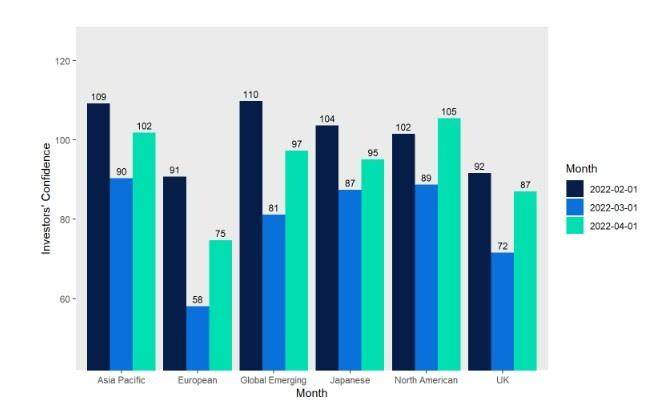

- Confidence has risen in all regions

- After the biggest fall in March, confidence in the European sector has the largest increase this month

- Europe has rebounded but it remains less favourable than Asia and the US as uncertainty remains

Emma Wall, Head of Investment Analysis & Research at Hargreaves Lansdown:

“Investor confidence was hit last month as the terrible events in Ukraine unfolded, and the world struggled to make sense of the horror of war. In the first weeks of the conflict, market volatility increased, and retail investors turned to perceived safe havens – gold, cash and total return funds which prioritise capital preservation. The investment region facing the most uncertainty was Europe, as investors feared contagion risk, and the reliance of much of the continent on Russian energy supplies. This month, confidence is returning, but there are still clear concerns about the uncertain outlook, with investors feeling most optimistic about North America and Asia Pacific markets. Fund flows over the past month reflect this, with investors buying into US equity funds, and global equity funds to diversify their geographical exposure.”

| Top Funds, Month to 22nd April (Number of net buys, alphabetical) |

| Artemis Global Income |

| Artemis Income |

| Baillie Gifford American |

| Baillie Gifford Managed |

| Baillie Gifford Positive Change |

| Fundsmith Equity |

| JPMorgan Emerging Markets |

| Jupiter Asian Income |

| Rathbone Global Opportunities |

| Troy Trojan (Class X) |

Investor Confidence – Global Sectors

- The investor confidence index is compiled by surveying clients on a monthly basis. Each month we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average around 10% of clients respond.