To mark the start of 2025 Marine Money Week in New York, we take an in-depth look, using VesselsValue data, at the US fleet—broken down by vessel type, the top 10 shipowning nations, and the current market value of all vessels types versus the historic median.

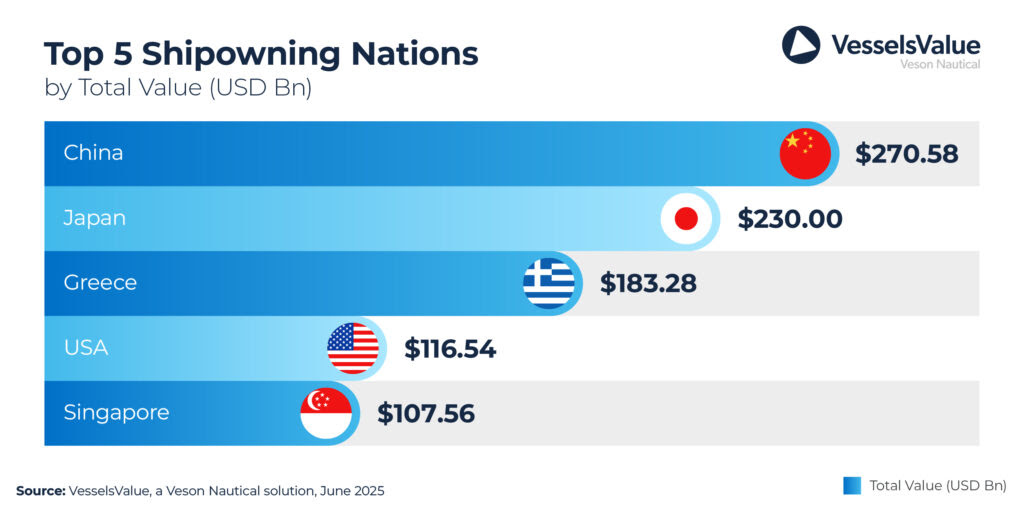

By beneficial owner country, China retains the top spot in terms of the most valuable fleet, amounting to USD 271 bn. Japan ranks second with a fleet value of USD 230 bn and Greece ranks third with a fleet value of USD 183 bn.

The US ranks fourth, with a total fleet value of USD 116.5 bn. The cruise sector remains the country’s strongest maritime asset, reinforcing the US’ position as the world’s largest cruise owner. This is to be expected given that the two leading cruise companies, Carnival and Royal Caribbean, have their headquarters in the US.

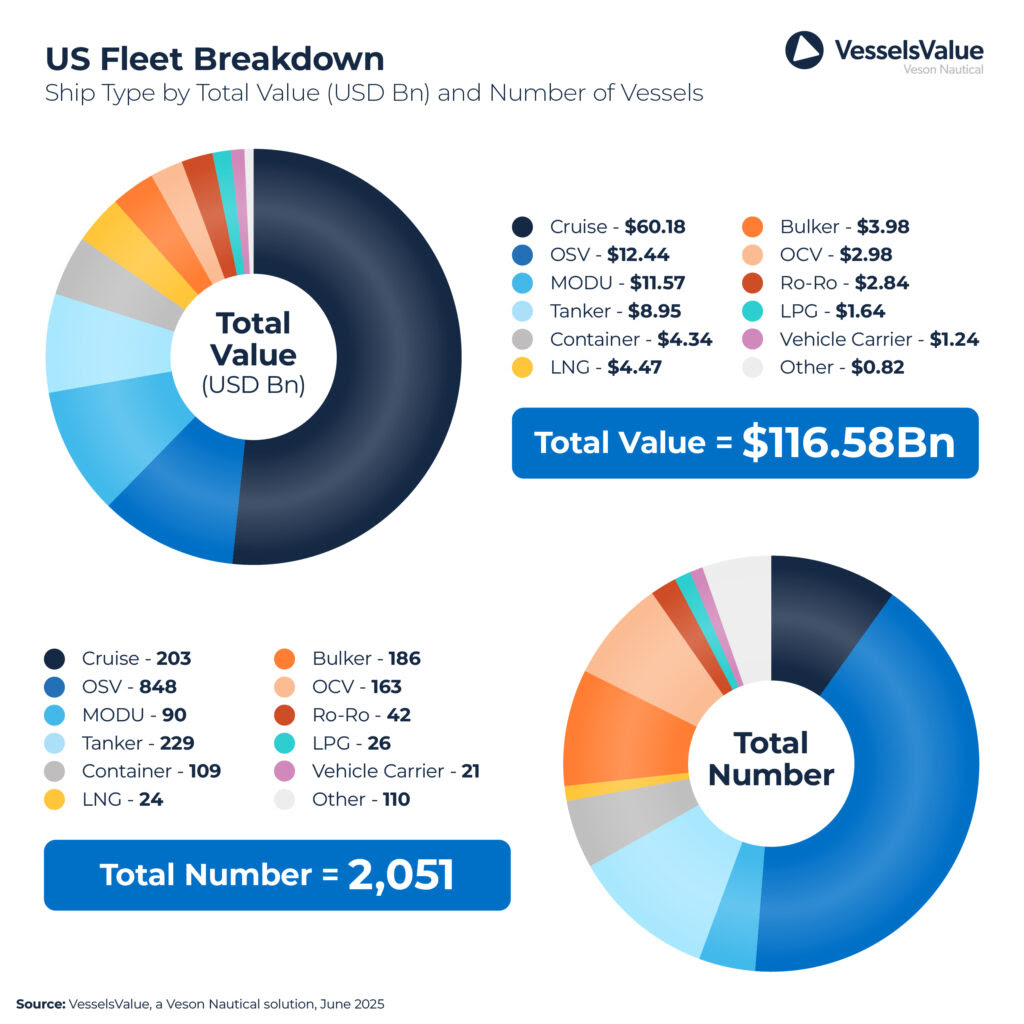

Cruise ships are the most valuable vessel type within the US fleet, worth a total of USD 60.1bn; this is also the second largest fleet in terms of volume with 203 vessels. The cruise sector has seen considerable increases in value so far this year, particularly for older vessels. This comes as demand for this sector has skyrocketed and—at the same time, many vessels were scrapped or laid up during the pandemic, therefore second hand vessels are in short supply.

The OSV sector ranks second with a value of USD 12.4 bn. However, in terms of volume, this sector takes the top spot, accounting for the majority of the US fleet with a share of c.35.5%

The MODU sector ranks third, valued at USD 11.6 bn, with a fleet of 90 vessels. Tankers rank fourth, valued at USD 8.9 bn, with the third largest fleet of 229 vessels. New entries to the fleet this year include 6 x Chinese built VLCCs of around 300,000 DWT, and 9-10 years of age, purchased by International Seaways from Ocean Yield for c. USD 257.7 mil.

In fifth place is the Container sector, with a value of USD 5.4 bn and 109 vessels. This sector has seen a considerable increase in values over the last year with gains across almost all sub sectors and age categories as rerouted vessels—due to geopolitical tensions in the Red Sea and Strait of Hormuz— have increased ton mile demand. For example, values for 15 YO Sub Panamax vessels of 2,500 TEU have increased by c.63.24% year-on-year from USD 17.71 mil to USD 28.91 mil.

Despite some market softening due to geopolitical factors and economic uncertainty, asset values remain firm across all sectors, when compared to the 10-year historical median. In particular, the PSV and AHTS sectors where 5YO vessels are 163% and 155% above the 10-year historical median. The Container sector is also noteworthy, with 5YO values up by 110% against the historical 10-year median.

Shipping asset values remain firm in 2025, driven by limited shipyard capacity, strong demand for secondhand vessels, and ongoing geopolitical tensions. With newbuild opportunities constrained and regulatory uncertainty discouraging fresh orders, buyers are increasingly choosing modern, eco-friendly tonnage. Extended trade disruptions have lengthened voyage times and tightened supply, supporting earnings and helping to stabilise asset values despite softer freight rates.

The US fleet reflects this broader market strength and diversity, with Cruise ships standing out as its most valuable segment, highlighting the sector’s continued stability amid challenging conditions.