The economic environment for global trade has profoundly shifted in the past year. Recovering demand from the pandemic has collided with supply side constraints in many industries, inflation and interest rates are rising, and the Ukraine war, together with sanctions on Russia have disrupted global commodity flows. In this article, using VesselsValue data, Vivek Srivastava, Senior Trade Analyst, analyses what the impact on global food supplies could be and which countries will be most affected. You can read the full article here.

“…The UN Food and Agriculture Organization estimates some 25 million tons of grains are currently stuck in Ukraine. China is by far the biggest destination for Russian and Ukrainian grain in recent years, taking between eight and ten million tons in the time period, but volumes have collapsed since the war. Countries such as Spain and Italy also exhibit a collapse since the war, and others such as Turkey and Egypt have maintained volumes very close to the same period last year.

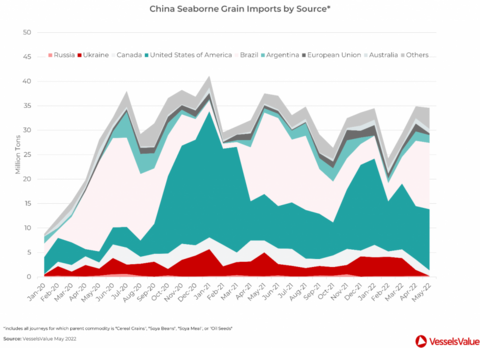

Though China is the biggest destination for Russian and Ukrainian grain, it is not a cause for concern. China’s seaborne import volumes from the two countrie s in the context of its imports from the other six countries that comprise the “Big Eight”. In the two years before the war, Russia and Ukraine only accounted for 10% of China’s total seaborne imports.

Lebanon stands out as country of particular concern. 71% of its seaborne grain imports came from Russia and Ukraine in the year before the war. Similarly, Tunisia imported 55% of its seaborne grain from the two countries in the year before the war, but almost nothing since…”

If you are looking for any expert insights, data or commentary, please don’t hesitate to reach out to press@vesselsvalue.com. We are more than happy to assist with any requests.