1)The ongoing impact of conflict in the Red Sea, spiraling freight rates and congestion across global ocean container supply chains resulted in record high carbon emissions in Q3.

The Xeneta and Marine Benchmark Carbon Emissions Index (CEI), which measures carbon emissions across Xeneta’s top 13 ocean container shipping trades, hit 107.9 points in Q3 – the highest on record and up 12.2% compared to a year ago before the Red Sea crisis.

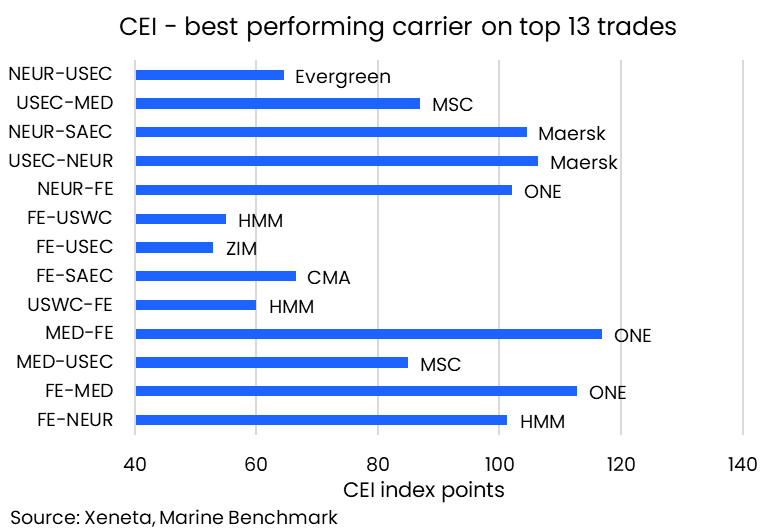

Looking across the top 13 trades, ONE and HMM take top spot as best performing carrier on three trades. Only COSCO, Hapag-Lloyd and Yang Ming failed to take top spot on any of the top 13 trades.

2)Missed the 2024 Xeneta Summit, or just want to revisit some sessions? Here is the day two recap, with insights delivered by industry-leaders on the 19th October, in Amsterdam.

https://www.xeneta.com/blog/xeneta-summit-2024-day-two-recap

Attendees of the 2024 Xeneta Summit have described it as the “home of Seafreight”, a “truly world class event” and “an inspiring event that gathered the brightest minds shaping the future of global trade”.

Yes, it delivers on thought leadership and practical insights. But more than anything, it centers around a shared belief that the world of ocean and air freight requires greater transparency, collaboration, and a fairer playing field for LSPs and BCOs alike – with less market swings and unexpected behavior.

3)The first day of the Xeneta Summit 2024 has drawn to a close and delegates at the Beurs van Belage in Amsterdam experienced an outstanding array of insight from experts across the ocean and air freight industry.

https://www.xeneta.com/blog/xeneta-summit-2024-day-one-recap