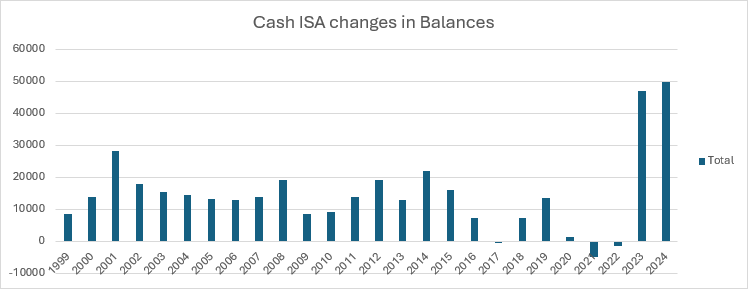

- Data from the Bank of England this morning has shown that 2024 was a record year for the Cash ISA market, with savers depositing over £49.8billion – up from the previous record of £47.1 billion in 2023.

- Cash ISAs have become increasingly popular in the face of rising tax bills. At the moment, they also offer the highest rates in the savings market.

- HL’s Cash ISA platform shows that clients are still preferring easy access over fixed rates, with 90% of deposits going into variable rate products.

- Savings platforms continue to dominate the Cash ISA easy access market. No banks and building societies feature in the top three for rates.

The Bank of England reported on effective interest rates for December: Effective interest rates – December 2024 | Bank of England

It also issued its Money and Credit report for December: Money and Credit – December 2024 | Bank of England

Mark Hicks, head of Active Savings, Hargreaves Lansdown:

“The Cash ISA market had a record year in 2024, attracting almost £50 billion in savings, and becoming the fastest growing sector of the savings market. As interest rates have risen, frozen income tax thresholds and an no changes to the personal savings allowance have persuaded more savers to use Cash ISAs to protect their savings from tax.

Data from HL’s Cash ISA platform shows that variable rate accounts continued to dominate in 2024, with 90% of inflows going into these products, and only 10% being placed in fixed terms. This isn’t surprising given 2024 was characterised by an abnormal savings market, where easy access rates were consistently outperforming fixed terms rates. Whilst this dynamic still exists, fixed terms offer savers security of return, which is particularly valuable with the prospect of a number of rate cuts coming in 2025.

Multiple providers are still paying around or slightly above 5%, but these aren’t guaranteed to remain as we head towards the end of the tax year – especially given they will likely already be operating them at a loss. It means anyone planning to get a cash ISA before the end of the tax year may want to strike sooner rather than later.”

Cash ISA deposit growth balances

(Source: Bank of England)

About HL’s Cash ISA platform

HL Cash ISA offers easy access, limited access and fixed term ISAs, all in one wrapper.

Products are provided by eleven banks, meaning clients can obtain £595k of FSCS protection, because it offers access to seven institutions, and the first £85,000 within each one is protected. Other ISA wrappers only offer £85k of FSCS protection