Hamburg Commercial Bank posts 2020 pre-tax profit of € 257 million and strong capital ratio

- 2020: Net income before taxes EUR 257 (previous year: 77) million and after taxes (Group net result) EUR 102 (12) million

- Excellent CET1 capital ratio of 27.0% (31/12/2019: 18.5%)

- Strong start to 2021: HCOB expects Group net result after taxes of around EUR 40 million for first quarter

- CEO Ermisch: “Transformation well advanced – 2020 financial results and stronger results trend than planned in 2021 give solid foundation for promising future and final move to BdB”

HAMBURG – Hamburg Commercial Bank AG (HCOB) presented its final figures for financial year 2020 on Thursday, confirming Group net income before taxes of EUR 257 (previous year: 77) million and other preliminary key figures announced in February. Thanks to its prudent business policy, the bank coped excellently with the challenges of a volatile market environment in light of the pandemic and significantly strengthened its capital positions and profitability. Improved operating margins in the client business, a noticeably lower cost base and one-off effects contributed to the very good overall result. The positive figures confirm the success of HCOB’s sharpened business model as a specialized financier, further bolstering confidence that the Bank is well positioned for its intended entry into the Association of German Banks (BdB), which will mark the successful completion of its transformation and privatization as a whole.

“Hamburg Commercial Bank is on the home stretch of its far-reaching transformation, and the current year will be shaped by the switch from the protection scheme of the German savings banks finance group to that of Germany’s private banks. This complex transition is unprecedented in the German banking landscape and we have been making extensive preparations for it since the change of ownership to private investors at the end of 2018. We have worked hard and made the most of the past two years: Today, HCOB is extremely well capitalized and has high portfolio quality, the cost programs are taking effect, and the bank is continuously becoming more profitable. The good financial results for 2020 and the stronger than planned earnings trend in 2021 confirm the Bank’s solid foundation for a promising future as a diversified, specialist financier with a clear competence and financial profile. We are firmly convinced that we will complete a successful switch to the BdB in January 2022, thus finally concluding our transformation and the first privatization of a Landesbank,” said Stefan Ermisch, CEO of HCOB.

Profitability improved – positive one-off effects – costs reduced by 12%

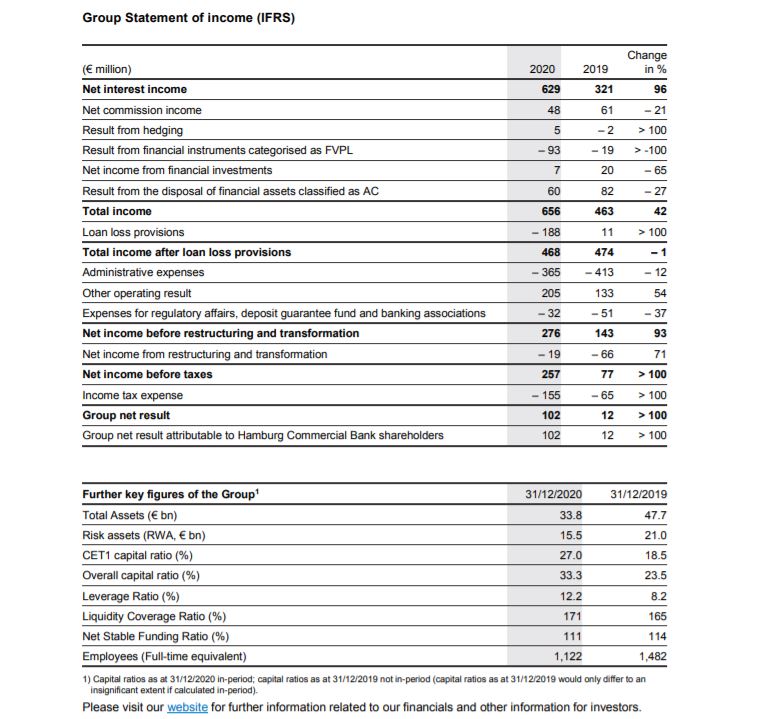

The very good net income before taxes (IFRS) of EUR 257 (77) million was due to improved profitability

in the operating business, lower refinancing costs, a noticeable reduction in administrative expenses and

gains on disposals. Net income was held back by additions to the loan loss provisions and by valuations

of FVPL assets. After taxes, the bank posted a Group net result of EUR 102 (12) million. The costincome ratio improved – partly thanks to one-off effects – to 42% (31/12/2019: 69%).

Total income increased appreciably to a total of EUR 656 (463) million and was largely driven by improved net interest income of EUR 629 (321) million. Net income from hybrid financial instruments contributed EUR 72 million, compared with a loss of EUR -181 million in the previous year. Net commission income amounted to EUR 48 (61) million, reflecting the planned decline in business volume and the Bank’s focus on profitable and scalable products. The result from the disposal of financial assets classified as AC mainly includes income from the sale of receivables and made a positive contribution of EUR 60 (82) million to total income. The result from financial instruments categorised as FVPL had a negative impact on total income of EUR -93 (-19) million.

Administrative expenses decreased by around 12% to EUR -365 (-413) million. This decrease was driven by personnel expenses, which fell to EUR -178 (-218) million as a result of the reduction in the number of employees by 360 to 1,122 full-time equivalents (FTEs). Operating expenses amounted to EUR -180 (-185) million, despite investments in the comprehensive modernization of the IT landscape and in further forward-looking transformation projects. Depreciation of property, plant and equipment and amortisation of intangible assets came to EUR -7 (-10) million.

At EUR 205 (133) million, the other operating result made a significant contribution to the Group net result and includes gains of around EUR 150 million from the sale of various properties as part of the Bank’s building strategy. Expenses for regulatory affairs, deposit guarantee fund and banking associations had a negative impact of EUR -32 (-51) million, with contributions to the bank levy decreasing year-on-year as a result of the reduced total assets. Net income from restructuring and transformation had a moderate negative impact of EUR -19 (-66) million and mainly includes transformation expenses for the realignment of the bank.

NPE ratio stable – high risk coverage – risk provisioning increased – RWA reduced

The NPE (non-performing exposure) ratio was maintained at 1.8% (31/12/2019: 1.8%) thanks to de-risking activities initiated at an early stage and despite significantly reduced total assets. The NPE coverage ratio (based on Stage 3 LLP) for non-performing loans was a solid 48% at year-end (31/12/2019: 57%). Including collateral, and taking into account the substantial stock of Covid-related GLLP (incl. model overlays), this resulted in a very high overall coverage ratio of 158% and thus a substantial buffer for cushioning further potential negative impacts. In view of the adverse economic development, the bank continued its prudent risk provisioning policy and again took into account more conservative assumptions on economic developments. Overall, loan loss provisions had a negative impact of EUR -188 (11) million on the result, although defaults have remained at a moderate level to date.

Hamburg Commercial Bank began restructuring its balance sheet early on, in the run-up to the recession, and further reduced total assets by almost 30% to EUR 33.8 (47.7) billion. In addition, RWA (risk assets) were reduced by just over a quarter to EUR 15.5 (21.0) billion and the CET1 capital ratio rose to an excellent 27.0% (31/12/2019: 18.5%). The very solid leverage ratio of 12.2% (31/12/2019: 8.2%) also demonstrates the Bank’s robust capital positions.

Selective new business – improvement in profitability

New business was managed according to clear risk and return targets and concluded on a selective basis. In addition, demand for new loans was limited across all asset classes against the backdrop of subdued economic development. As expected, gross new business was significantly below the previous year at EUR 2.9 (7.2) billion, although noticeably higher profitability was achieved due to improved net interest margins. Contributions to operating profit developed very solidly across the individual segments:

Margins in the Real Estate segment again developed positively and are reflected in improved net interest income in the operating business. At EUR 61 (201) million, net income before taxes and before risk provisions was down on the prior-year figure, which benefited from high income from early repayment penalties as well as the reversal of provisions for legal risks. As part of HCOB’s prudent and forward-looking business strategy, new business was noticeably reduced to EUR 0.8 (4.0) billion.

The Shipping segment contributed net income before taxes and before risk provisions of EUR 10 (47) million to the Group net result, with operating margins developing solidly. Valuation effects from customer derivatives had a noticeable negative impact. Focused gross new business with national and international shipping companies with good credit ratings amounted to EUR 0.9 (1.3) billion.

In the Corporates & Structured Finance segment, which combines the Corporate Banking & Advisory business units and project financing in the Energy and Infrastructure sectors, the contribution to net income before taxes and before risk provisioning was EUR 90 (33) million. New business of EUR 0.6 (2.0) billion was generated.

The newly created Diversified Lending & Markets segment, which covers the International Corporates business as well as Capital Markets, got off to a very good operational start. Net income before taxes and before risk provisions of EUR 13 (7) million benefited from income from diversification in Markets, while valuations of legacy portfolios had a negative impact. The segment made its first contribution of EUR 0.6 billion to the Bank’s new business in the international corporate sector.

Benchmark bond successfully placed – sustainability anchored in Bank’s DNA

HCOB further optimized its liability structure and placed a senior non-preferred benchmark issue of EUR 500 million, with a three-year maturity and attractive terms, on the capital market in the past financial year. With a further senior preferred benchmark bond successfully issued in the first quarter of 2021, the bank significantly extended the maturity spectrum of its bonds and established itself as a regular issuer in the international capital markets.

In terms of sustainability, Hamburg Commercial Bank set some key parameters in 2020. It signed the Principles for Responsible Banking of the United Nations Finance Initiative (UNEP FI) and joined the Responsible Ship Recycling Standards initiative. HCOB wants to actively support the sustainabi lity

transition in the economy and among its customers. To meet this ambitious goal, the bank has defined specific ESG (Environmental, Social, Governance) guidelines that are incorporated into all business policy decisions. In addition, transparent exclusion criteria have been defined at company, sector and country levels.

Outlook – 2021 is decisive year of transformation – good basis for switch to BdB

2021 is a decisive year of transformation of Hamburg Commercial Bank. In the third transformation year, the Bank’s top priority is to maintain the strong financial key figures achieved at the end of 2020 and, as a result, successfully gain admission to the BdB’s deposit guarantee fund at the beginning of 2022 HCOB has from today’s perspective no doubt that it will achieve this target.

On the basis of currently available information, the Bank expects to be able to achieve positive IFRS net income after taxes (Group net result) for the 2021 financial year, moderately above the level seen in the year under review (2020). According to the Bank’s own initial calculations, the expected Group net result after taxes for the first quarter of 2021 is around EUR 40 million and thus higher than planned. A review of the full-year forecast will take place in conjunction with the half-year financial statements. These earnings forecasts are subject to any unforeseeable effects resulting from the implementation of the estructuring/ transformation process or unforeseeable geopolitical influences such as a significantly slower economic recovery from the recession triggered by the coronavirus crisis.