Capital Gains Tax in the frame – speculation and data

- There is speculation that Rachel Reeves will use changes to capital gains tax (CGT) to help fill the hole in the public finances – possibly by equalising the rates of income tax and CGT.

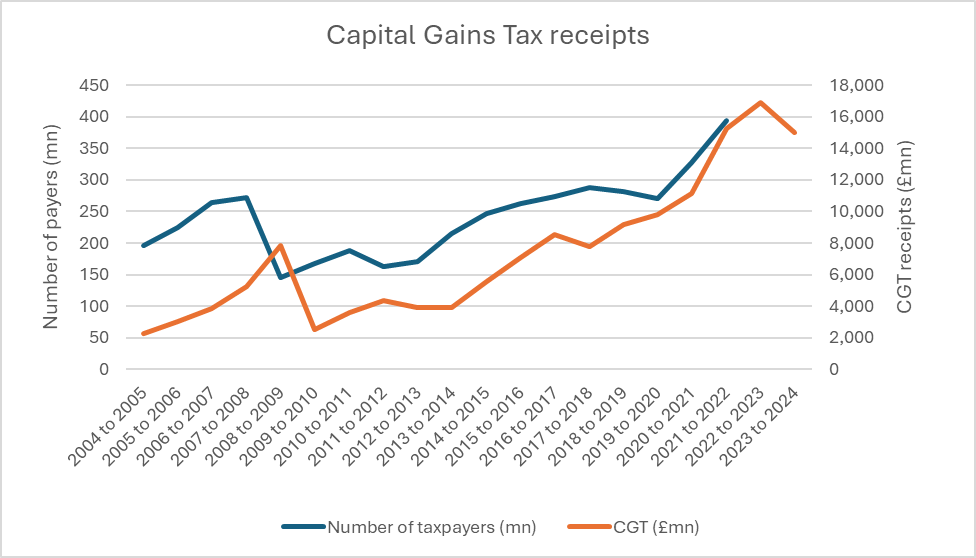

- 2022/2023 was a record year for CGT, with receipts at £16.929 bn. Final annual details will be reported on Thursday, including breakdowns of types of gains

- This is a fourfold increase in ten years.

- The numbers of people paying CGT rose by 50% to 394,000 over 5 years to 2021/2022.

- This is just the start of it – after the annual tax-free allowance was cut from £12,300 in 2022/23 to £3,000 in the current tax year.

On Thursday, HMRC will publish the annual capital gains tax report for the 2022/2023 tax year Capital Gains Tax statistics – GOV.UK (www.gov.uk)

Sarah Coles, head of personal finance, Hargreaves Lansdown:

“Capital Gains Tax speculation has intensified. As Rachel Reeves peers into the hole in the public finances and is set to reveal just how deep it goes, rumours are swirling as to whether CGT changes could be used to generate extra cash to help fill it.

One of the suggestions doing the rounds is that capital gains tax rates could rise to match income tax. It was one of the things the Office for Tax Simplification explored in 2020. This would see a shocking hike for UK investors.

As the OTS highlighted in 2020, in the long term it runs the risk of people hoarding their profits until they die. This would mean, for example, buy-to-let investors refusing to part with properties they don’t really want in an effort to avoid CGT, while first time buyers struggle to get on to the property ladder.

The tax system should be encouraging and rewarding long-term investing. This has been absent from the CGT system since taper relief was abolished in April 2008. Right now, investors face the double-whammy of a system that taxes investments that are simply keeping pace with inflation and allows for far lower gains to be realised tax-free each year. If the rates do end up rising, it would add insult to injury. We’d urge the Chancellor to reintroduce incentives that reward long-term investing.

| Shares | Current | Future | Increase |

| Basic rate taxpayer | 10% | 20% | 100.0% |

| Higher rate taxpayer | 20% | 40% | 100.0% |

| Additional rate taxpayer | 20% | 45% | 125.0% |

| Second residential property | Current | Future | Increase |

| Basic rate taxpayer | 18% | 20% | 11.1% |

| Higher rate taxpayer | 24% | 40% | 66.7% |

| Additional rate taxpayer | 24% | 45% | 87.5% |

Surging CGT

It’s a common myth that ‘no-one pays capital gains tax’. It is true that most of this tax is paid by a relatively small number of people, but the rapid increase in the amount of CGT paid, the cuts to the annual tax-free allowance, and the numbers paying this tax show it’s something all investors need to consider.

The single-year surge in CGT will owe something to the fact that people will have taken gains early, to take advantage of the £12,300 allowance while it lasted. We may also have seen an increase in sales of second properties – which is now one of the least tax efficient ways to invest.

It’s also why the monthly data shows CGT actually fell in 2023/24 to £15.025 billion. However, the current tax year is likely to show CGT back on an upwards trend – powered ever-higher by the additional cut in the tax-free allowance. You can see the impact that rule-changes have from the surge in 2008/9, following wholesale changes including the abolition of taper relief.

Block Capital Gains Tax – 5 ways to pay less tax

- Use your annual allowance

You get an annual CGT allowance on a use-it-or-lose it basis. If you’re building up a big gain, you can realise it gradually, over a period of years, £3,000 at a time, and pay no tax. You can sell investments and reinvest the money, effectively resetting your gains to zero.

- Offset any losses you make during the tax year

In any given year you may have losses on some investments and gains on others. You can use this to your advantage. When you complete your tax return, you can add details of the losses you’ve made, which will be offset against the gains when you’re calculating how much CGT you owe. In some cases, this will bring the CGT bill down to zero.

If you make more losses than gains, you should still make a claim for the extra losses. You will then be able to carry them forward into next year, to offset against any gains you make then. You can’t do this unless you have made a claim for the loss in the year you made it.

- Use a stocks and shares ISA

After the annual exemption of £3,000, CGT on stocks and shares is charged at 10% for basic-rate taxpayers and 20% for higher and additional-rate payers. By moving investments into an ISA, CGT is completely avoided. It’s worth noting this isn’t just a boon when you decide to sell up and cash out, it also makes an enormous difference every time you rebalance your portfolio as you go along.

ISAs aren’t just useful for brand new investments. If you have assets outside an ISA or pension, you can use the Share Exchange (Bed & ISA) process to sell assets outside an ISA – within your £3,000 CGT allowance – and move them into the ISA wrapper. That way you don’t have to worry about either dividend tax or CGT on these investments at any point.

- Plan as a couple

If you’re married or in a civil partnership, you can transfer the ownership of some assets to your spouse or civil partner. There’s no CGT to pay on the transfer. When they sell up, there may well be tax to pay, and the gain will be calculated by comparing the cost on the day of selling with the day when their spouse originally bought the asset. However, they have a CGT allowance of their own to take advantage of, so a chunk of the gain won’t be subject to tax. If they’re taxed at a lower rate, they may also pay any CGT at a lower rate too.

- Pay into a pension

Money paid into a pension will grow free of CGT, but that’s not all. Higher and additional rate taxpayers benefit from tax relief at their highest marginal rate. As a result, making contributions can push people out of paying higher rate tax altogether. The capital gains tax rate is lower for basic rate taxpayers, so bringing yourself under this threshold means you’ll pay tax at a lower rate on at least some of the gain.

How CGT works

Capital gains tax is charged on the profits made when certain assets are sold, or transferred to someone who isn’t a spouse or civil partner. If all gains in a tax year fall within the annual CGT allowance (£3,000) there is no tax to pay.

When you make gains above the annual allowance, CGT on stocks and shares can be charged at either 10% or 20% depending on an investor’s other taxable income. Provided combined taxable income and gains don’t exceed £50,270, 10% CGT on gains above the annual allowance is paid. Where gains and taxable income exceed £50,270, 20% CGT is paid.

If gains fall into two bands, taking the investor from the basic rate into the higher rate tax band, capital gains tax is paid at 10% on the amount which falls in the basic rate band and at 20% on the amount which falls in the higher rate band.

Where CGT is paid on property, the rates rise to 18% and 24%.