Solid 2021 results underpin Fugro’s Path to Profitable Growth

Strong fourth quarter with growth in all regions

■ Full year revenue up 5.8% with continued diversification towards wind, infra and water at 61% of revenue.

■ EBITDA increased to EUR 175.6 million driven by Europe-Africa and Americas, and an EBIT margin of 4.3%.

■ Q4 revenue growth of 24.8% and Q4 EBIT margin of 4.3%.

■ Resilient performance due to cost control, operational delivery and early signs of improved pricing.

■ Free cash flow of EUR 39.5 million due to operational performance and good working capital management.

■ Positive net result of EUR 71.1 million.

■ Further deleveraging to 1.7x.

■ 12-month backlog increased by 11.6% to EUR 1,014.1 million, back to pre-pandemic level.

■ Outlook 2022: continued revenue growth and further margin expansion towards 2023-2024 target.

| Key figures (x EUR million)from continuing operations unless otherwise indicated | Q4 2021 | Q4 2020 | 2021 | 2020 |

| Revenue | 410.4 | 318.1 | 1,461.7 | 1,386.3 |

| comparable growth1 | 24.8% | (12.8%) | 5.8% | (12.4%) |

| EBITDA2 | 44.9 | 33.2 | 175.6 | 162.0 |

| EBITDA margin2 | 10.9% | 10.4% | 12.0% | 11.7% |

| EBIT2 | 17.4 | 3.5 | 63.0 | 48.2 |

| EBIT margin2 | 4.3% | 1.1% | 4.3% | 3.5% |

| Net result3 | 59.6 | (74.0) | ||

| Net result incl. discontinued operations3 | 71.1 | (173.8) | ||

| Backlog next 12 months | 1,014.1 | 866.2 | 1,014.1 | 866.2 |

| comparable growth1 | 11.6% | (8.0%) | 11.6% | (8.0%) |

| Cash flow operating activities after investing (free cash flow)4 | 14.6 | 36.1 | 39.5 | 88.4 |

| Net leverage5 | 1.7 | 2.1 | 1.7 | 2.1 |

1 Corrected for currency effect

2 Adjusted for specific items: onerous contract provisions, restructuring cost, impairment losses, and certain advisor/ other costs of EUR 2.7 million in 2021 (2020: EUR 28.4 million)

3 Attributable to the owners of the company

4 Incl discontinued operations; 2020 free cash flow includes EUR 49.9 million proceeds from the sale of Global Marine

5 Total debt (incl. subordinated debt) minus cash on balance sheet divided by last 12 months adjusted consolidated EBITDA for covenant purposes, including IFRS-16

Mark Heine, CEO: “We delivered a clear improvement in our results. The margin was up, in particular in Europe-Africa and Americas, and we generated a positive free cash flow and a positive net result. We won numerous exciting new projects, including follow-up contracts for Denmark’s Energy Island, multiple wind farm site characterisations on the east coast of the US and several investigation works in support of the future Hong Kong-Shenzhen Innovation and Technology Park.

Considering the impact of the pandemic throughout the year, I am particularly grateful for the unwavering commitment and flexibility of Fugro’s employees to delivering high quality services to our clients. The resilient performance was a combination of strict cost management, operational delivery, and early signs of improved pricing, particularly driven by a tightening supply market and new digital Geo–data solutions. We successfully advanced our digital technology journey focused on robotics, remote, analytics and insights.

In a rapidly changing world with an increasing need for insightful Geo-data, our services are more relevant than ever. The energy transition, climate change adaptation and sustainable infrastructure are at the heart of our strategy and we are well positioned to support clients with their transformation in light of these urgent global themes. By now, we generate 61% of our revenue in wind, infra and water. The strong growth, quality and composition of our backlog underline our ambition to further diversify in these growth markets.

The positive market outlook reinforces our Path to Profitable Growth strategy. On the trajectory towards our mid-term targets, our 2022 management agenda is focused on the following topics: further implementation of our digital transformation, innovation and sustainability agenda, excellence in commercial and operational delivery; another step-change in safety and employee engagement and the roadmap to reach our net zero carbon emission ambition by 2035.”

Performance review 2021

In the fourth quarter of 2021, revenue growth at 24.8% was particularly strong and supported by all regions, business lines and market segments. EBIT margin was 4.3% compared to 1.1% in the comparable period last year as a result of improved performance in Americas and Middle East & India, in particular in marine.

Full-year revenue increased by 5.8% on a currency comparable basis. Revenue from renewables sustained its growth trajectory with an increase of 21%. Infrastructure and water were up by 5% and 11% respectively. In the fourth quarter, oil and gas related revenue increased in all regions, whereas for the full year, revenue declined versus 2020.

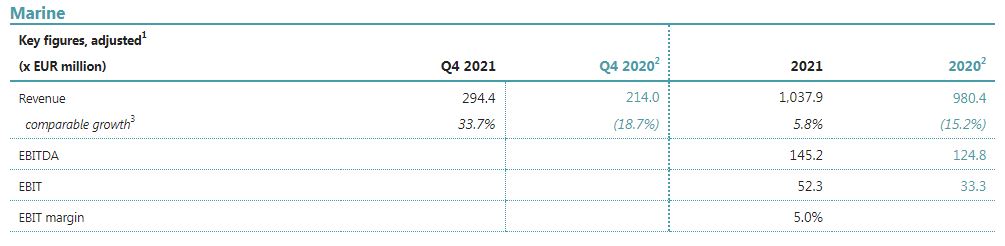

EBITDA for the full year increased to EUR 175.6 million, driven by improvements in Europe-Africa and Americas, resulting in an EBIT margin of 4.3% compared to 3.5% in 2020. Results in the marine and land asset integrity business lines were higher in all regions. Throughout the year, operations were still impacted by the pandemic, in particular operational complexities of cross border projects in Asia Pacific in combination with lower government cost compensation, and low activity levels in Middle East & India. As a result, marine and specifically land site characterisation margins declined.

Fugro generated a positive net result of EUR 71.1 million driven by improved EBIT, net finance expense and income tax.

Fugro’s 12-month backlog grew by 11.6% to EUR 1,014.1 million, which represents the largest increase since the end of 2018, and was supported by all business lines in all regions.

Free cash flow was EUR 39.5 million compared to EUR 38.5 million in 2020 excluding EUR 49.9 million proceeds from the sale of Global Marine Group. An increase in cash flow from operating activities by EUR 32.9 million was offset by higher working capital related to the revenue growth in the second half of year. Working capital as a percentage of 12-months rolling revenue was 10.9% at the end of 2021 compared to a particularly low level of 8.1% a year ago. Days of revenue outstanding was 82 days at the end of 2021 compared to 83 at year-end 2020. Capex amounted to EUR 79.7 million, in line with EUR 81.2 million in the previous year. Net debt was EUR 292.7 million as at 31 December 2021 compared to EUR 368.4 million at half-year 2021.

Fugro is reviewing the possibility to extend its debt maturity profile. At this stage, it is uncertain whether Fugro will proceed and, if so, when this might happen.

Outlook 2022

For 2022, Fugro expects an increase in revenue in offshore wind, infrastructure and water markets, plus modest growth in the oil & gas market, resulting in overall continued revenue growth. In addition, the company is focused on further margin expansion towards its 2023-2024 mid-term targets of an EBIT margin of 8-12% and a free cash flow of 4-7%, on the back of higher pricing, increasing asset utilisation, disciplined cost management, operational excellence and digital transformation. At the same time, the company will continue to focus on actively managing any impacts of the pandemic, inflationary pressures and a tight labour market. To support the anticipated growth and the company’s transformation agenda, capex is estimated at around EUR 100 million.

Review by business

Viewers can log here below and read the full report/press release: