Recent developments on the sanctions and tariffs front are clearly having a significant effect on international shipping and trade.

Speakers gathered at a London Shipping Law Centre seminar on April 30th had no doubt that the volatility and unpredictability surrounding the extent and timings of US-inspired tariff rises were making the complicated web of sanctions against particular countries even more difficult to negotiate. An audience of over 100, in person and online, convened at the London offices of Clyde & Co to hear about the emerging effects on shipping and trading contracts and how they might develop. The moderator was Ian Woods, a partner at Clyde & Co.

Patrick Murphy, also a Clyde & Co partner, surveyed the range of sanctions imposed by the USA, the UK, the EU and the UN (under section 41 of the charter). Within the US, there were various sources of sanctions, including Congress and Executive Orders. The main targets were Russia, Iran, Syria, Venezuela, Cuba, Libya, North Korea and the Yemen.

Financial and trade sanctions extended to shipping services such as fnance and insurance. All commercial service providers, not least banks, needed to be very careful in dealing with the “dark fleets” of the sanctioned countries themselves and those dealing or trading with them.

Sacha Patel, legal director of Steamship Mutual P&I club, emphasised that the clubs had to continue servicing the interests of members in underwriting risk while reconciling their activities with the requirements and implications of sanctions. P&I cover would have to continue even if members breached sanctions.

Philip Henley of Ameropa Holdings (pictured above), which deals in the global distribution of fertilizers and grains, summarised the uncertainties ensuing from the sudden changes of date re the imposition of new tariffs, in the case of his business on nitrates, phosphates and potash; and, in a wider context, relating particularly to Russia and oil supplies. The 90-day pause on impositions on April 7th seemed correlated to the marked US requirement for particular imports. Declared tariff levels had been factored in to those price movements favourable to doing business. However, a context of falling oil prices, a volatile stock market and a weakening dollar made trading life that much harder. “We hope to work out deals but we don’t have a secure picture.”

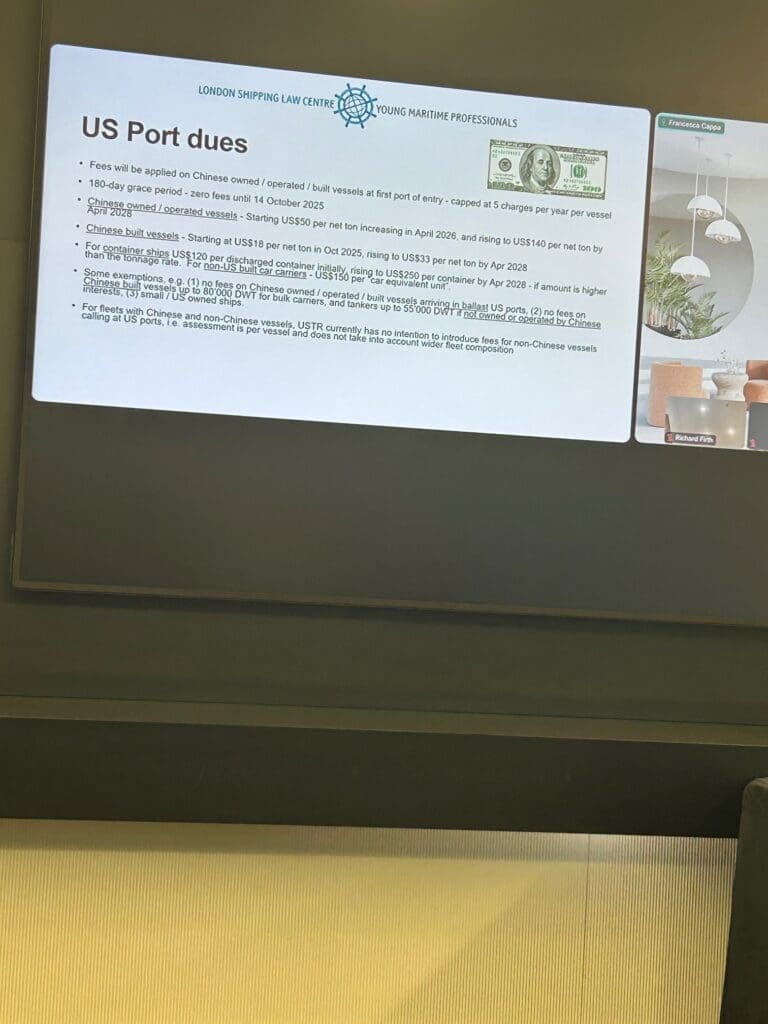

Francesca Cappa, legal and insurance counsel to Ameropa Geneva and chairman of the LSLC’s Young Maritime Professionals Group (pictured above) , reflected on the size and unpredictability of US port dues. There were variations affecting tankers and bulkers and their cargoes. The effects were seeping through to shipbuilding contracts, particularly affecting to those relating to Chinese shipyards. Disputes between buyers and sellers were likely to increase.

Barrister Andrew Stevens, of 4, Pump Court, forecast “frequent battlegrounds” across a wide range of scenarii. These would involve injunctions, suits and anti-suits; licences from the UK’s Office of Financial Sanctions Implementation; dilemmas for funding banks, problems with bills of lading and the calculation of damages arising from non-performance.

He reminded his audience that universally-accepted sanctions clauses were difficult to draw up even before factoring in sudden and unpredictable tariffs. Individual countries sometimes interpreted provisions differently. Force majeure clauses and frustration considerations would come increasingly to the fore in the context of current and anticipated tariff changes. What would constitute “reasonable steps” to avoid liability in force majeure events? In what circumstances could frustration be invoked, if an event “could not reasonably have been anticipated?” Uneconomic performance would not usually be enough to plead frustration. Mr. Stevens warned: “Look out for arbitration findings and court judgements.”