Next UK government must be brave on policy reform By Peter Sedgwick Regardless of which party is selected to form the next UK government on 4 July, there should be…

FOMC

A new standard in measuring women’s rights By Tea Trumbic The legal gender gap is wider than previously estimated. While no country provides equal economic opportunity for women, some countries…

Africa’s bold bargain with global finance By Udaibir Das As the world grapples with crises – ranging from climate upheaval to geopolitical tensions – Africa stands at a crossroads of…

AI in finance 2024 Tuesday 19 March, Seminar This event is OMFIF’s inaugural seminar on artificial intelligence policy and governance in finance. Taking place in partnership with the University of…

Beware basing Russian reparations on vengeance By John Nugée While it is tempting to say Russia’s assets should be seized as reparations for the destruction it has inflicted on Ukraine,…

German coalition woes hold back financial market progress By David Marsh Disarray in the German coalition government over energy and growth policies is likely to hold back much needed progress…

GLOBAL & REGIONAL DAILY HIGHLIGHTS June 15 2022 Global Markets All eyes today are on the FOMC monetary policy outcome and Fed Chair Jerome Powell’s press conference afterwards, with money…

Central banks still finding their digital niche, How to insure against the risk of stablecoin runs, and more

Central banks still finding their digital niche By Mausi Owolabani Digital assets and central bank digital currencies could provide alternative payment solutions for consumers and should supplement rather than replace…

GLOBAL & REGIONAL DAILY HIGHLIGHTS May 6 2022 Global Markets Markets intense volatility after Wednesday’s FOMC meeting strengthens dollar’s safe haven appeal; peripheral spreads widen with the Italian and the…

Beware central bankers on monetarist war path, Communications can bite central banks, and more

Beware central bankers on monetarist war path, Communications can bite central banks, and more THE WEEKEND REVIEW Latest opinion and analysis from OMFIF around the world 14-18 February 2022, Vol.13 Ed.7 Most-read Commentary…

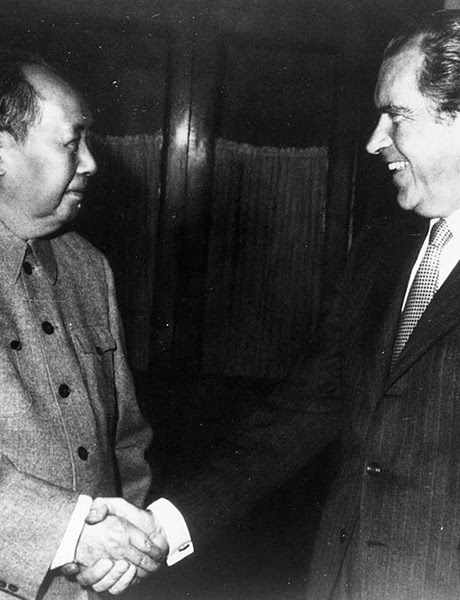

How the Nixon shock set broad path for renminbi rise 50 years ago Thursday 12 August 2021 – Vol.12 Ed.32.4 Commentary: Renminbi’s rise, 50 years after the dollar-gold shock By…

10 reasons why renminbi will keep rising, Views on the December FOMC meeting Monday 14 December 2020 – Vol.11 Ed.51.1 Commentary: 10 reasons whyrenminbi will keep rising By David Marsh…

GLOBAL & REGIONAL DAILY (Friday 12 June 2020) GLOBAL & REGIONAL DAILY HIGHLIGHTS June 12 2020 Global Markets Oil prices resumed their downtrend, pressured by increased excess supply worries and…

GLOBAL & REGIONAL DAILY (Thursday 11 June 2020) GLOBAL & REGIONAL DAILY HIGHLIGHTS June 11 2020 Global Markets The FOMC stayed put on interest rates at this week’s two-day monetary…

Daily Overview of Global Markets & the SEE Region (Wednesday, 10 July, 2019) HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: All eyes today are on the Fed Chairman who will…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: In line with market expectations, the Fed kept the rate for the fud funds target rate unchanged at 2.25-2.50% at this week’s two-day…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: In early European trade today, core government bond yields were off last week’s fresh lows in reaction to FOMC Chairman Jerome Powell’s dovish…

Commentary: Fed signals slowdown in rate increase By Darrell Delamaide in Washington It came as a surprise when US Federal Reserve Chair Jay Powell said in a speech that there…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: Government bonds came under renewed selling pressure across the euro area and the US as investors are braced for a hawkish language from…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: In line with market expectations, the FOMC delivered a 25bps rate hike at this week’s monetary policy meeting which concluded yesterday. The updated…

November FOMC: still on track for a December rate hike (Thursday, November 2, 2017)

Global Economic & Market Outlook – Focus Notes (Thursday, November 2, 2017) November FOMC: Still on track for a December rate hike As broadly expected, the Federal Reserve maintained its…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: As expected, the FOMC unanimously decided to stay put on interest rates at the two-day meeting that concluded late yesterday with the federal…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: USD remained under selling pressure in European trade on Monday amid heightened political jitters with DXY recording a fresh 13-month low earlier today and taking…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: Major European bourses were firmer in early trade while the USD was under pressure and US Treasury yields were a tad lower…

HIGHLIGHTS WORLD ECONOMIC & MARKET DEVELOPMENTS GLOBAL MARKETS: Wall Street firmed a tad overnight capitalizing on a stronger-than-expected Markit services PMI index for May. Another focus for the market yesterday…