Susannah Streeter, head of money and markets, Hargreaves Lansdown: ‘’A dose of more certainty has been injected into European politics, with the Germany’s Conservatives winning the elections. It comes at…

Euro

Next UK government must be brave on policy reform By Peter Sedgwick Regardless of which party is selected to form the next UK government on 4 July, there should be…

The future of payments: a new engine? By Jon Cunliffe Should the public have a right to the safest money in the economy – central bank-issued money? Does the ability…

Latin American sovereigns re-examine art of allocation to boost liquidity, and more

Latin American sovereigns re-examine art of allocation to boost liquidity By Burhan Khadbai In order to improve the diversification of their bonds and boost their liquidity in the secondary market,…

Market report: Geopolitical concerns shrugged off, while pound dips and oil stabilises

Susannah Streeter, head of money and markets, Hargreaves Lansdown ‘’The FTSE 100 has climbed at the start of the week with consumer discretionary and real estate companies boosted by hopes…

Outlook 2023: What to expect for ESG By Eoin Murray The large-scale trends shaping the investment world are well-known at this juncture, namely climate change, biodiversity and ecosystem loss, social…

Outlook 2023: Euro will continue to beat expectations By Geoffrey Yu After all the uncertainty which Europe endured last year, it is quite a feat that the European Central Bank’s…

In conversation with UK law commissioner on digital assets Tuesday 18 October, Roundtable The Law Commission’s ‘Digital assets’ consultation paper covers current legal considerations for cryptotokens, non-fungible tokens, proof of…

HIGHLIGHTS September 20 2022 Global Markets With the Fed widely expected to deliver a further 75bps rate hike at this week’s policy meeting and signal that additional rate tightening is…

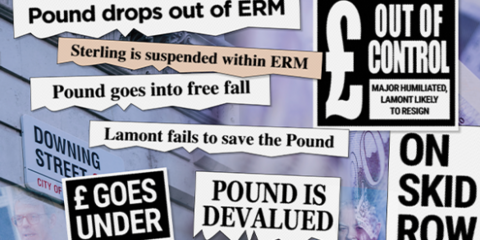

Six lessons from Black Wednesday for today’s central bankers By David Marsh Britain’s forced departure from the exchange rate mechanism of the European Monetary System on 16 September 1992 was…

UK energy crisis calls for rethink on private debt mobilisation By Burhan Khadbai The UK faces a daunting task in raising the cash needed to fund its ambitious energy package…

Market Report: Nerves frayed on financial markets as inflation still proves hot to handle

FTSE 100 ends down 1.1% after US inflation comes in higher Nasdaq slides by 4%, while the S&P fell by 3% Bitcoin plummets by more than 6% The dollar strengthens…

HIGHLIGHTS September 9 2022 Global Markets The ECB unanimously decided to raise its key policy rates by 75bps yesterday, the biggest rate hike in the Central Bank’s history, and made…

Welcome to the world of general disequilibrium By Brian Reading Official forecasters use econometric models which assume all markets return simultaneously to general equilibrium in the medium term. Cost-push inflationary…

Think twice about copying Russia’s national payments strategy By Lewis McLellan When Russia invaded Ukraine, the full weight of the international community’s sanctions was brought to bear to starve Moscow’s…

Implications of Germany’s draft budget Tuesday 26 July, Roundtable Germany’s cabinet has approved a 2023 draft budget that foresees a sharply lower €17bn deficit in a bid to restore fiscal…

July 18 2022 Global Markets Yields of USTs and Bunds were below recent highs, and the EUR gained some ground ahead of Thursday’s ECB policy meeting where the Central Bank…

Market report: A drab day in stock markets lies ahead, with a focus on currencies

Market report: A drab day in stock markets lies ahead, with a focus on currencies UK and European markets heading for a fall of around 0.2% Euro has fallen to…

Financial markets will keep betting against the euro, African sovereigns should prepare for green bond opportunities, and more

Financial markets will keep betting against the euro By Lorenzo Codogno What’s wrong with the euro? Again and again, we end up discussing its instability and the relentless attempts by…

Global Public Investor 2022 launch Tuesday 5 July, Launch OMFIF’s Global Public Investor is a key reference point for financial institutions and provides a lens on approaches to investing in…

GLOBAL & REGIONAL DAILY (Monday January 3 2022) GLOBAL & REGIONAL DAILY HIGHLIGHTS January 3 2022 Global Markets The oil market kicked off 2022 on a positive tone, while sovereign…

Central banks have everything they need to stop inflation acceleration Thursday 2 December 2021 Vol.12 Ed.48.4 Commentary: ECB should keep eyes on inflation prize By Agnès Belaisch and Matteo Cominetta…

Memo to Chancellor Scholz: ‘Sustainable investment not real estate’, COP26 must prompt action on net zero commitments, and more

Memo to Chancellor Scholz: ‘Sustainable investment not real estate’, COP26 must prompt action on net zero commitments, and more THE WEEKEND REVIEW Latest opinion and analysis from OMFIF around the world 22-26 November…

Scholz is banking on Europe and Draghi, Digital euro as a complement to cash Wednesday 20 October 2021 – Vol.12 Ed.42.3 Commentary: Italy and France advance in German agenda By David…

How to strengthen European banking and rise of the digital euro Monday 6 September 2021 – Vol.12 Ed.36.1 Commentary: Three ways to fix European banking union By Ignazio Angeloni in…