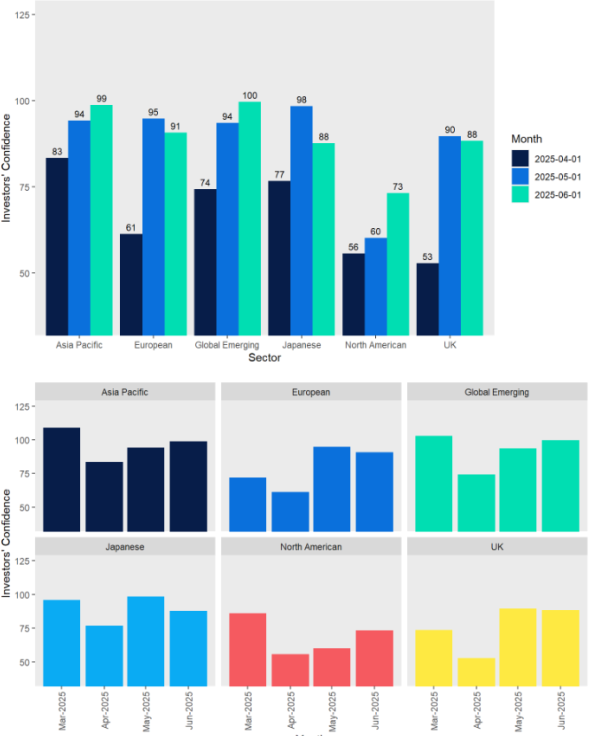

- HL investors’ confidence was mixed in June, reflecting a more cautious stance than in May.

- This month, confidence has fallen the most in Japan and it improved in the US.

- Confidence in UK economic growth has increased by 12%.

- The Investor Confidence Index is compiled by surveying HL clients on a monthly basis. This month’s survey was open 1-8 June.

Kate Marshall, lead investment analyst, Hargreaves Lansdown:

“After a huge rebound in investor confidence among HL clients last month, June has seen a more mixed picture so far. This isn’t a huge surprise given the ongoing uncertainty around tariffs from the Trump administration and the potential impact on businesses, and economies, across the globe.

Investor confidence in the European sector decreased slightly (down 4%) but it fell the most in the Japanese sector (down 11%). Long-term Japanese bond yields have recently risen significantly, leading to concerns over higher borrowing costs and the potential for worsening public finances.

Investors’ confidence in the UK sector has decreased this month, though only slightly, by 1%. That said, confidence in UK economic growth increased by 12%. The UK economy grew by 0.7% in the first quarter of 2025, which surpassed expectations and perhaps indicates some resilience despite global uncertainties.

On the other hand, the US saw the biggest rise in investor confidence, increasing 22%. It’s a stark difference from last month – while confidence in the North American market increased in May, the magnitude of the rise was much smaller than other markets. The pause in tariffs, a tentative trade deal with the UK, and a noticeable pullback in tariffs on Chinese goods may have appeased investors somewhat.

For a second consecutive month, the most popular fund in June so far was an actively managed fund – Artemis Global Income. Passives remain the most popular choice with investors overall though, with eight of the top ten funds being index trackers.

Within investment trusts, infrastructure was a popular choice. The outlook for infrastructure spending remains good given the government’s net zero commitments. Most infrastructure trusts also pay an attractive income and currently trade on large discounts, which have made them popular with investors. Elsewhere, a range of other income trusts investing across different regions – including the UK, Asia and Europe – have been popular with investors.”

Global investor confidence

HL data

| Top funds, June so far, HL clients (net buys) |

| Artemis Global Income |

| Fidelity Index World |

| Legal & General International Index Trust |

| UBS S&P 500 Index |

| Vanguard FTSE Global All Cap Index |

| Legal & General US Index |

| Legal & General European Index |

| HSBC FTSE All World Index |

| Artemis Income |

| Legal & General Global Technology Index Trust |

| Top investment trusts, June so far, HL clients (net buys) |

| SDCL Energy Income Trust Plc ORD GBP0.01 |

| City Of London Investment Trust Ordinary 25p Shares |

| Greencoat UK Wind plc Ordinary 1p |

| Blue Star Capital plc GBP0.001 |

| Henderson Far East Income Ltd Ordinary NPV |

| Supermarket Income REIT plc Ord GBP0.01 |

| JPMorgan European Growth & Income plc ORD GBP0.005 |

| NextEnergy Solar Fund Ltd Ordinary NPV |

| Fidelity Special Values plc Ordinary 5p |

| CVC Income & Growth Limited Ord NPV GBP |