- The Bank of England is no longer willing to offer unending support to markets

- Markets have reacted positively to the new Chancellor, but volatility remains

- Experience is key when investing in these uncertain times

Hal Cook, Senior Investment Analyst, Hargreaves Lansdown:

“For the last decade, the Bank of England (BoE) has been in ‘whatever it takes’ mode. While interest rates rose from 0.25% to 0.75% in 2017/18, this was more about policy ‘normalisation’ than it was about cooling the economy – even though inflation was above target at the time. Hence why it was two 0.25% rises, 10 months apart. Things have changed now and while the BoE has stepped in to stop gilt markets falling apart over the last couple of weeks, that has already ended – for now at least.

Markets have responded positively to the effective cancellation of Kwasi Kwartang’s ‘mini-budget’ from 23 September that new Chancellor Jeremy Hunt announced yesterday, however it remains clear that the BoE is more focussed on the longer-term implications of inflation. By raising rates further, it risks hurting the economy and tipping the UK into recession. For many investors, this will be the first time that they have been in a position where the BoE isn’t going to necessarily come to the rescue – a scenario we haven’t been in since before the financial crisis, arguably longer. At the same time, we have the underlying reason for the step change in approach: generationally high inflation.

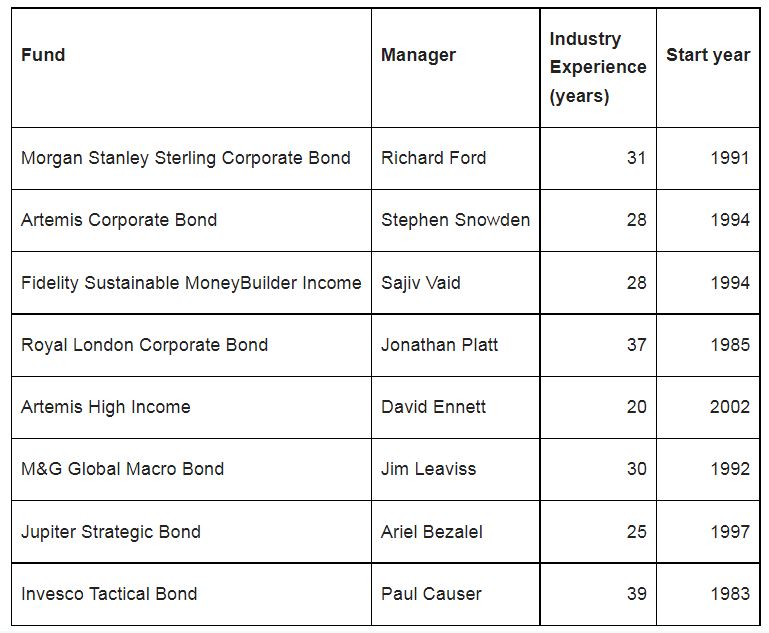

One of the things we look for in funds are managers with lots of experience and time in the industry. The reason we place a lot of emphasis on this is because we want to invest with people who have been through market cycles and experienced different economic conditions and monetary policies that can impact future investment returns. For the eight actively managed bond funds on the Wealth Shortlist, the average industry experience of the lead manager is 30 years. Their industry start dates range from 2002 all the way back to 1983. While time in the market is no a guarantee of positive future returns, we think experience helps managers make better informed decisions, especially when facing uncertainty.”

HL’s Wealth Shortlist bond funds