Investors back to buying funds – but caution remains

- UK investors put £2.8 billion into funds in April – a £1 billion increase on March and the highest level since August 2021

- But caution remained as the bond and money market fund flows outpaced equities with £1.1bn each compared to £93m for equities

- Tracker funds experienced another strong month, with inflows of £1.6 billion.

Data published today by the Investment Association (IA) revealed the five best-selling sectors for April 2023 were:

- Short Term Money Market with net retail sales of £770 million

- Global with net retail sales of £340 million

- UK Gilts followed with net retail sales of £259 million

- Specialist Bond with net retail sales of £226 million

- Mixed Investment 40-85% Shares was fifth with net retail sales of £225 million

Emma Wall, head of investment analysis and research, Hargreaves Lansdown:

“The asset management industry can breathe a sigh of relief – investors are buying funds again, after a dreadful 2022 which saw record outflows across all sectors. The Investment Association data for fund flow for April 2023 revealed net retail sales of £2.8bn for the month, up from £608m the year before. But while investors are buying again, it is worth noting what they are trading – fixed Income funds saw inflows of £1.1bn, as did Money Market funds, while Equity funds only attracted net sales of £93m. The worst-selling IA sector in April 2023 was UK All Companies, which experienced outflows of £1.1bn.

Clearly, while confidence in investing has returned, confidence in equity markets remained off in April. Concerns about inflation are in part to blame, as were less-than-rosy economic forecasts. Persistent warnings of a downturn in the developed world spooked many investors into lower risk assets. But since April, there have been some green shoots.

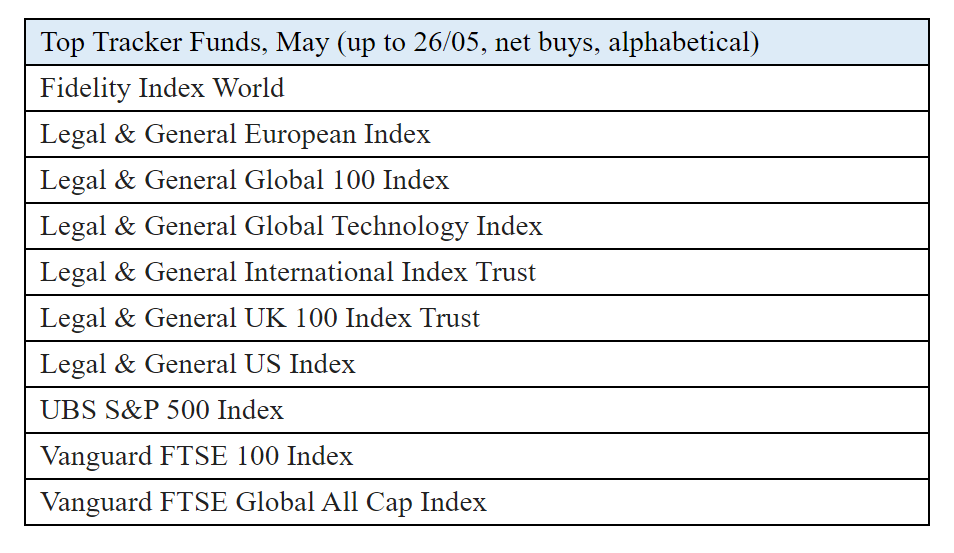

The HL Investor Confidence data for May found confidence had risen when reflecting on the outlook for the European, Global Emerging and Japanese stock markets. And confidence in UK Economic Growth also rose by two points, as inflation figures revealed a welcome fall below double digits. This slight increase in optimism seems to have been reflected in the top fund buys for May (tables below). Alongside Money Market funds, investors are looking to global equities, and tech stocks as well as European equity funds. Today’s news of a resolution on the US debt ceiling will also provide a welcome boost for markets, though it is clear caution will remain while prices are high and recession fears loom.”

HL data