- HL Investor Confidence Index has decreased by six points to 95.

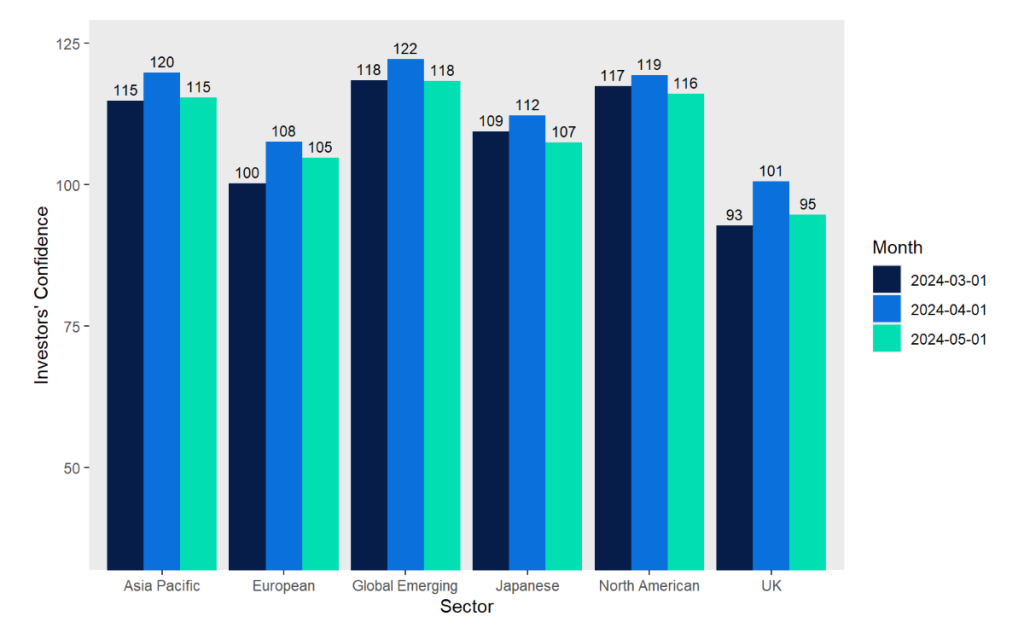

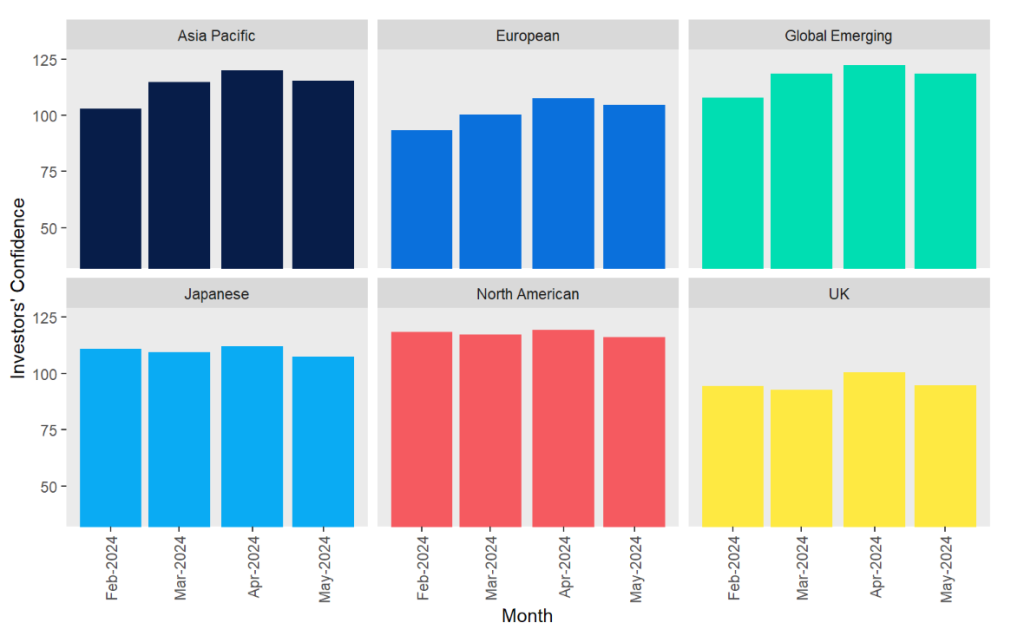

- Confidence has decreased in all sectors. Most significantly with the Asia Pacific, Japanese and UK sectors.

- The UK saw a six-point fall, even as the FTSE 100 was breaking a new all-time high last month.

- April saw the S&P 500 break its winning streak.

Emma Wall, head of investment analysis and research, Hargreaves Lansdown:

“April saw the S&P 500 break its winning streak, falling 4.2%, dragged down by poor tech stock performance. US smaller companies fared even less well, with the Russell 2000 falling more than 7% in the month. What caused the wobble? A mix of too much of a good thing in the preceding months – a classic market correction, triggered by geopolitical issues in the Middle East, stubborn inflation and the Federal Reserve indicating that we would be in a higher for longer interest rate environment – for even longer.

Such is the dominance of the US market on global peers and portfolios, that it is likely this single market pullback caused the drop in the HL Investor Confidence Index this month – open for the first week of May. But if investors had a crystal ball on that first May Day Bank Holiday weekend and projected just a week onwards, they would have seen that it was merely a blip. The earnings season on both sides of the pond has been broadly positive, with many companies beating expectations on both earnings and revenue. In the US, only the materials, healthcare and energy sectors failed to increase earnings year on year on average.

The US was not the region which suffered the biggest drop in conviction however – the UK saw a six-point fall, even as the FTSE 100 was breaking a new all-time high last month, rallying through the 8,000 mark. It has subsequently gone on to climb even higher. Investor confidence in Japan and Asia Pacific also dropped five points each.

Despite record performance from the FTSE 100, investors have not been buying UK funds this month. Not a single UK equity fund features in the top 10 most bought funds in April, even though there’s been a market rally, falling inflation and some very positive company results. The UK remains undervalued in our view – trading at 45% discount to the US. This is currently at or near the biggest discount to the US in over 20 years. The FTSE 100 and the FTSE 250 are trading at significant discount to the Eurostoxx 50 too and at a discount to their historical average. Hence this is attracting M&A bids for even FTSE giants like miner Anglo American. The combination of attractive and growing dividends, significant share buybacks, and the discount the UK market continues to trade on makes it an attractive time to invest.”

nvestor Confidence in global sectors

HL data

| Most bought HL funds, May (net buys) |

| UBS S&P 500 Index |

| Jupiter India |

| Fidelity Index World |

| Legal & General US Index |

| Legal & General International Index Trust |

| Legal & General Global Technology Index Trust |

| Vanguard FTSE Global All Cap Index |

| Rathbone Global Opportunities |

| Artemis Global Income |

| Vanguard LifeStrategy 100% Equity |

| Most bought HL investment trusts, May (net buys) |

| JPMorgan Global Growth & Income |

| Temple Bar Investment Trust |

| Greencoat UK Wind |

| Ashoka India Equity Investment Trust |

| Pershing Square Holdings Ltd |

| Alliance Trust |

| Polar Capital Technology Trust |

| Fidelity European Trust |

| Chrysalis Investments Limited |

| India Capital Growth Fund |

Investor Confidence Index

The Investor Confidence Index is compiled by surveying HL clients on a monthly basis. Each month we send the investors’ confidence survey to 6,000 random clients and there is a representative split of our clients by age. On average around 10% of clients respond.