Veson Nautical says Greece accounted for over a quarter of all orders in record year for sector

A record number of new tankers were ordered in 2024 with 435 orders placed across the year, an increase of around 31% year-on-year according to according to Veson Nautical’s ‘2024 End- Of-Year-Report’.

The report, compiled by Veson’s data and intelligence arm VesselsValue, states that the growth in the tanker newbuilding sector was driven by high demand, fleet renewal, and a focus on compliance with green regulations as well as continued elevated ton- demand for this sector and strong resale values.

“The tanker newbuild sector was very active in 2024, especially in the first half of the year, as owners looked to future proof their fleets with the latest technology and fuels,” says Thomas Zwick, Senior Maritime Analyst at Veson Nautical. “However, while 2025 has got off to slower start, orders are expected to increase as demand is there, but emulating the levels seen in 2024 is unlikely.”

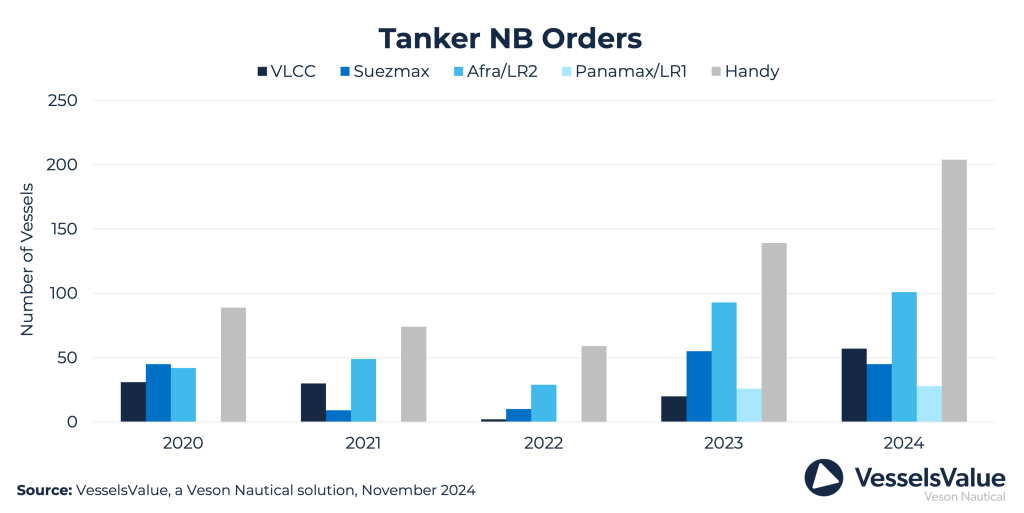

The report adds that the majority of orders placed this year have been in the Handy class sector, which accounted for around 47% of the total number with 204 such vessels ordered. The vessels ordered were largely in the MR sector, and are smaller coated vessels being ordered due to their flexibility and the potential to trade in a wide range of locations.

In second place, with 101 orders was the Aframax/LR2 sector, then Very Large Crude Carriers (VLCCs) in third place with 57 orders, Suezmax class in fourth with 45 new vessels, and Panamax/LR1 in fifth with 28 new orders.

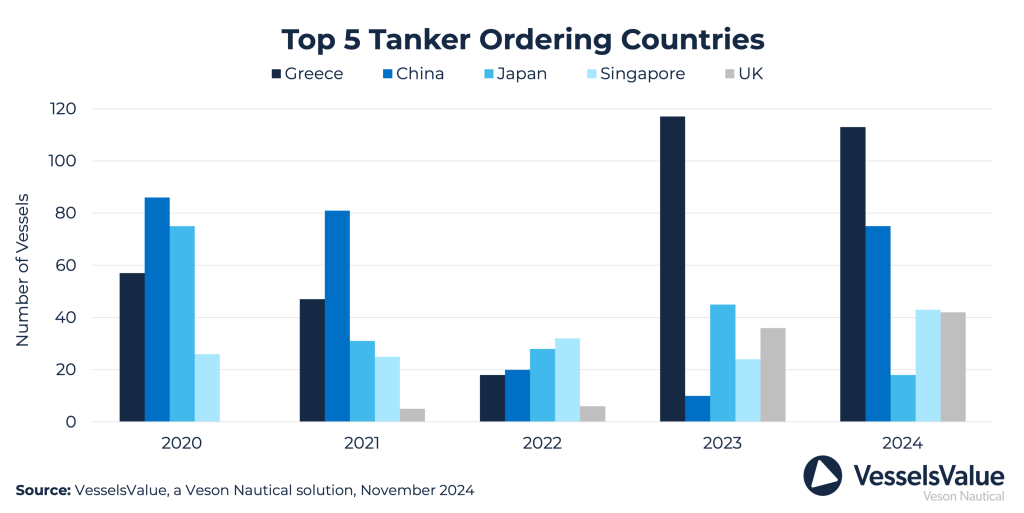

The report also states that Greece was been the most active in the tanker newbuild sector, with 113 orders reported in 2024. China was in second place, with 75 orders placed, Singapore is in third with 43 orders, UK in fourth with 42 orders and Japan in fifth with18 new orders.

Chinese shipyards dominated the tanker newbuild order market with 322 orders. South Korea ranked second with 74 orders, Vietnam third with 25 orders, and Japan fourth with 12 orders.

The report concludes that 2024 was a strong year for the tanker sector, but by the end of the year, earnings had corrected lower and second-hand sales slowed as a result of very high prices and weak demand from China. Shifting geopolitics, especially around the Israel/Hama ceasefire and the unpredictability of returning US President Donald Trump may result in some volatility.

Though 2024 did have the greatest number of tanker orders in years, data shows that the pace of ordering abated through the year with little activity in the fourth quarter compared to the first.

“A recent decrease in vessel values and newbuilding prices, coupled with the current long lead times and geopolitical uncertainties are likely to act as a drag on activity and investor appetite in 2025,” Zwick concludes. “However, activity is still set to be much higher than during recent low points in 2021 and 2022.”