Brief Update No 25/05 Date: 21 Feb 2025

STATEMENT

This document has been approved for distribution by Sea Guardian S.G. Ltd / Operations Department. The provided Intel and information derive from open sources, the Institute for the Study of War (ISW), the Joint Maritime Information Center (JMIC) and United Kingdom Maritime Trade Operations (UKMTO) respective WebPages and products. All rights reserved. No part of this Risk Assessment may be reproduced in any form: electronic, mechanical, or other means without written permission by Sea Guardian S.G. Ltd. Under no Circumstances can Sea Guardian S.G. Ltd be held responsible for any loss or damage caused by a reader’s reliance on information obtained by this Assessment.

Objectives

The purpose of this brief is to provide the Maritime Industry and the Security Stakeholders with:

- Major maritime security incident summary and analysis for the time period 12 – 19 Feb 2025

- Threat assessment updates concerning military operations – terrorism – piracy and also cargo theft, smuggling, stowaways

- Overview of risk assessment and relevant information, in order to support operational planning and decision making.

RECENT KEY DEVELOPMENTS

- On Feb 12, the U.S. President Donald Trump announced that he spoke by phone with his Russian counterpart Vladimir Putin and they agreed to visit each other and immediately begin negotiations through their respective teams. Trump said he discussed with Putin the issue of Ukraine, the Middle East, but also energy issues, artificial intelligence and the course of the dollar $. He said they agreed that they both want to stop the deaths and the war in Ukraine.

- On Feb 12, according to the Washington Post, US intelligence agencies warn that Israel is likely to launch a pre-emptive attack against Iran’s nuclear facilities by the middle of the year, citing multiple agency reports.

Such an attack would cause weeks or even months of delays to Iran’s nuclear program, but it would also escalate tensions in the region and risk a wider conflict. However, newspaper point out that these intelligence reports were made before Joe Biden’s term ends and Donald Trump took office. - On Feb 12, Israeli media reported that the US approved an Israeli request for the IDF to extend its deployment in five strategically significant locations in southern Lebanon by ten days, which would be until Feb 28.

- On Feb 12, Syrian Interim Defense Minister Marhaf Abu Qasra met with southern military commanders Naseem Abu Ara and Ali Bash in Damascus in an attempt to consolidate its control over groups in southern Syria that have not joined yet the Defense Ministry.

- On Feb 12, the Syrian Interim President Ahmed al Shara held his first official call with Russian President Vladimir Putin, suggesting that Syria seeks to maintain a future relationship with Russia, even while Russia withdraws its military assets from Syria. The Kremlin reported that Putin and Shara discussed recent negotiations over Russian basing rights in Syria.

- On Feb 12, the Syrian Interim President Ahmed al Shara formed a preparatory committee that is mostly comprised of pro-HTS individuals who are loyal to him. The composition of this committee suggests that it will likely make decisions that align with Shara’s views and objectives.

- On Feb 13, Lebanese authorities denied Iranian Mahan Air flight permission to land at Beirut International Airport after they received unspecified warnings from Israel. Lebanese civilians waving Hezbollah flags blocked the road outside Beirut International Airport to protest against the authorities’ decision. The IDF stated that the Islamic Revolutionary Guards Corps Quds Force had used Beirut International Airport in recent weeks to transfer funds to Hezbollah.

- On Feb 13, Israel and Hamas reportedly reached an agreement to continue the implementation of the first phase of the ceasefire agreement. Egyptian and Qatari mediators on Feb 12 succeeded in preventing a breakdown of the ceasefire agreement.

- On Feb 13, Israeli Strategic Affairs Minister Ron Dermer said that the IDF will remain in several positions in southern Lebanon “until Lebanon complies with its ceasefire commitments”.

- On Feb 13, Houthi Supreme Leader Abdulmalik al Houthi stated that the Houthis will respond with “military force” if Israel and the US implement US President Donald Trump’s plan to displace Palestinians from the Gaza Strip. He stressed that “We will intervene with rocket and drone attacks and sea attacks if America and Israel carry out their plan to forcibly displace …..”. In addition, Houthi President Mahdi al Mashaat emphasized that the Houthis are “alert” and ready to conduct military action.

- On Feb 13, the Syrian Interim Foreign Minister Asaad al Shaibani attended an international conference in Paris to discuss Syria’s political transition. The French President Emmanuel Macron stated that the Syrian interim government should “fully integrate” the SDF into the new Syrian army and that France will not abandon the SDF. Macron also called for immediately lifting sanctions on Syria and announced that France will provide $50 million in aid to Syria. However, the French foreign minister said that the EU requires “guarantees” before it will lift sanctions on Syria.

- On Feb 13, the Turkish President Recep Tayyip Erdogan, during an official visit to Pakistan made new statements in support of the Palestinians and against US President Donald Trump’s plan to remove them from the Gaza Strip. In a joint interview with Pakistani Prime Minister Shahbaz Sharif he stated that “Together with Pakistan, we are trying to provide the necessary support to the just cause of our Palestinian brothers at the United Nations, the Organization of Islamic Cooperation and other platforms. We believe that we must strengthen our decisive stance, especially at a time when there are proposals to uproot our brothers in Gaza from their homeland, which is illegal and unconscionable”. He also reiterated his position in favor of establishing an independent Palestinian state based on the 1967 borders, with geographical integrity and East Jerusalem as its capital.

- On Feb 13, Hamas announced that after talks with Egyptian and Qatary mediators it is committed to releasing hostages according to the “planned schedule”, paving the way for a new exchange on Feb 15, with the release of Israeli hostages held in the Gaza Strip and the release of Palestinian prisoners in Israeli jails, after days of uncertainty over the future of the warring parties’ agreement.

- On Feb 14, the Ceasefire Implementation Mechanism Chairman, US Army Major General Jasper Jeffers, said that he is confident that the Lebanese Armed Forces (LAF) will control “all population centers in the southern Litani area” by February 18.

- On Feb 14, Senior Hamas official Osama Hamdan said that negotiations for the second phase of the Israel-Hamas ceasefire-hostage agreement will begin on Feb 17, if Israel does not delay the delivery of humanitarian aid and heavy equipment to the Gaza Strip. The Israeli government has not yet confirmed that it will send a delegation to the negotiations.

- On Feb 14, the French President Emmanuel Macron urged Syria’s transitional authorities to consider working with the international coalition “Inherent Resolve” based in Iraq fighting Islamic State, in order to prevent a destabilization of their country during the transition period.

- On Feb 14, AFP reported that meeting of leaders of five Arab countries Saudi Arabia, Egypt, the United Arab Emirates, Qatar and Jordan, as well as the Palestinian Authority will be held in Riyadh on Feb 20, to discuss a response to U.S. President Donald Trump’s plan for the Gaza Strip, before that response is presented on Feb 27 at a planned Arab summit in Egypt.

- On Feb 14, Sudan’s government stated that they are finalizing an agreement allowing Russia to establish a naval base there. The agreement will be valid for 25 years and will allow support for Russian warships in the Red Sea. The base will be able to accommodate up to four ships at a time. Moscow has been seeking for years to build such an infrastructure near Port Sudan, and the issue has attracted international attention, coming after Russian military being expelled from Tartus and Latakia.

- On Feb 15, Hamas and Israel conducted the sixth exchange of Israeli hostages with Palestinian prisoners, as part of the ceasefire agreement in Gaza, which during previous week came close to collapse. The release of three Israelis, all of them dual nationals who have been held in the Gaza Strip for 16 months, and 369 Palestinian prisoners, comes as US Secretary of State Marco Rubio is expected in Israel on Feb 18.

On Feb 15, Indian Prime Minister Narendra Modi’s visited Washington DC and met with Donald Trump. During the meeting Trump confirmed his support for the international trade corridor IMEC (India-Middle East-Europe Economic Corridor), which is planned to connect India and its industrial production there with Europe via Saudi Arabia and Israel. This route will compete with China’s “Silk Road” to Europe, and shows the very serious international competition that exists for faster and with as few “strangulation points” commercial communication, as possible. So IMEC is planned to start in India, arrive by merchant ships in Saudi Arabia, start a rail connection with Jordan and

arrive at the port of Haifa in Israel, bypassing the Red Sea and Suez. In fact, this corridor would also have an energy component, with transportation next to the railway part of electricity and data, as well as hydrogen (and natural gas). From Haifa, the second – now maritime – leg will start, with merchant ships to Europe, where the main point of arrival and then transit-distribution throughout the continent was very critical.

- On Feb 15, the Wall Street Journal reported that Israeli officials requested to hold ground in five tactically significant locations in southern Lebanon after the expiration of the Israel-Lebanon ceasefire agreement.

- On Feb 15, the Syrian Interim Foreign Affairs Minister Asaad al Shaibani met with several officials on the sidelines of the Munich Security Conference in Germany. Shaibani met with German Foreign Minister Annalena Baerbock, Turkish Foreign Minister Hakan Fidan, British Foreign Secretary David Lammy, Norwegian Foreign Minister Espen Barth Eide, the United Nations High Commissioner for Human Rights Volker Turk and the German Deputy Interior Minister Hans-Georg Engelke. Discussions covered bilateral relations, security, and regional developments.

- On Feb 15, Hamas and the Palestinian Islamic Jihad (PIJ) agreed to release three Israeli hostages after mediators confirmed that Israel would allow the entry of tents and engineering equipment into the Gaza Strip. Israel also released 369 Palestinian prisoners.

- On Feb 15, the newly-appointed Syrian Preparatory Committee provided some details about how it plans to select representatives to attend the National Dialogue Conference. This conference will reportedly facilitate the drafting of a new Syrian constitution, and therefore, the composition of its attendees will influence the trajectory of the post-Assad Syrian state. The preparatory committee is comprised of five males and two females and does not appear to include representatives of the Alawite, Druze, Kurdish, and Shia communities. It remains unclear how the Preparatory Committee will ensure the diversity of conference attendees.

- On Feb 16, the Syrian Interim Foreign Affairs Minister Asaad al Shaibani advocated for other countries to lift financial sanctions on Syria at the al Ula Conference on Emerging Market Economies in Saudi Arabia. The conference explored possible technical assistance from the World Bank and the International Monetary Fund (IMF) to integrate Syria’s central bank back into the international financial system.

- On Feb 16, during an interview with Fox News, the US National Security Adviser Michael Waltz stated that US President Donald Trump is “deadly serious” about Iran “never” having a nuclear weapon. Waltz stressed that Iran obtaining a nuclear weapon is an “existential” threat to Israel and could ignite a “nuclear arms race” in the Middle East. Waltz added that Trump is willing to take “whatever action is necessary” to prevent Iran from obtaining a nuclear weapon but is still willing to negotiate with Iran.

- On Feb 16, the Israeli Prime Minister Benjamin Netanyahu, after meeting US Secretary of State Marco Rubio, stated that Israel and US President Donald Trump had a “common strategy” for the future of the Gaza Strip. “We discussed Trump’s bold vision for the future of Gaza and we will work to ensure that this vision becomes a reality”, the Israeli president told reporters after the meeting, adding that the two leaders have a “common strategy” for the future of the Palestinian territory. For his part, Mark Rubio, on his first official trip, declared that “Hamas must be destroyed and exterminated.” At the same time, he referred to Tehran, stressing that “there can never be a nuclear Iran”. At this point, Israel’s prime minister said they would “complete the mission” in the face of the threat from Iran with U.S. support.

- On Feb 17, a Syrian Defense Forces (SDF) commander stated that the SDF and the governing body in northeast Syria agreed to merge their forces into the Syrian Defense Ministry. There still appear to be several outstanding issues in negotiations between the SDF and the Syrian interim government, but both parties appear to be engaging with one another constructively.

- On Feb 17, a Druze leader in Suwayda, Sheikh Hikmat al Hijri, expressed his openness to collaboration with the HTS-led Syrian interim government. Hijri emphasized that the Druze in southern Syria would cooperate with the interim government since the government has promised to align with international laws.

- On Feb 17, Houthi spokesperson and chief negotiator Mohammed Abdulsalam and Political Bureau negotiator Abdulmalik al Ajri discussed the Israel-Hamas ceasefire with Iranian Foreign Affairs Minister Abbas Araghchi in Muscat, Oman. Abdulsalam stated that the Houthis are ready to confront any “aggressive moves” by the United States and Israel. Araghchi emphasized Iran’s support for the Houthis and unifying Yemen.

- On Feb 17, the Israel Defense Forces (IDF) confirmed that it will remain indefinitely in five strategically significant positions in southern Lebanon after withdrawing from all other positions on February 18.

- On Feb 17, the Israeli Prime Minister Benjamin Netanyahu stated that he rejects the idea that Hamas or the Palestinian Authority (PA) will govern the Gaza Strip. In addition, Netanyahu expressed his support for US President Donald Trump’s plan to “create a different Gaza.”

- On Feb 17, according to Hamas spokesman Hazem Qasim statements Hamas appears eager to stop ruling the Gaza Strip, in an opening that coincides with US-led efforts to extend the initial ceasefire and agree terms for a permanent end to hostilities with Israel. He also stated that “It is not necessary for Hamas to be part of the political and administrative situation in the next phase of Gaza, especially if it serves the interests of our people”.

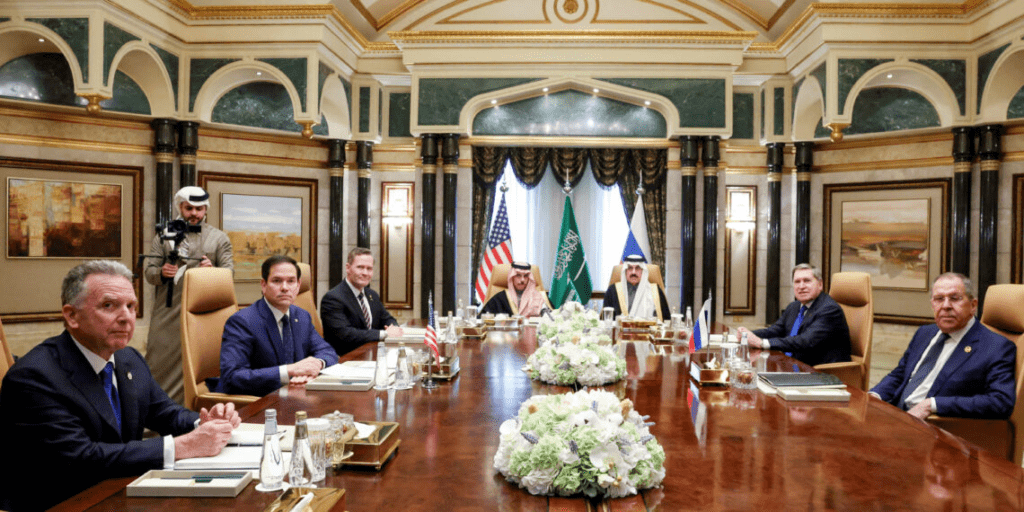

- On Feb 17, US Secretary of State Marco Rubio was received by Saudi Arabia’s Crown Prince Mohammed bin Salman (MbS) in Riyadh. Rubio, who was accompanied on the trip by the White House National Security Adviser Mike Walz and Middle East Special Envoy Steve Whitkoff, discussed the situation in the Gaza Strip following U.S. President Donald Trump’s proposal that the United States take control of the enclave.

- On Feb 17, Israel’s Security Council is expected to discuss the second phase of a ceasefire agreement with Hamas on Feb 18, which would free all hostages held in Gaza and end the war once and for all. Israel also announced it was sending negotiators to Cairo to discuss the continuation of the first phase of the deal, which ends on Mar 01.

- On Feb 18, the US Secretary of State Marco Rubio along with Trump national security adviser Mike Walz and White House Middle East envoy Steve Whitkov met in Riyadh, Saudi Arabia, with a Russian delegation headed by the Russian Minister of Foreign Affairs Sergei Lavrov. The talks were the first high-level face-to-face talks between Russian and U.S. officials in years and are supposed to precede a meeting between the presidents of the United States and Russia. During the discussions, the war in Ukraine was the main topic, both sides were satisfied with this initial approach and they decided to “appoint high-level groups in order to start working towards ending the conflict in Ukraine as early as possible, in a sustained, continuous and acceptable manner to all parties.

- On Feb 18, the U.S. Secretary of State Marco Rubio stated that the United States was open to Arab countries’ proposals on Gaza.”At the moment the only plan — which they don’t like — but the only plan, is that of Trump. So, if they have a better one, it’s time to present it” he said. The U.S. Secretary of State is preparing to tour the Middle East and says he hopes to be able to discuss the ideas during a visit to Saudi Arabia, the United Arab Emirates and Israel after talks with Egyptian and Jordanian officials in Washington.

- On Feb 18, Hamas and Israel announced the imminent release, scheduled for Feb 22, of six Israelis held hostage in the Gaza Strip, following the repatriation on Feb 20 of the bodies of four hostages, including, those of the last two children he was holding, in exchange for Israeli authorities releasing Palestinian prisoners under the ceasefire agreement.

- On Feb 19, US President Donald Trump stated that he is more “confident” about the possibility of an agreement with Moscow on a possible end to the war in Ukraine after U.S. and Russian diplomats held talks in Saudi Arabia, saying he would “probably” meet Vladimir Putin later this month.

- On Feb 19, Hamas stated that it is ready to release all remaining hostages at once in the second phase of a ceasefire between the group and Israel after 15 months of conflict. “We notified the mediators that Hamas is ready to release all hostages at once during the second phase of the deal, rather than in stages like in the first phase,” said Tahar al-Nunu, a Hamas official.

- On Feb 19, during a news conference with the Spanish prime minister in Madrid, the Egyptian President al-Sisi called on the international community to adopt a plan to rebuild war-torn Gaza without displacing Palestinians, after US President Donald Trump angered Arabs with his vision for the enclave. He also stated that “We stressed the importance of the international community adopting a plan to rebuild the Gaza Strip without displacement of Palestinians – I repeat, without displacement of Palestinians from their territories”.

- On Feb 19, the European Council announced that it extended the EU maritime security mission, Operation ASPIDES in the Red Sea, for a further year, until 28 February 2026.

- On Feb 19, during a meeting with US Secretary of State Marco Rubio in Abu Dhabi, the United Arab Emirates (UAE) President Sheikh Mohammed bin Zayed Al Nahyan stated that the UAE rejects the displacement of Palestinians.

MARITIME SECURITY INCIDENTS: 12 – 19 Feb 251

| INCIDENT No | INCIDENT Type | INCIDENT TIME | INCIDENT DETAILS |

| – | – | – | – |

1 In accordance to JMIC and/or UKMTO sources

THREAT ASSESSMENT UPDATE:

Military operations – terrorism – piracy and also cargo theft, smuggling, stowaways

Military Operations

- The current status in Syria is added to the general military conflict and unrest that takes place in the Middle East region, affecting also the East Mediterranean Sea. Though the HTS has become the predominant group and fully controls the interim Syrian government, it is highly likely that conflicts between rival rebels’ factions will resume over the status in future Syria.

- Syrian armed factions have started to integrate into the new Syrian army and security apparatus. It is unclear how extensive the integration of armed groups across Syria, yet the pace at which this integration occurs has increased over the last weeks. It is also unclear to what extent groups that integrate into the Defense Ministry will subordinate themselves to largely HTS-dominated command structures.

- Conflicts in the northern part of Syria between rival groups backed by Turkey, Turkish lead rebels and Kurdish militias are still ongoing. Turkey and the Turkish-backed Syrian National Army (SNA) continueto attack SDF positions along key ground lines of communication.

- Overall, the ceasefire in Lebanon was maintained even though from time-to-time IDF forces had conducted minor strikes against selected targets within Southern Lebanon. By the end of the ceasefire on Feb 18 the IDF has withdrawaled from Southern Lebanonwith the exception of 5 specific key outposts and already the LAF has begun to backfill the IDF previous held positions.

- Overall, the ceasefire in the Gaza Strip is still maintained and the hostage exchange is continuing after days of uncertainty during last week over the future of the warring parties’ agreement.

- Already the second phase of the Israel-Hamas ceasefire agreement is being discussed. However, recent Hamas postponement of the release of Israeli hostages and the subsequent Israeli reactions and threats along with the frail and weak condition of the Israeli hostages who were released, have made the ceasefire extremely fragile.

- Both Iranian-backed Iraqi militias and the Houthi movement which ceased military operations against Israel after the ceasefire in the Gaza Strip continue to uphold the cease fire and there have been no new attacks or incidents. Nevertheless, the recent Houthi threats against Israel and the US if the ceasefire in Gaza is not respected, is quite alarming.

- After the implementation of the ceasefire in the Gaza Strip on Jan 19, the IDF ceased their operations there and diverted their attention to operations in the West bank, against Hamas cells. These operations have increased in intensity over the last few weeks.

- Since Jan 19 there have been no US, UK or IAF airstrikes against Yemen.

- On Feb 13 Iran received a large shipment of a chemical precursor for solid missile propellant from China. Western officials estimated that this shipment could be used to fuel up to 260 mid-range ballistic missiles. It is assessed that over the next weeks Iran will try to replenish its stock of ballistic missiles.

- On Feb 15 International Atomic Energy Agency (IAEA) Director Raphael Grossi stated that Iran will likely have 250kg of uranium enriched up to 60% by the next IAEA report in Mar 2025. This marks a significant increase in Iran’s stockpile of enriched uranium since the IAEA’s last report in Nov 2024.

- A significant number of Russian vessels that had been at the Port of Tartus in recent weeks, have left Syria as Russian-Syrian negotiations about Russia’s continued access to its bases in Syria, reportedly failed. On Feb 14, satellite imagery showing the Russian cargo vessel Baltic Leader and potentially the Admiral Golovko Admiral Gorshkov-class frigate about 250 kilometers south of the coast of southwestern Cyprus. It is unclear now if the Baltic Leader will bring evacuated Russian cargo to Russia or Libya. Publicly available marine tracking data showed that two cargo vessels that departed Tartus in late January, the Sparta and Sparta II, were sailing off the coast of the Netherlands on February 15, presumably in transit to Russia.

Terrorism – piracy and also cargo theft, smuggling, stowaways

- The reemergence of terrorists group associated with ISIS and Al Qaeda in Syria since Nov 2024, has enhanced the terrorist threat level across the East Mediterranean Sea. Nevertheless, the risk of open conflict between these groups and the HTS has recently forced certain groups to lay down their arms and join with HTS.

- JMIC over the last weeks has received information from regional partners regarding pirate activity off the coast of Somalia and recommends merchant vessels to remain vigilant when transiting these waters and

- make necessary precautions according to Best Management Practices and industry guidelines, having armed guards onboard.

- Anti-Houthi Yemen media reported on Feb 13 that the Yemeni National Resistance Front (NRF) Coast Guard intercepted an Iranian weapons shipment to the Houthis from Djibouti. The NRF Coast Guard arrested at least five sailors affiliated with the Houthis for smuggling an unspecified number of cruise missile bodies, missile and drone engines, reconnaissance drones, naval devices, an electronic jamming system, and a wired communication system.

- On 18 Feb, two explosions occurred on an oil tanker SEA JEWEL while berthed in Savona, Italy, with damage below the waterline. The crew reported hearing two loud bangs at the bottom of the ship, suggesting the possible placement of explosive devices. The cause of the explosions remains unknown, but initial evidence points to possible sabotage, according to Italian media citing local authorities. Italian authorities are investigating thoroughly the case.

RISK ASSESSMENT

East Mediterranean Sea

- The risk of attacks or incidents in the East Mediterranean Sea for the time being is assessed LOW with the exception of all Israeli ports and the Syrian Coastline. Any port call in Israel should be arranged after a direct contact with the Israeli authorities, while it is not clear whether there are still any Syrian authorities or if they fully represent the newly establish interim government.

- Terrorist groups and other uncharted armed groups in northern and western Syria pose a threat to the region’s security environment and could potentially be dangerous for merchant shipping security along the Syrian coastline and ports.

- Turkey is attempting on one hand to pacify the Kurdish populations on its southern territory and along its southern borders and on the other hand to occupy more Syrian territory under the pretext of creating a safe zone. It is assessed that SNA with Turkish Armed Forces support, will continue to assail SDF forces. It is assessed that over the last days Turkey and HTS coordinated efforts to coerce the SDF to disarm and be integrated into the HTS-led defense apparatus since the fall of the Assad regime, have beginning to bear fruit with at least part of SDF leadership willing to discuss the issue.

- Turkey, HTS and Interim Syrian Government cooperation is constantly deepening and it is assessed that Turkey will attempt to incorporate Syria into its close allies, as it did with the West Libya GNA government, in order to increase its footprint in the region and pursue its geopolitical goals. It is assessed that Turkey’s secondary objective is to be awarded with the reconstruction of Syria in order for 2,5 million Syrian refugees to be established in northern Syria, and displace the local Kurdish populations.

- It is assessed that the efforts of Turkey to project itself as a “regional power” in the Middle East and North Africa region (MENA), as well as East Africa either through political intervention or military presence, will be intensified over the next period.

- Recent HTS-led interim government’s efforts in the southern and western parts of Syria to dissolve all former opposition forces and integrate them into the new Syrian Defense Ministry have begun bearing fruit. Nevertheless, conflicts in the northern part of Syria between rival groups backed by Turkey, Turkish lead rebels and Kurdish militias suggest that it will likely difficult to finally reach to a lasting agreement on how to govern the country over the following months. There is still risk for Syria to become another “failed state” in the MENA region, following the footsteps of Libya and Iraq.

- The international community is beginning to engage with the Interim government in Syria and already sanctions to the previous regime are gradually being lifted. However, the EU and most countries remain uncertain and intend to wait for this government to show its true intentions on how to build and run the future Syrian State, and also on how they interact with other countries. Over the last two months, the interim Syrian Government has begun to successfully establish lines of communication and to reinvigorate diplomatic relations with Turkey, most Arab states, the US and EU. It is assessed that relations with Turkey, Qatar and Saudi Arabia are already at a high level, with the rest of the Arab states following at a lower level, while Egypt considers the HTS as a potential threat due to its ties with Turkey and the Muslim Brotherhood.

- It has become obvious that for the time being, US participation in the formation of the new Syria is not a priority for Trump and it is assessed that the US President will eventually withdraw any US forces that are currently stationed in Syria. A US withdrawal from Syria however, would very likely create opportunities for ISIS to rebuild itself in northeastern Syria in particular.

- It is assessed that the US President’s “bold” proposed plan for US to take control of the Gaza Strip in order to be rebuilt and the relocation of Palestinians to other Arab countries, even though at first hand has been rejected by many countries, will gradually in the long term begin to represent a possible solution to the geopolitical stalemate in the Middle East.

- It is assessed that the recent phone call between Trump and Putin, the visits of the US Secretary of State in Israel and the Arab Countries of the region and finally the meeting in Riyadh of the US and Russian delegation suggest that over the next weeks the US will increase their efforts in putting an end to the Israeli –Hamas- Palestinian Authority conflict over the Gaza Strip and to try to establish a lasting solution to the problem that will bring peace and stability in the region before turning its full attention to Iran and its remaining proxies.

- It is assessed that Israel will certainly have a pivotal role both in mitigating Turkey’s ambitions, influence and overall foothold in the new Syria, on behalf of US and generally in promoting US objectives in the region. Over the next period it is also expected that the influence of Saudi Arabia in Syria and the overall region will be elevated, acting as a secondary pillar for US objectives and policies.

- It has become clear that Russia has lost its bases in Syria for good. Over the last weeks Russia has continued to extract by sea its remaining military assets. It is assessed for the time being, that Russia will move its forces from Syria back to Russia territory in order to reinforce the operations against Ukraine. However, it is expected that in the long-term Russia will try to establish a new naval and air base into an East Libya area (controlled by General Haftar) and also in Soudan in order to assure its presence in the region.

- It is assessed that further Israeli efforts to neutralize Syria as a potential threat and to establish a safe zone during the next weeks, could lead to a new escalation in tensions between Israel and Turkey over the future of Syria, since their interests are colliding. It is highly likely that the US will try to play a mediator role to improve the relations between Turkey and Israel, avoiding any further tensions.

- In Lebanon over the next period, it is assessed that Hezbollah military will be gradually but steadily evicted by the Lebanese army (LAF) which has moved to backfill IDF previous held positions according to the agreement that followed the ceasefire period which ended on Feb 18. The agreement which permits IDF to maintain control of 5 key outposts within Lebanon will provide the future base for Israel to come to terms with the new Lebanon leadership. Hezbollah requires time and support from Iran to rebuild and reorganize. It is assessed that under current circumstances in the region it is highly unlikely in the near future for Hezbollah to regain its military capabilities or to assume significant operations against Israeli forces in Lebanon and Syria or against Israeli territory.

- Hamas will likely use the first phase of the ceasefire in Gaza and the return of Gazians to Northern Gaza to reorganize and replenish its forces and move cells around the Gaza Strip without Israeli retaliation. It is assessed that Hamas can only achieve limited reorganization and will be unable to regenerate itself during this period or to seriously impede the IDF if the ceasefire collapses. Nevertheless, the return of Gazans to the northern Gaza Strip will make it difficult for the IDF to conduct operations with the same intensity as it did before the ceasefire.

- While the ceasefire between Israel and Hamas has been in place since January 19, recent events proved how fragile it is still. Hamas under pressure from Egypt and Qatar was finally forced to conduct hostage release in line with the ceasefire agreement and to abandon any thoughts of retaining the hostages in order to gain leverage during the second phase of negotiations.

- Hamas ambitions that by retaining the hostages, it can increase domestic Israeli pressure on the Israeli government to continue negotiations and reach a permanent ceasefire and to pressure Netanyahu to negotiate again in the future have been failed in total. Already discussions have begun over the issue of the second phase of negotiations

- On the other hand, the Israeli Prime Minister Benjamin Netanyahu with the full support of the US, will has openly declared his willingness to order the IDF to resume military operations in the Gaza Strip if the agreements are not kept.

- The Houthi have also declared that they will immediately resume its attacks against Israel and merchant shipping in the Red Sea and Golf of Aden if the agreements are not kept.

- In the West Bank it is assessed that the IDF will resume efforts against Hamas cells and will increase operations both in volume and intensity within Jenin refugee camp.

- It is assessed that in the future we could witness an escalation in tensions in Libya between Libyan parties, Turkey and Russia, which may lead to a new round of armed conflict that could threaten merchant shipping around Libyan territorial waters.

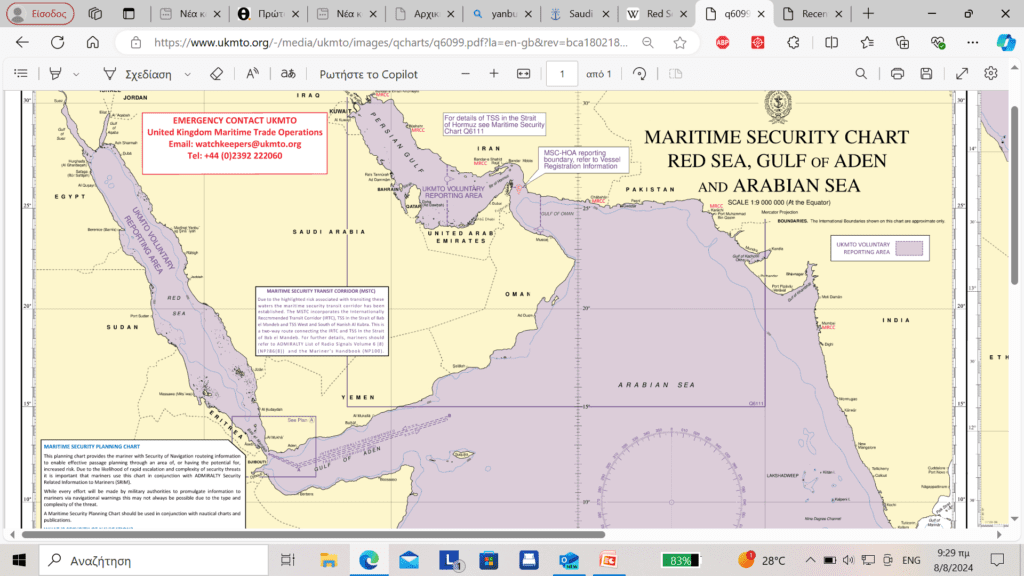

Suez Canal – Northern Red Sea

- The risk of attacks or incidents at the Suez Canal and the Northern Red Sea for the time being is assessed LOW.

- Cessation of kinetic retaliations between Yemen and Israel due to the ceasefire in Gaza has significantly decreased concern for collateral damage on merchant vessels in the vicinity of Eilat port and while transiting the Gulf of Aqaba.

- The risk of attacks or incidents in Eilat port for non-Israeli vessels is assessed LOW provided that there will be no problems or incidents in implementing all phases of the Israel-Hamas ceasefire agreement, nor any attacks against the Houthis in Yemen. In case of renewed hostilities between Israel and the Houthis, due to recent Hamas deviations from the ceasefire agreements, the risk of attacks or incidents against merchant vessels will automatically revert to HIGH.

- The risk for merchant shipping transiting the Gulf of Aqaba if they are heading for Jordanian, Egyptian or Saudi Arabian ports and with no Israeli, US or UK ties, is assessed to be LOW, since the Houthis are avoiding to attack any Arab state port in the region.

- Numerous shipping agencies indicate that there has been a small increase in the number of merchant vessels which transited through the Suez Canal with 987 vessels from Dec 2024 rising to 1.033 vessels for Jan 2025 and that the trend is to slowly increase. It is assessed, provided there will be no more future Hamas deviations from the ceasefire agreements and that there will be not issues with the implementation of the second phase of the Israel-Hamas ceasefire agreement, that by late Feb 2025 there will be a substantial increase in the volume of ships transiting the region.

Bab-el-Mandeb Straits – Southern Rea Sea

- The southernmost part of the Rea Sea and the Bab-el-Mandeb Strait are still assessed to be the most hazardous areas for international shipping, with no significant incident occurring during last period.

- After the Israel-Hamas ceasefire agreement the risk of attacks or incidents against non-Israeli ships is assessed LOW provided that there will be no problems or incidents in implementing all phases of the Israel-Hamas ceasefire agreement, nor any attacks against the Houthis in Yemen.

- In case of renewed hostilities between Israel and the Houthis due to deviations from the ceasefire agreements, the risk of attacks or incidents against merchant vessels will automatically revert to HIGH.

- Despite the recent de-escalation, it is assessed that the Houthis will continue to monitor vessels with multiple layers of indirect associations to Israel, US or UK in order to be targeted and attacked at a short notice, if the situation escalates again. Maritime industry stakeholders should take into account such associations when conducting threat and risk assessments.

- It is assessed that the US and UK airstrike campaign against Yemen will continue to be paused while the naval units of the USN and the RN along with the warships of international/EU maritime Operations “PROSPERITY GUARDIAN” and “ASPIDES”, will continue patrolling the area on high readiness.

Gulf of Aden

- The eastern part of the Gulf of Aden is still assessed to be the one of the most hazardous areas for international shipping, with no significant incident occurring during last period.

- After the Israel-Hamas ceasefire agreement the risk of attacks or incidents against non-Israeli ships is assessed LOW, provided that there will be no problems or incidents in implementing all phases of the Israel-Hamas ceasefire agreement nor any attacks against the Houthis in Yemen.

- For the rest part of the Gulf of Aden the risk of attacks or incidents is assessed LOW.

- It is assessed that the naval units of the USN and the RN along with the warships of international maritime Operation “PROSPERITY GUARDIAN” and “EU ASPIDES” will continue patrolling the area in high readiness.

- Recent information from regional partners regarding piracy activity off the coast of Somalia is assessed to be alarming and should move the shipping industry to enhance its security posture.

Arabian Sea – Gulf of Oman

- The risk of attacks or incidents at the Arabian Sea and the Gulf of Oman for the time being is assessed LOW.

Hormuz Strait – Persian Gulf

- The risk of attacks or incidents at the Hormuz Straits and the Persian Gulf for the time being is assessed LOW.

- Nevertheless, the announcement and uncertainties arising from the reactivation of the “Maximum Pressure Campaign” towards Iran by the US, could escalate tensions in the region and potentially lead to incidents impacting the maritime environment.

OVERALL ASSESSMENT

- Over the next period the US President Donald Trump will try to pursue the next three US goals which will reshape geopolitically the region. First to end the war in Gaza, second to bring an end to Hamas and Hezbollah and third to complete the “Abraham Accords” which he considers to be his own vision and work. In this context, Saudi Arabia and Russia will be used as leverage in order to push the Arab Countries and Iran along with its proxies to settle with US objectives and goals for the region.

- Since Jan 19, 2025 and the pause of the Houthis’ disruptive campaign against merchant shipping in the Red Sea, the stalemate in maritime security and freedom of navigation for merchant shipping in the region has been gradually lifted. It is assessed that as the ceasefire agreement between Israel and Hamas is proceeding and vessels and infrastructure remain untargeted, improved stability is expected.

- However, this pause in the disruption of the flow of merchant shipping through the Suez Canal and the Red Sea is quite precarious and should not be deemed rigid and solid in the mid or long term. It is assessed that even minor deviations from the ceasefire agreement could lead to hostilities, which would subsequently prompt the Houthis to again direct threats and attacks against international shipping at a short notice. In addition, the matter of upholding and implementing all phases of the Israel-Hamas ceasefire agreement by all key players in the region smoothly and without any problems or incidents, is a huge challenge on its own.

- It is assessed that the recent Houthi statements will discourage global firms and ship-owners to reenter in volume the Red Sea at all types of ships and cargos and over the next months, but still already there has been an increase in the overall number of ships (especially container ships) transiting through the Suez Canal.

- The current situation around the seas of the Arabic Peninsula will continue the weeks to come to create risks for the shipping industry and will deter vessels other than container ships to cross the Red Sea and the Suez Canal.

- It is assessed that in the short term, Houthis might resume with their campaign against Israeli merchant shipping in the Red Sea through invoking their pretext of supporting the Palestinian struggle and forcing Israel to uphold the agreements.

- It is also assessed that the risk of entering Israeli ports is now LOW since the Houthis pledged to stop attacking Israeli territory.

- The matter of returning the flow of merchant shipping through the region to its previous volume which is linked with the progression of US efforts in maintaining the overall stability and security in the region, will be determined over the next weeks. Stock markets globally are emitting positive signs for trade and economy, as the policy of the newly elected President of the US is unfolding.

Sea Guardian S.G. Ltd / Intel Department (www.sguardian.com / +30 6944373465)

can support your operational planning, assist in determining the risk assessment and provide assistance in decision making by producing tailored made assessments upon request on ports in the region, on routes, on cargos and specific merchant vessels.

You can refer to our previous Threat & Risk assessment analysis briefs for more information and background analysis on the events and situation in the region.

Viewers can also see last week’s report:

www.sguardian.com/

info@sguardian.com /

tel. +302109703322