Descartes’ Shipping Report: strong U.S. container imports continue

Descartes Releases January Report on Global Shipping Crisis

ATLANTA, Georgia, January 12, 2022 (GLOBE NEWSWIRE) — Descartes Systems Group (Nasdaq: DSGX) (TSX:DSG), the global leader in uniting logistics-intensive businesses in commerce, released its January report on the ongoing global shipping crisis and analysis for logistics and supply chain professionals. The report shows continued strong U.S. ocean container import volumes and economic indicators, which may point to similar levels of disruption for global supply chains in 2022 as in 2021.

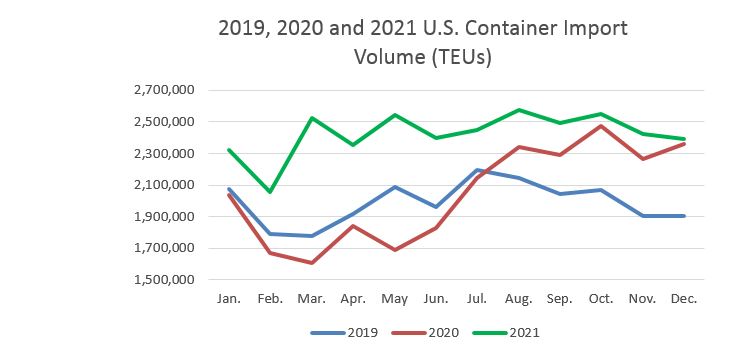

While December was the second month in a row with declining container import volumes (see Figure 1), compared to December 2020 and pre-pandemic December 2019, it was still a record month with volumes up 1% and 25%, respectively. From a pattern perspective, the November/December decline is similar to 2019. Looking at year-over-year container import volumes, 2021 was 18% higher than 2020 and 22% higher than 2019. When considering the extent of the container import increase and the fact that higher volumes have persisted for 18 months, the chronic supply chain disruption (e.g., delays, variability, etc.) that has ensued should not be surprising.

Figure 1. U.S. Container Import Volume Year-over-Year Comparison

Source: Descartes Datamyne™

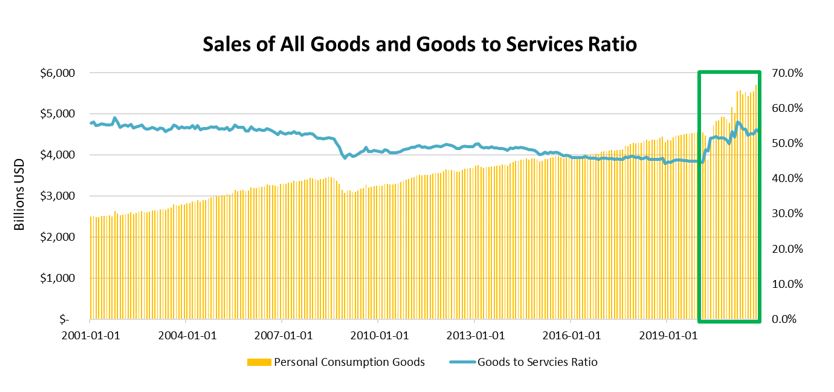

“In the U.S., consumer behavior driving a high ratio of goods to services expenditures (see Figure 2) is the fundamental driver of the current situation and doesn’t appear to be changing,” said Chris Jones, EVP Industry & Services at Descartes. “The new coronavirus variants are having multiple impacts keeping consumers from spending on services as opposed to goods and exacerbating existing resource shortages and the ability to move good efficiently. We believe 2022 is shaping up to be another congested and frustrating year for global supply chains and importers and logistics services providers need to view this as a longer-term situation and plan accordingly.”

Figure 2. U.S. Personal Consumption Metrics

To learn more about the key economic and logistics factors driving the global shipping crisis and strategies to help address it in the near-, short- and long-term, visit Descartes’ Global Shipping Crisis Resource Center.