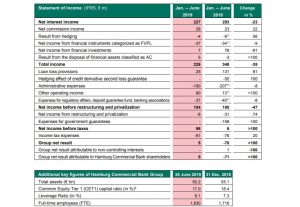

Hamburg Commercial Bank generates pre-tax profit of € 96m in the first half of 2019

– H1: Group net result after tax of € 5 (-70) million

– Focused new business: € 3.6 (3.8) billion at better margins

– Solid CET1 ratio of 17.0% and leverage ratio of 8.1%

– CEO Ermisch: “On course for positive 2019 result”

HAMBURG – Hamburg Commercial Bank AG (HCOB) generated a satisfactory result in the first half of 2019 and made clear progress in the initial months following privatization on the way towards becoming a successful commercial bank. Resolute portfolio management in its operating business, strict cost discipline as well as significantly better funding after privatization and also income from non-operating activity, contributed to the generally solid result.

“We are making speedy progress in all areas of our transformation. Repositioning of HCOB has started well. All measures to cut costs, widen margins and manage the balance sheet and risks are in place and being executed as part of our multi-year transformation. Meanwhile, our good capital resources put us on a firm foundation. From the second half and in the course of 2020 this uptrend will also be more clearly reflected in our operating result. I am convinced that we will become a successful bank in the next three years and that we will meet our targets,” said Stefan Ermisch, CEO of Hamburg Commercial Bank.

Operating performance on target

The Group net result before taxes of € 96 (prior-year period: 6) million corresponds to a pre-tax return on equity of 4.4% (31/12/2018: 2.2%). HCOB’s operating performance was on target in the first half and the Bank benefited from cost savings as well as better funding as a consequence of it successful privatization. The total income of € 226 (348) million was down from the previous

year’s figure, as budgeted, and was underpinned by net interest income of € 227 (293) million.

The previous year’s figures benefited considerably from favorable, privatization-related effects as well as income from sales of securities, which were significantly greater than the non-recurring income of the current reporting period. Temporary valuation effects in connection with interest rate hedging derivatives that cannot be taken into account in hedge accounting weighed on the fairvalue result (income from FVPL-categorized financial instruments) of € -37 (-34) million. Net commission income was up 22% to € 28 (23) million. The other operating income of € 80 (13) million due to partially reversed provisions for legal risks as well as settlement claims contributed to the Group result. A net reversal of risk provisioning in the amount of € 25 (131) million also

had a beneficial effect as there was further, encouraging improvement in the quality of the loan portfolio in the first six months of the current year. After taxes, the Group net result came to € 5 (-70) million, with the very high tax expense having been due to the planned reversal of deferred tax assets in the amount of € 90 million.

Additional cost savings following privatization

Our stepped-up cost initiatives and efficiency gains are so far only partially reflected in reduced administrative expenses of € -190 (-207) million. Operating expenses were cut by 16% to € -80 (-95) million thanks especially to savings on services and project work. Personnel expenses amounted to € -105 (-99) million. Our agreed, extensive job shedding will gradually take effect from the second half of the year and reduce these expenses significantly by the end of 2021. The same applies to operating expenses, which will drop accordingly as a result of restructuring. The number of employees in the Group was down to 1,630 full-time employees on 30 June 2019 (31/12/2018: 1,716) and will contract to about 950 by 2022. Corresponding provisions for the reconciliation of interests and redundancy program successfully agreed with the social partners at the end of March 2019 were already fully made in the 2018 financial year.

Depreciation/amortization of tangible and intangible assets amounted to € -5 (-13) million.

New business more focused and more profitable – Resolute portfolio management

New business including syndication was, at € 3.6 (3.8) billion, below previous year’s level. At the same time, focused new business profitability was significantly improved compared with the prioryear period, with strictly observed risk parameters and lower funding costs. Real estate finance provided € 2.3 (2.3) billion and deals with shipping clients contributed € 0.5 (0.3) billion to new business. In our Corporate Clients division, new business amounted to € 0.8 (1.3) billion. HCOB is adhering to its risk-adjusted margin expectations and will therefore deliberately curtail lending wherever this is expedient due to fierce competition as well as the economic development.

Improved portfolio quality: NPE ratio down to 1.7%

The Bank is maintaining its conservative approach to risk and has, with a view to the markets and the increasingly difficult economic trend in Europe, raised its general loan loss provisions, especially for its real estate segment. Even so, some provisions were reversed because of the good credit quality and in the wake of successful restructuring in the shipping business, meaning that loan loss provisioning contributed a total of € 25 (131) million to the result in the first half.

“The clearing of our legacy assets and our forward-looking approach in the past few years are now paying off. We have been cautious and only have a very limited exposure to the cyclical sectors of the German economy that are currently being affected by the tribulations in world trade and the recent economic slump. In future we shall continue to look very closely at the economic trend,

because we intend to maintain our good portfolio quality and will, if needed, adjust the capital tied up in the lending business,” said Stefan Ermisch, CEO of Hamburg Commercial Bank.

Based on further reduced non-performing loans, the bank’s non-performing exposure ratio dropped to 1.7% (31/12/2018: 2.0%). The NPE coverage ratio for non-performing loans improved to over 62.7% by the end of the first half (31/12/2018: 61.0%). The CET1 ratio stood at 17.0% at the end of the first half (31/12/2018: 18.4%) after necessary regulatory adjustments to the calibration parameters for internal models and is thus now at a good level, not only in comparison with the market, but also comfortably above our target figure of 16%. At 8.1% (31/12/2018: 7.3%), the leverage ratio was also at a good level and far above the regulatory requirements, thereby

underpinning the solid balance sheet picture. As expected, and due to our proactive balance sheet management, total Group assets contracted to € 50.2 (31/12/2018: 55.1) billion.

Outlook

The Bank still anticipates a modestly positive, IFRS-based Group net result before taxes for the 2019 financial year, subject to unforeseeable effects of restructuring/transformation as well as unforeseeable geopolitical factors. “We made good progress in the first half of 2019 and shall work hard on our transformation in the future, too, because our Bank’s realignment will stretch over the next few years. In operating terms, we must improve our efficiency further; we will keep a close eye on the currently very challenging economic developments and will continually adjust our planning accordingly. Moreover, we will further step up our digital strategy and IT transformation to drive our Bank’s modernization,” said Stefan Ermisch, CEO of Hamburg Commercial Bank.