Preliminary 2020 results: HCOB significantly increases earnings with strong capital position

- Net income before taxes of EUR 257 (previous year: 77) million

- Strong CET1 ratio at 27.0% (31/12/2019: 18.5%)

- CEO Ermisch: “HCOB strengthened in difficult environment and achieved excellent results–transformation well advanced

HAMBURG – Hamburg Commercial Bank AG (HCOB) achieved a Net income before taxes of EUR 257 (previous year: 77) million, demonstrating its prudent business policy and resilience in a challenging environment. The excellent capital position was significantly bolstered once more and balance sheet quality was safeguarded by early de-risking, which kept it at a solid level despite the negative impact of the COVID-19 pandemic on the economy as a whole. Major progress was made in all areas of the transformation agenda and the sharpened business model as a specialized commercial lender with a focus on renewable energy and infrastructure project finance, commercial real estate, shipping, diversified lending and selected corporate banking is bearing fruit.

Improved operating margins from the client business and newly established business lines contributed to the very good overall result, as did lower funding costs and a significant reduction in administrative expenses. The number of employees decreased as planned to 1,122 (31/12/2019: 1,482 FTE). The result was also influenced by income from the sale of properties as part of the building strategy. In light of the severe recession brought on by the COVID-19 pandemic, loan loss provisions were increased sharply to shield the portfolios, while coverage ratios were maintained at a sound level. HCOB began to restructure its balance sheet at an early stage, in advance of the current recession, and reduced its total assets by almost 30%

while taking a very cautious approach to new business. In addition, around a quarter of riskweighted assets were shed and the CET1 ratio improved to a strong 27.0% (31/12/2019: 18.5%).

“While dominated by the coronavirus pandemic, 2020 was a crucial year for the success of our profound transformation, and the excellent result of HCOB shows that we took the right strategic path. With the reduction of risk positions already started in 2019 and accelerated during the pandemic, we managed to maintain the good quality of our loan book in a challenging environment and once again significantly strengthened our capital base. Moreover, HCOB is steadily becoming more efficient and more profitable, allowing us to achieve important goals after two thirds of our transformation process and in some cases even surpassing expectations.

This gives us a good basis on which to expand our strategic options in the German banking market,” said Stefan Ermisch, CEO of Hamburg Commercial Bank AG. “We will consistently pursue our course in order to take advantage of opportunities and to act flexibly as a capitalstrong and robust commercial bank.”

Profitability increased – strong net interest income – positive one-off effects

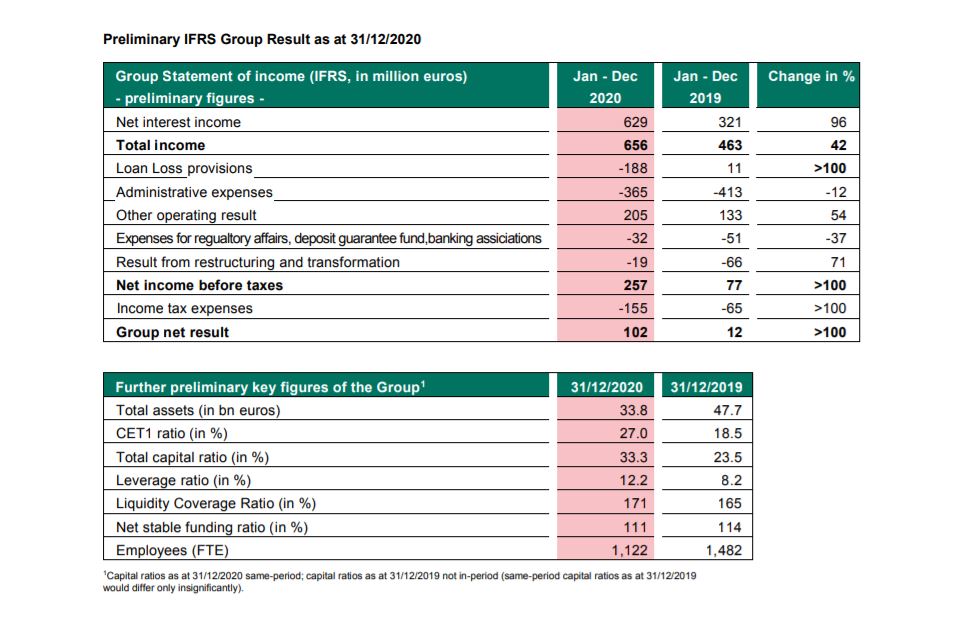

Net income before taxes (IFRS) was EUR 257 (77) million, according to preliminary calculations, amid a challenging market environment. Higher-margins in our operating businesscontributed to this very good result, as did rigorous cost management and one-off effects. After taxes, the bank reported a group net result of EUR 102 (12) million. The cost-income ratio (CIR) improved – also supported by one-off effects – to 42% (31/12/2019: 69%).

Total income increased to EUR 656 (463) million and was mainly driven by the significant rise in net interest income to EUR 629 (321) million – despite a noticeable reduction in total assets.

Especially pleasing was the development of sustainable income from the operating business, which is included in this figure, increasing by around a fifth thanks to the profitability-oriented management of the business. In addition, net interest income benefited from lower funding costs and from valuation effects on hybrid financial instruments amounting to EUR 72 million; in the previous year, revaluations had a significant negative impact of EUR -181 million.

The other operating result improved to EUR 205 (133) million and made a substantial contribution to net income. This includes a gain of around EUR 150 million from the sale of various properties successfully disposed of as part of the building strategy of the transformation program and with a view to the Bank becoming smaller.

Sound credit quality – excellent capitalization – burden from loan loss provisioning

The success of the early started de-risking strategy is also visible in the solid NPE ratio in 2020, a year massively impacted by the pandemic. At 1.8% (31/12/2019: 1.8%) the NPE ratio was maintained at last year’s sound level despite a significantly reduced balance sheet. The NPE coverage ratio (based on Stage 3 LLP) for non-performing loans was a solid 48% at year-end (31/12/2019: 57%); including collateral, the ratio is 118%. In addition, HCOB has a substantial stock of COVID-related GLLP, so that when all NPE risk provisioning components are taken into account a very high coverage ratio of 158% is achieved resulting in a substantial buffer for further potential negative COVID-19 impacts.

With the reduction of loans on the basis of risk and profitability criteria, the business volume was scaled back considerably: total assets declined by almost 30% to EUR 33.8 (47.7) billion, while risk-weighted assets (RWA) were reduced by just over a quarter to EUR 15.5 (21.0) billion.

With a notably lighter load of risk-weighted assets, HCOB’s capitalization has significantly improved from an already high level: the CET1 ratio increased to an excellent 27.0% (31/12/2019: 18.5%), which is well above the level of other national and international banks. The solid leverage ratio of 12.2% (31/12/2019: 8.2%) further proves the bank’s robust capital positions.

HCOB continues to pursue its conservative risk provisioning policy and, partly in view of the ongoing pandemic, built net Loan loss provisions of EUR -188 (11) million, although actual defaults having been moderate thus far.

Cost program taking effect – selective new business – improved margins

HCOB’s consistently implemented cost management continues to bear fruit. Even though forward-looking investments were made in IT infrastructure, administrative expenses fell as planned by around 12% to EUR -365 (-413) million. The number of employees decreased as planned by 360 to 1,122 full-time equivalents (FTE) at the end of the year, putting the bank well on track for the 2022 target of around 700 FTE. The provisions required for the extensive reduction in FTE by around 60% between the end of 2018 and 2022 were already fully reflected in the 2018/2019 financial statements.

As part of the focused business strategy, new business was managed selectively, according to clear risk/return targets. As expected, the volume remained below the previous year at EUR 2.9 (7.2) billion. New business contributed to the encouraging development of net interest margins across the portfolio.

Preliminary IFRS Group Result as at 31/12/2020

Group Statement of income (IFRS, in million euros:

.